Bitcoin volatility slashes unrealized profits, STHs hit the hardest

Bitcoin’s extreme volatility this week has wiped out a significant amount of unrealized profits across the entire market.

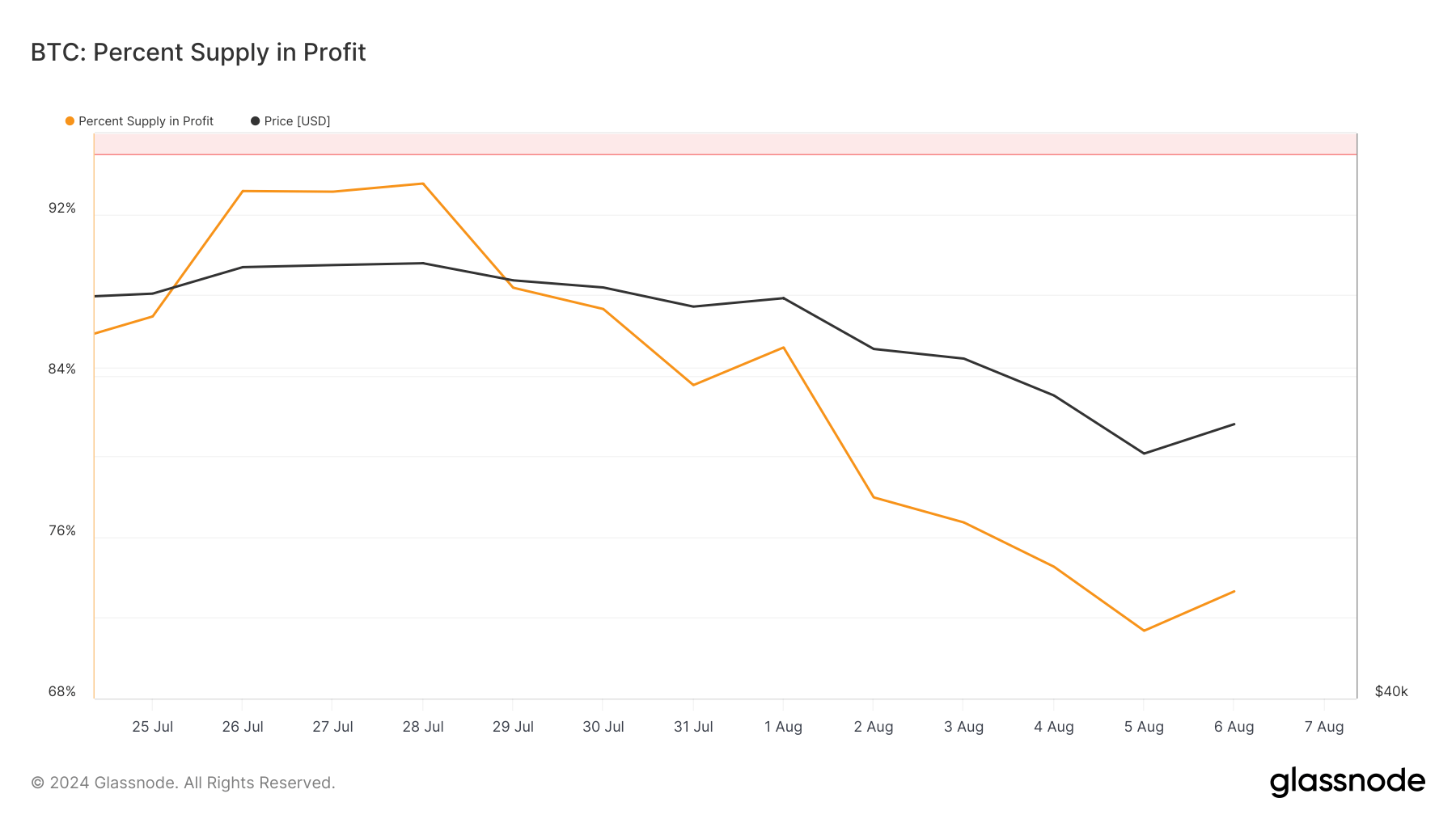

Data from Glassnode showed that on Aug. 1, over 85% of Bitcoin’s circulating supply was in profit, reflecting a stable and enduring bullish sentiment as the price settled at around $65,000. However, as the price began declining over the past week, a huge chunk of this profitability was wiped away.

