Bitcoin and Ethereum Suffer Sharp Declines Amid Market Turbulence

- Bitcoin saw a sharp decline to $52,500, falling 10% from its previous level of $58,350 within just a two-hour window.

- Although there was a minor recovery to $54,384, it marked the lowest point since February 26, when Bitcoin last dipped below $53,000.

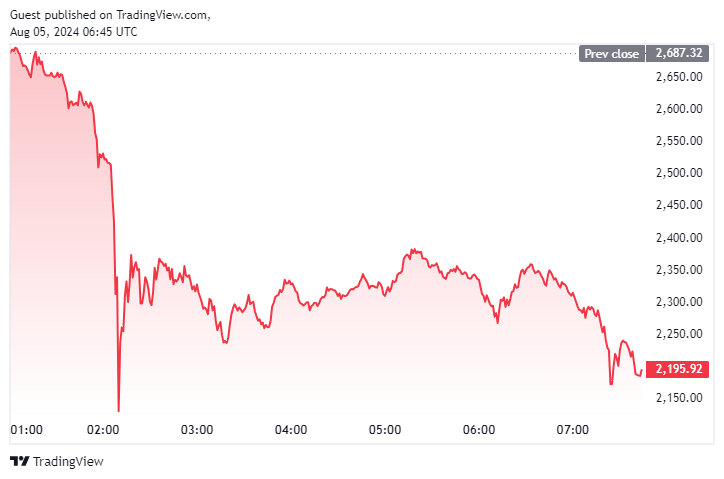

- Ethereum followed Bitcoin’s downward trajectory, plummeting from $2,695 to $2,118, an 18% loss, leading to substantial liquidations worth $740 million in leveraged positions.

Understand the latest market dynamics with an in-depth look at the recent drops in Bitcoin and Ethereum, shedding light on the key drivers and investor takeaways.

Recent Bitcoin and Ethereum Market Developments

The cryptocurrency market recently witnessed a dramatic sell-off, with Bitcoin plunging 10% within a two-hour span to $52,500. Although the price later recovered slightly to $54,384, this drop represents the lowest trading point since late February. Ethereum mirrored this decline, falling 18% from $2,695 to $2,118, resulting in leveraged position liquidations totaling $740 million. Among these, Ethereum long positions incurred severe losses amounting to $256 million.

The Role of Market Dynamics and External Factors

The downward trends observed in major cryptocurrencies can be attributed to several interlinked factors. Notably, a sharp downturn in the Japanese stock market influenced by a central bank interest rate hike precipitated a ripple effect across financial markets, including cryptocurrencies. In Japan, banking shares experienced their worst performance since the financial crisis of 2008, spreading apprehension to the crypto market.

Leverage and Volatility: A Double-Edged Sword

High leverage within the cryptocurrency space significantly contributes to market volatility. Leveraged traders, especially those holding long positions, face amplified risks during sudden market downturns. Recently, the approval of Ethereum ETFs in the United States generated investor interest, yet the subsequent price decline has highlighted the precarious nature of leveraged trades. As Ethereum and Bitcoin prices dropped, losses for leveraged positions in Ethereum reached $256 million, while Bitcoin saw $231 million wiped out in a single day.

Broader Economic Influences and Investor Sentiments

Besides leveraged trading, broader economic factors also exerted pressure on the cryptocurrency market. Weak US employment data and decelerating growth in tech companies added to the market’s negative sentiment. Additionally, concerns about substantial sales by Jump Crypto exacerbated the situation, contributing to a $500 billion reduction in total market capitalization over just three days. Investors are now more cautious about short-term trades, focusing instead on risk management and long-term strategies.

Conclusion

The dramatic price movements in Bitcoin and Ethereum underscore the inherent risks tied to leveraged trading. High volatility will likely persist, urging investors to prioritize prudent risk management and maintain a long-term perspective. Staying informed and cautious can help navigate the complexities of the cryptocurrency market more effectively, avoiding significant losses during turbulent periods.

The post Bitcoin and Ethereum Suffer Sharp Declines Amid Market Turbulence appeared first on COINOTAG NEWS.