Ether (ETH) Rebounds After Losing Almost 15% Within Three Days

The price of Ether (ETH) partially recovered on May 2nd after a significant decline. The cryptocurrency had fallen 14.2% from April 28th to May 1st, reaching a low of $2,817. This downturn coincided with $162 million in leveraged long liquidations, a sign of investor anxiety.

However, Ether managed to climb 6.4% on May 2nd, approaching the $3,000 mark.

This Rebound Came Despite Broader Economic Concerns

Persistent inflation in the United States, coupled with a weak 1.6% growth in the first quarter, dampened investor sentiment. Additionally, interventions by the Bank of Japan to stabilize the yen and a modest 0.4% annual growth in the Eurozone further fueled risk aversion. This cautiousness extended beyond cryptocurrencies, impacting other asset classes.

For instance, WTI oil prices fell to a 50-day low of $78.18 on May 2nd. Similarly, commodities like copper and wheat experienced declines of 4.4% and 3.2%, respectively, since April 29th. The cryptocurrency market as a whole faced a setback with the first-ever net outflow from the BlackRock Bitcoin spot exchange-traded fund (ETF) on May 1st.

This outflow, amounting to $1.2 billion over six trading days starting April 24th, signaled a withdrawal of institutional interest from Bitcoin spot ETFs. This lack of enthusiasm is particularly concerning as the U.S. Securities and Exchange Commission (SEC) nears its decision deadline on the VanEck Ethereum ETF requests by May 23rd.

However, A Contrasting Picture Emerged In Hong Kong

Despite the faltering demand for U.S. spot Bitcoin ETFs, Hong Kong launched its own spot cryptocurrency instruments on April 30th. These instruments, particularly the spot Ethereum ETFs, witnessed net inflows of $44 million on the first trading day, indicating a localized appetite for such products. While the volume remains relatively small, it highlights the difference in market dynamics between Hong Kong and the U.S.

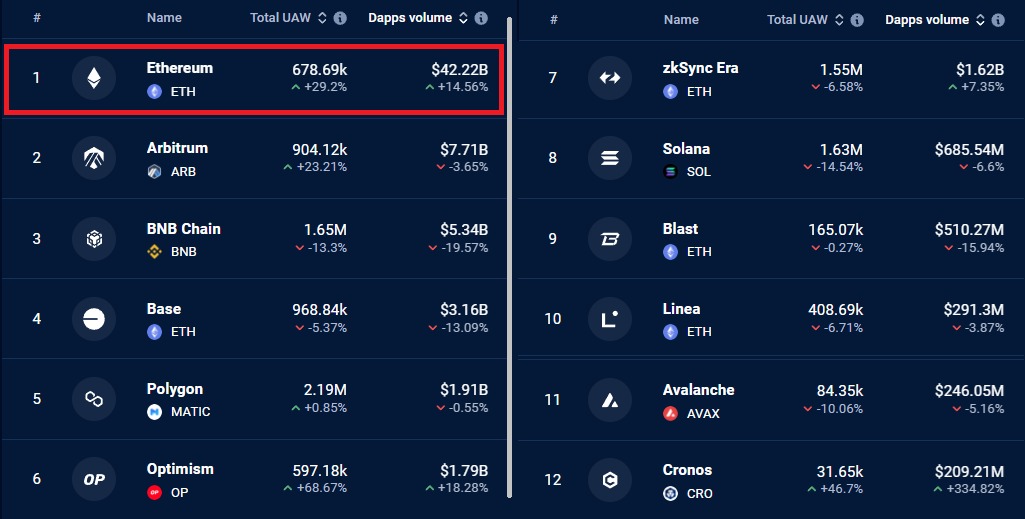

A surge in Ethereum network activity played a crucial role in bolstering Ether’s price and investor confidence. The weekly volume of decentralized applications (DApps) on Ethereum surged by 15% to $42.2 billion, significantly outperforming its competitors. BNB Chain experienced a 20% decrease, and Solana saw a 6.5% contraction in DApp volume during the same period.

This rise in activity was further reinforced by a 29% increase in the number of active addresses on the Ethereum network over the same week. Conversely, BNB Chain and Solana witnessed declines in active addresses. This user growth on Ethereum was primarily driven by applications like Xterio, EigenLayer, and Zerion.

Adding To The Positive Sentiment Were Comments From U.S. Federal Reserve Chair Jerome Powell

The comments were made after the Federal Open Market Committee (FOMC) meeting on May 1st. Powell suggested that interest rates might have reached their peak at 5.5%, which generally benefits risk-on assets like cryptocurrencies. While investors anticipate a potential rate cut in the coming months, possibly stretching into the first half of 2025, the immediate relief stems from the Fed potentially slowing down its tightening measures.

This, in turn, could decrease the appeal of fixed-income investments compared to inflation, potentially pushing investors towards riskier assets like Ether in the long run. For now, Ether investors are cautiously optimistic that the worst of the central bank’s liquidity tightening might be over.

The post Ether (ETH) Rebounds After Losing Almost 15% Within Three Days appeared first on Coinfomania.