NFT volumes decline amidst Silicon Valley Bank fiasco

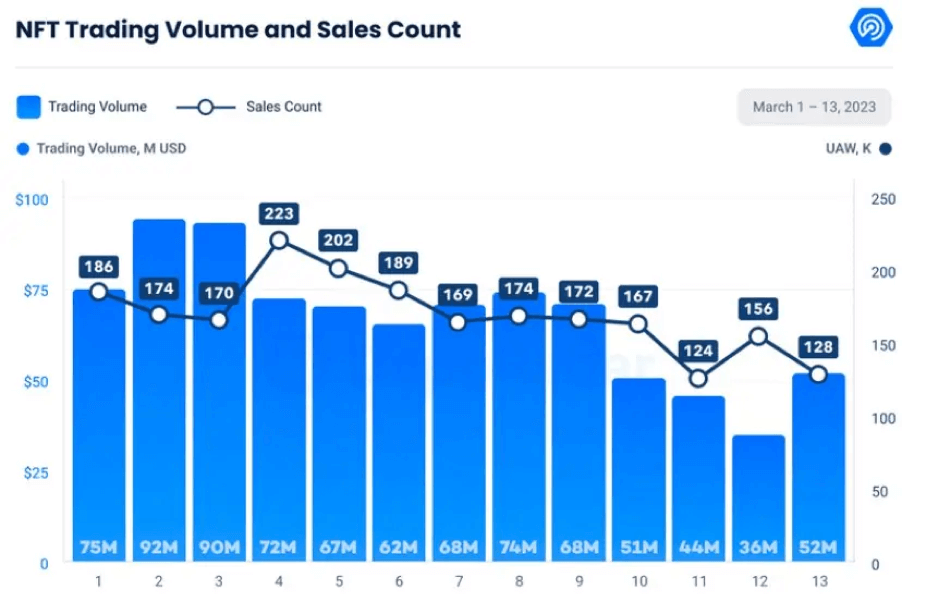

The collapse of Silicon Valley Bank had a ripple effect across the financial landscape, but fortunately, the cryptocurrency industry was not significantly impacted. However, the enthusiasm surrounding nonfungible tokens (NFTs) quickly waned. DappRadar reported that NFT trading volumes plummeted from highs of $68-$74 million on March 10 to a low of $38 million on March 12. This corresponds to an overall decrease in trading volume of 51% since the start of March and a 16% drop in revenue.

The chart also reveals a decrease in daily NFT sales, dropping by 27.9% between March 9 to 11. There were only 11,440 active traders on the latter date – the lowest number since November 2021. The least total of single transactions recorded this year was 33,112.

Which NFT collection declined the most?

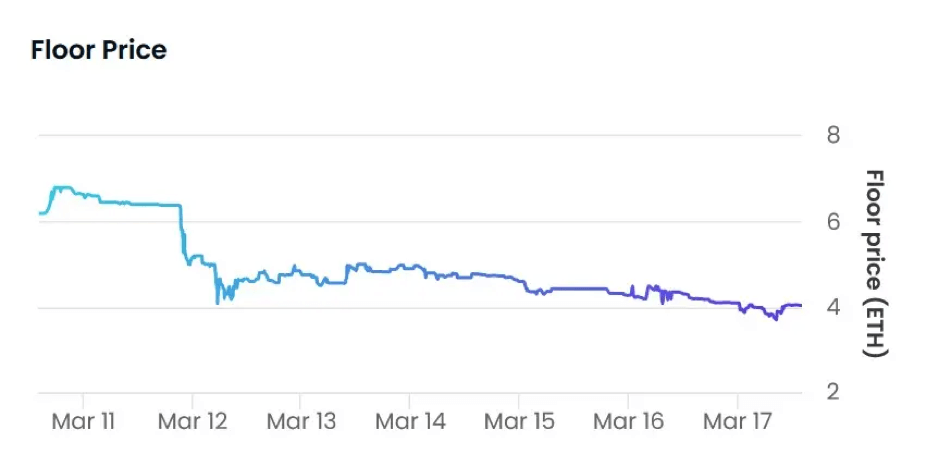

The report also indicated that certain “blue chip” NFT collections, such as CryptoPunks and Bored Ape Yacht Club (BAYC), were minimally impacted by the decline in the market. The robustness of these top-tier NFTs was quickly demonstrated when they recovered shortly after the disruption. Yuga Labs, the team behind BAYC, even confirmed that they had no exposure to the U.S. banking system’s failure. In contrast, Moonbirds experienced a 35.3% decrease in prices on OpenSea from 6.18 ETH to 4 ETH due to its direct link with SVB.