Bitcoin distribution rate slows down, potential shift towards accumulation

Quick Take

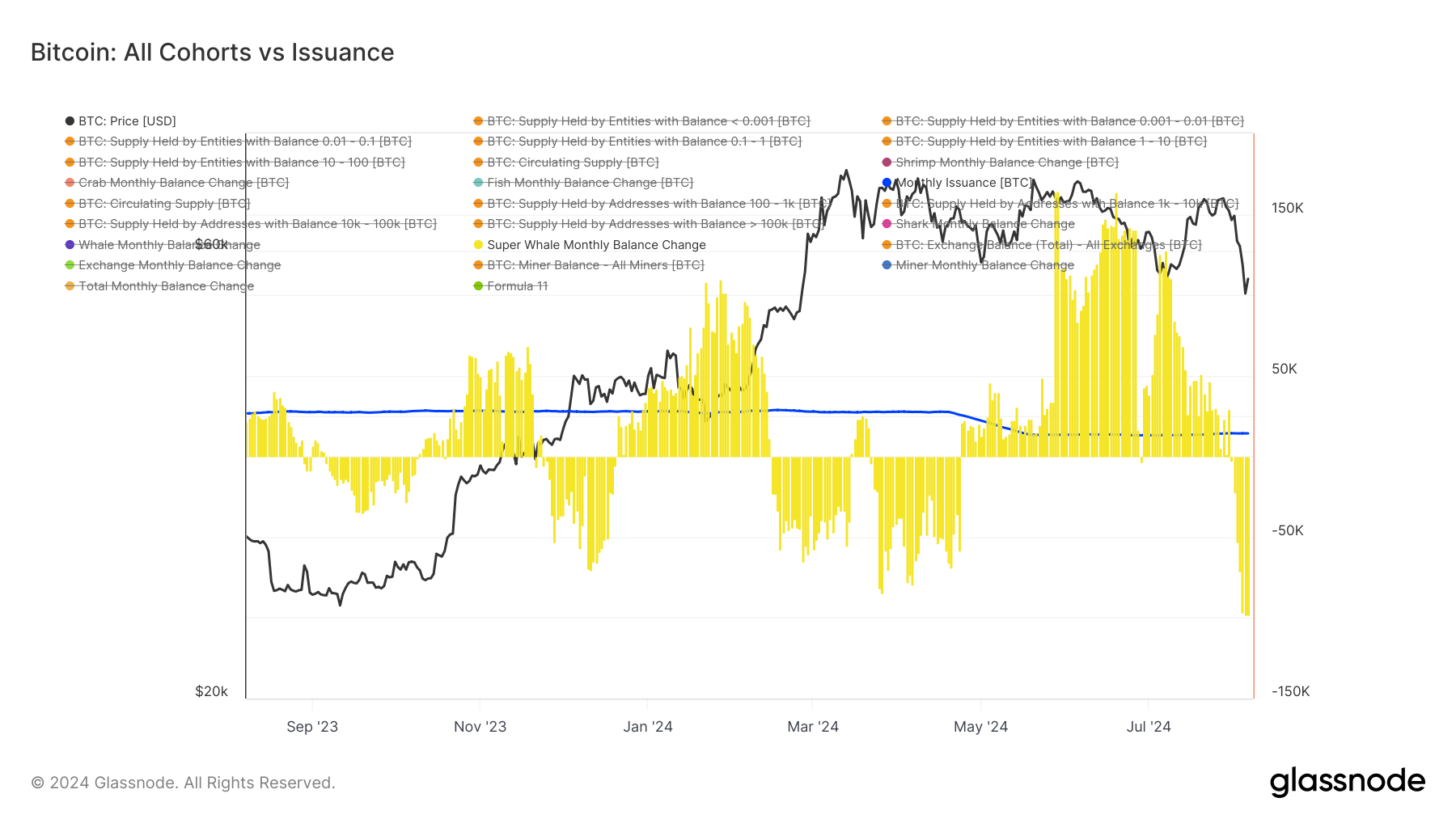

At the end of July, Bitcoin’s price surged to approximately $70,000. However, Glassnode data reveals that investor cohorts were capitalizing on this peak by selling off their holdings. Around 80,000 BTC were distributed during this period, marking the most significant distribution event since June 2021. This would include any distribution by the German Government and Mt. Gox. This selling spree was not an isolated incident. In mid-June, when Bitcoin reached the $70,000 mark again, investor cohorts began to decrease their accumulation, transitioning into distribution mode by July.

Several factors contributed to this extensive distribution. Notably, coins were being moved back onto exchanges. Super whales, entities holding over 10,000 BTC, were among those actively distributing their Bitcoin. Additionally, miners offloaded holdings, adding to the sell pressure in the market.

Currently, the distribution rate has significantly slowed down, with approximately 22,000 BTC being distributed over the past 30 days. This is a markedly smaller amount compared to the earlier mass distribution. If this trend continues, we could see a shift toward net accumulation in the near future and reinforce a local bottom of around $49,000.

The post Bitcoin distribution rate slows down, potential shift towards accumulation appeared first on CryptoSlate.