With Bitcoin dropping to below $50,000 on Aug. 5, the percentage of supply in profit fell to 71%, the lowest since October last year. Even though the price recovered to around $56,000 on Aug. 6, the supply in profit remains at just above 73%.

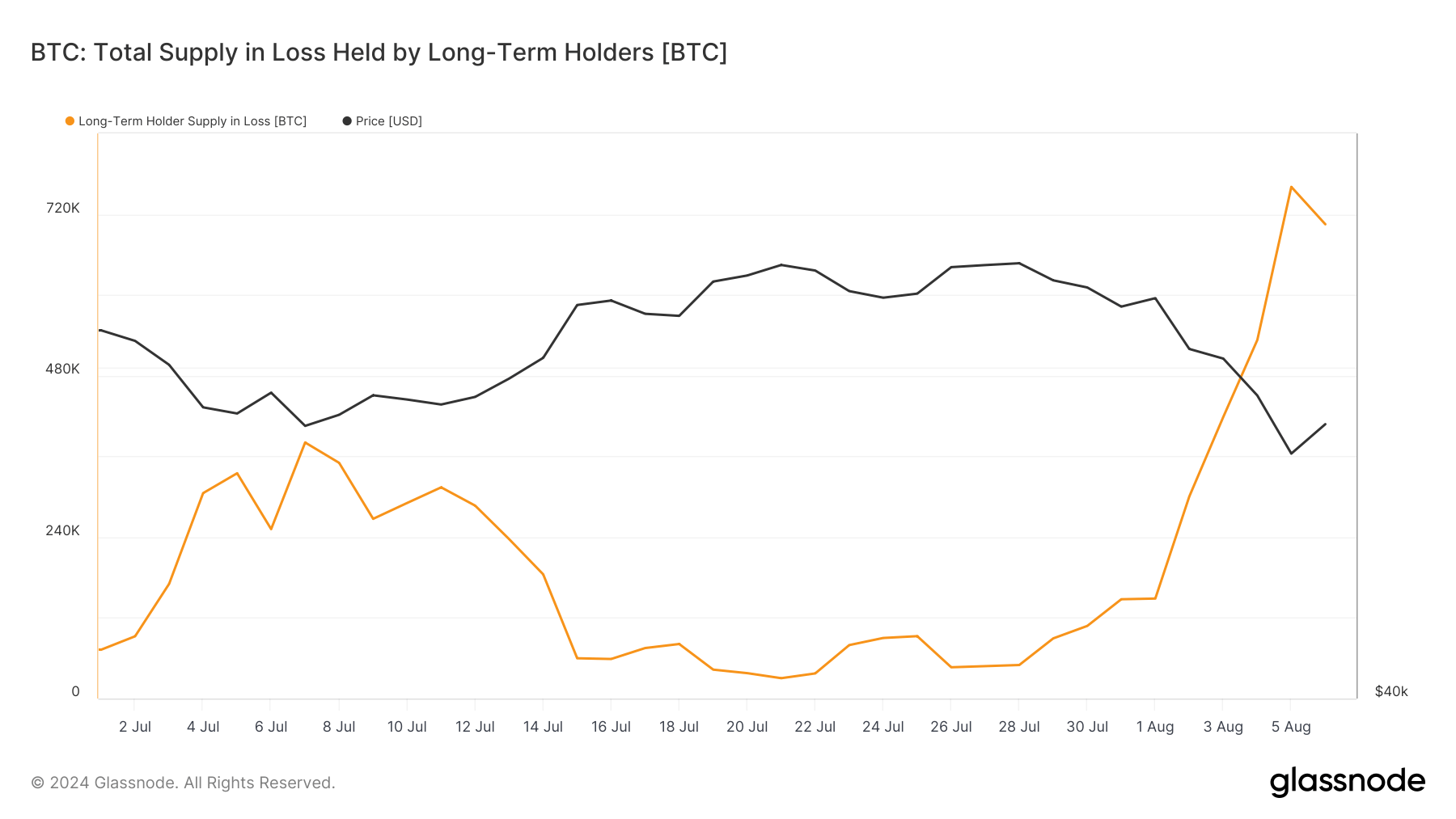

Both long-term and short-term holders saw a sharp increase in their supply held in loss.

