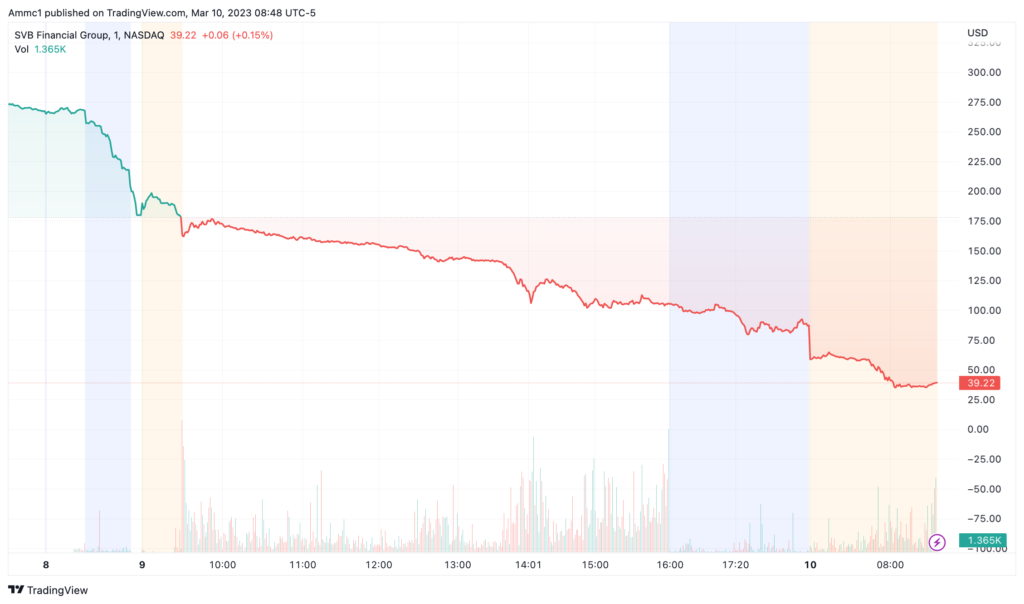

Devastating Drop: Silicon Valley Bank Stocks Plummet 60% In Hours

Key Points:

- Silicon Valley Bank and Signature Bank have experienced significant drops in their share prices, leading to a halt in trading for both banks.

- Signature Bank had been seen as a potential alternative for crypto companies looking for a new banking partner.

- Investors are increasingly concerned about the potential for further interest rate hikes by the Federal Reserve, which has led to a decline in the stock market throughout the week.

Silicon Valley Bank and Signature Bank have experienced significant drops in their share prices, leading to a halt in trading for both banks.

In pre-market trading, Silicon Valley Bank’s shares plunged 63%, trading at around $39.22 by 8:35 a.m. EST. Signature Bank, on the other hand, saw a 25% decline at the opening bell, leading to a halt in trading due to volatility.

The recent turmoil in the regional banking sector comes just days after Silvergate, a bank known for its crypto-friendly services, announced plans to wind down operations. Signature Bank had been seen as a potential alternative for crypto companies looking for a new banking partner. However, the recent drop in share prices may have dampened the prospects for both banks.

Investors are increasingly concerned about the potential for further interest rate hikes by the Federal Reserve, which has led to a decline in the stock market throughout the week. This concern has only been exacerbated by the release of February’s job data, which showed the US economy added 311,000 jobs, surpassing the consensus estimate of 225,000.

The recent volatility in the banking sector highlights the risks associated with investing in individual stocks, particularly in industries that are subject to regulatory changes and market fluctuations. While there may be opportunities for high returns, investors must also be prepared for the possibility of significant losses.

It remains to be seen how Silicon Valley Bank and Signature Bank will recover from the recent drops in their share prices. The banking sector as a whole may continue to face challenges as the Federal Reserve considers its next steps regarding interest rates. Investors should closely monitor the situation and consider diversifying their portfolios to mitigate risk.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News