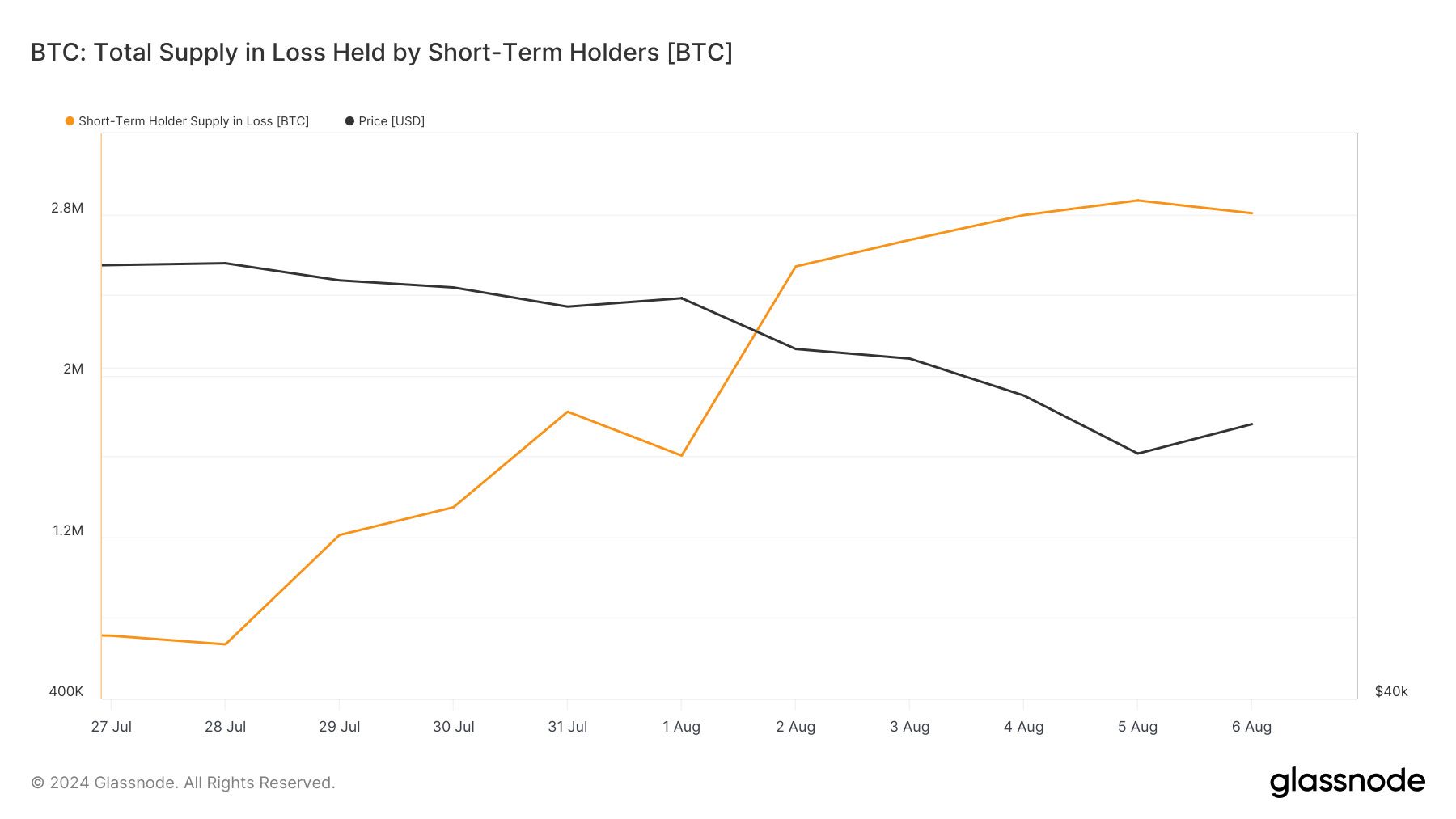

On Aug. 1, STHs held 1.603 million BTC in loss, but this figure rose to 2.868 million on Aug. 5 before decreasing slightly to 2.804 million BTC the next day. This shows that over 1.2 million BTC was bought at prices higher than current market prices, and STHs are sitting on a significant amount of unrealized losses.

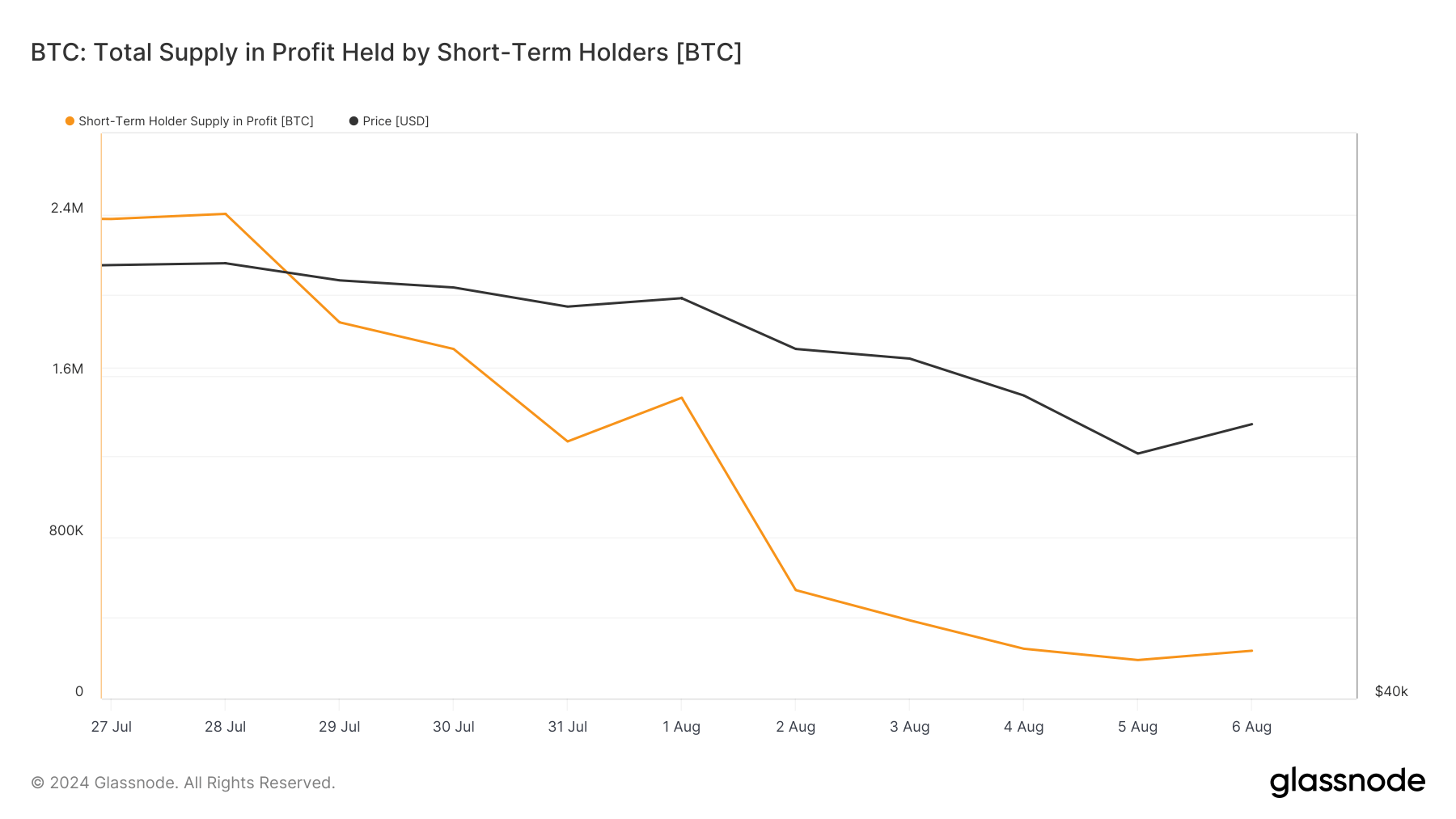

The short-term supply in profit plummeted as well. Between Aug. 1 and Aug. 5, the STH supply in profit fell from 1.490 million BTC to just 190,724 BTC, recovering slightly to 236,790 BTC on Aug. 6.

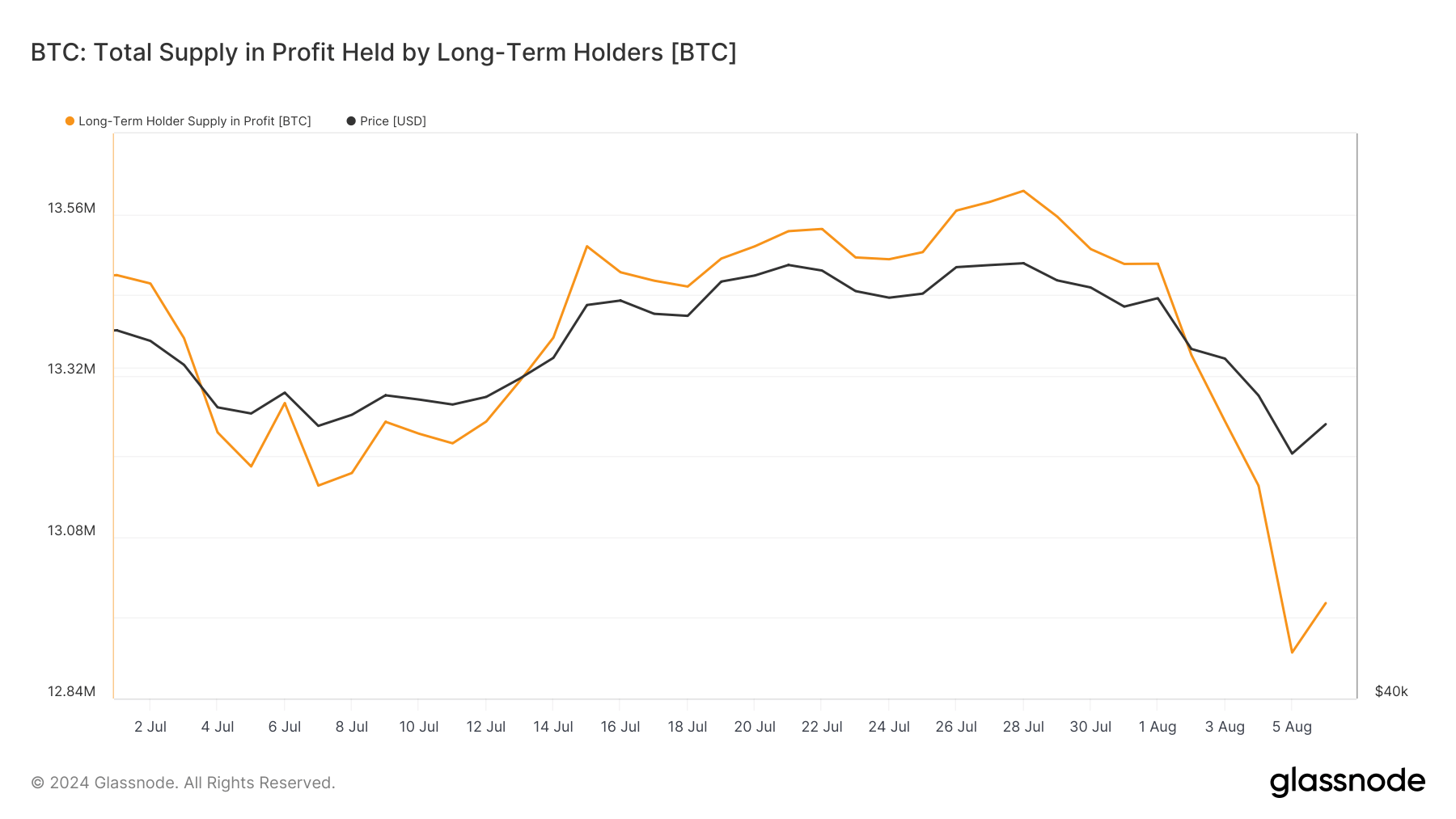

Long-term holders also saw losses, although significantly less pronounced than their STH counterparts. Long-term holder supply in profit decreased from 13.486 million BTC to 12.908 million BTC between Aug. 1 and Aug. 5.

Meanwhile, long-term holder supply in loss grew 148,601 BTC on Aug. 1 to 760,521 BTC on Aug.5, decreasing slightly to 704,926 BTC on Aug. 6. This gradual increase indicates that even LTHs are not entirely insulated from market volatility, though their broader time horizon offers some cushion.

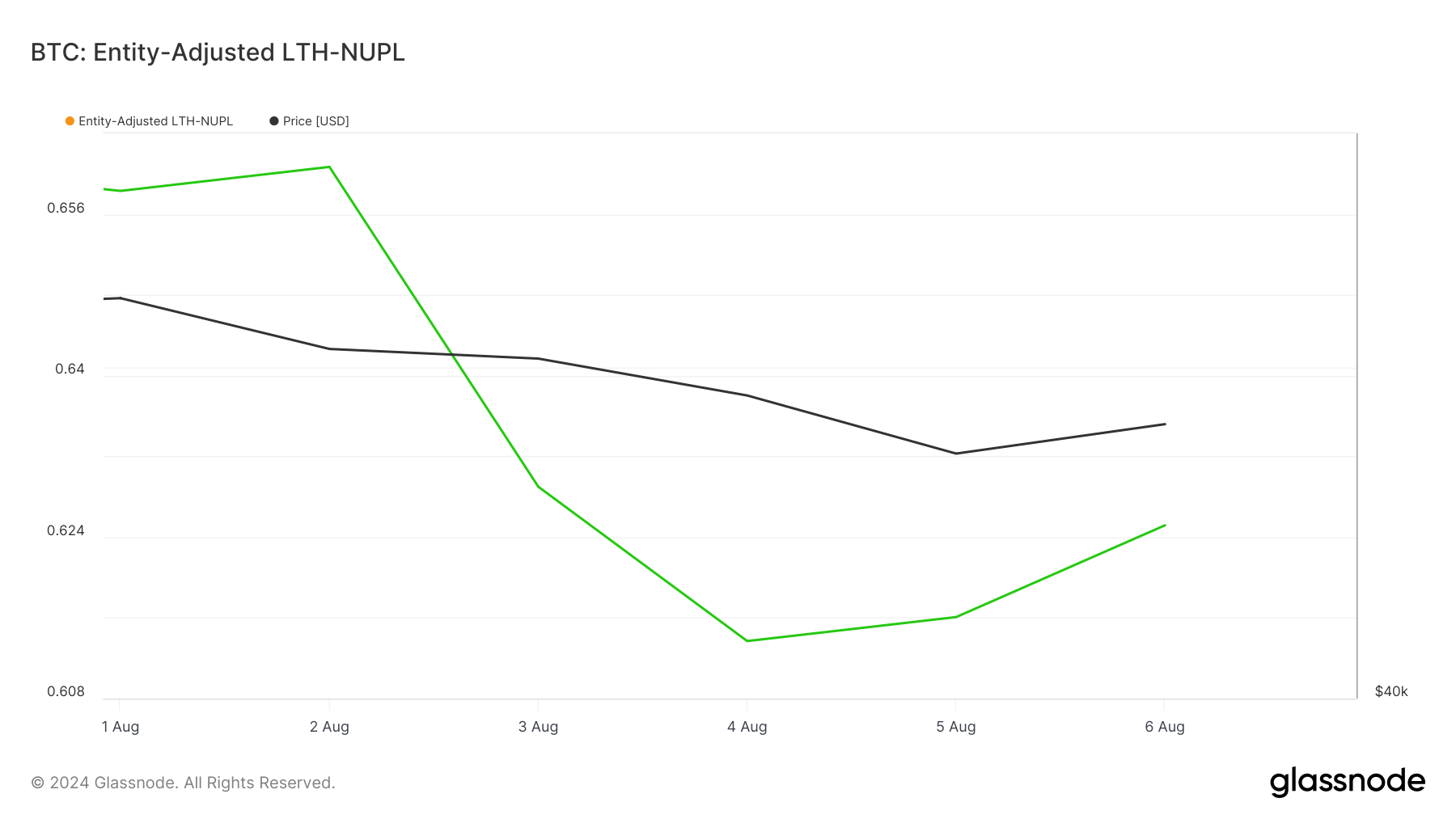

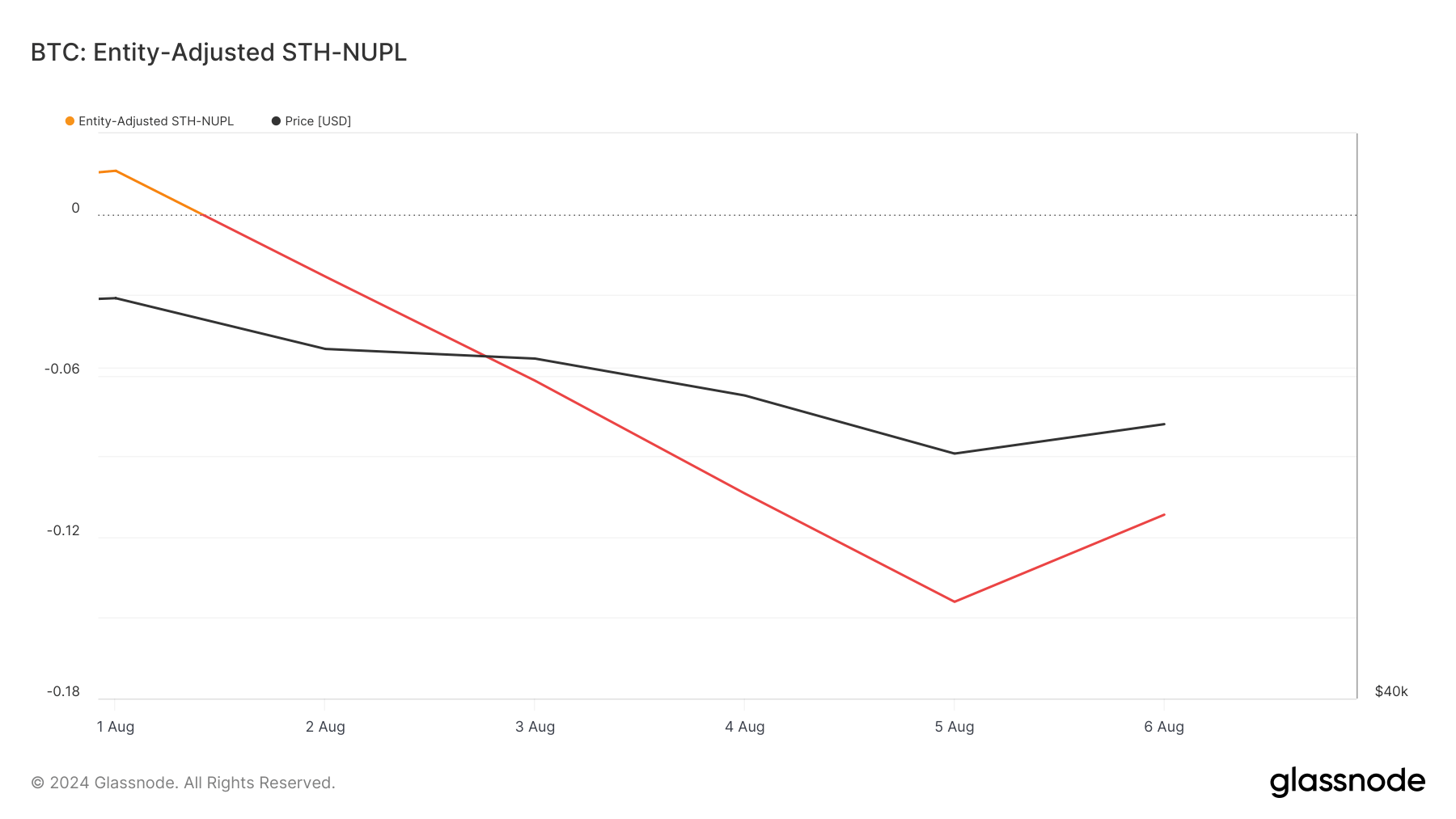

Looking at the entity-adjusted NUPL for long-term and short-term holders provides a clearer and more refined understanding of actual market profit and loss. Previous CryptoSlate analysis found that entity-adjusted metrics, especially NUPL, filter out non-economic transactions, which include internal transfers within the same entity.

These internal movements can distort traditional metrics by creating the false impression of heightened market activity or profit-taking, leading to an inaccurate representation of market sentiment.

The current data shows that the entity-adjusted LTH-NUPL has remained consistently above 0.5 throughout the year, reflecting a sustained belief among long-term holders in Bitcoin’s upward trajectory.

As of Aug. 6, LTH-NUPL stands at 0.625, indicating that long-term holders still have significant unrealized profits despite recent price fluctuations.

On the other hand, the entity-adjusted STH-NUPL saw significantly more volatility, dropping into negative territory in response to Bitcoin’s price drop. As of Aug. 6, STH-NUPL is at -0.111.

While short-term holders faced substantial unrealized losses and reacted more dramatically to price drops, long-term holders maintained a relatively stable outlook.

The post Bitcoin volatility slashes unrealized profits, STHs hit the hardest appeared first on CryptoSlate.