Bitcoin (BTC) Flashes Buy Signal, but Investors May Not Be Interested

Over the past seven days, Bitcoin’s (BTC) value has dropped by 10%. It has trended downward since it exchanged hands at a weekly peak of $69,801 on July 29.

As of this writing, the leading digital asset trades at $60,551, offering a buying opportunity for those looking to trade against the market. However, an assessment of the coin’s social activity reveals that traders are not keen on “buying this dip.”

Bitcoin Traders Shy Away From “Buying the Dip”

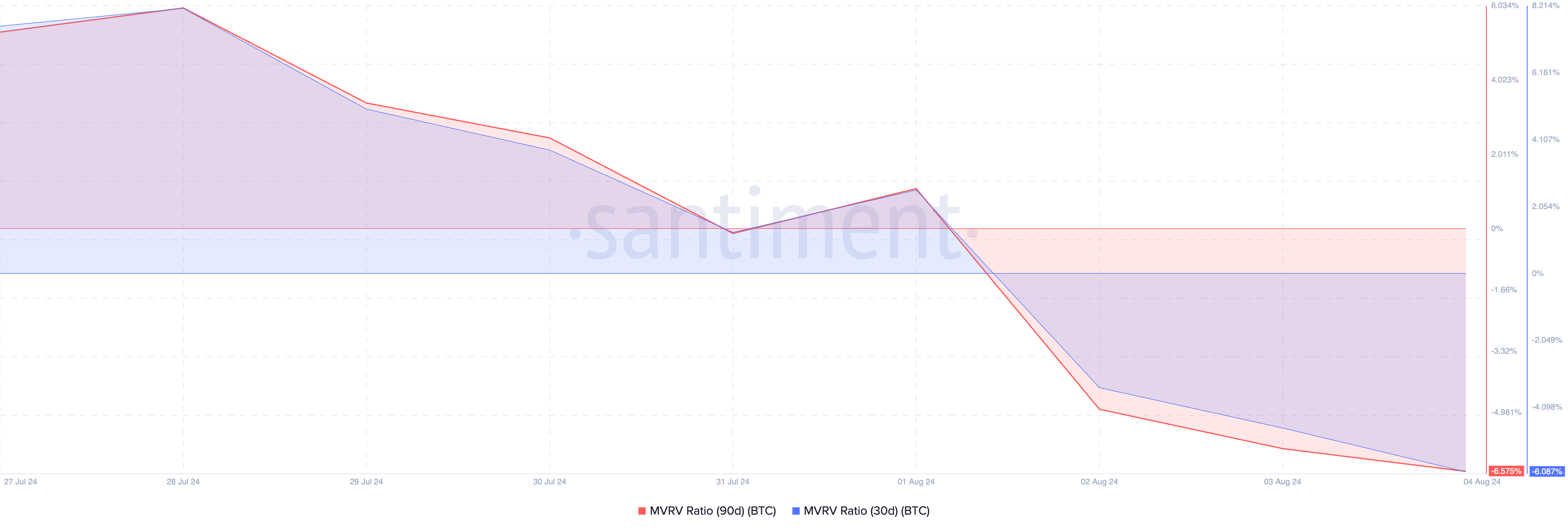

Bitcoin’s market value to realized value (MVRV) ratio suggests the leading cryptocurrency may be undervalued. The negative readings of this ratio, when assessed over different moving averages, confirm this. According to Santiment, the 30-day and 90-day MVRV ratios are -6.08 and -6.57, respectively.

Bitcoin Market Value to Realized Value Ratio. Source: Santiment

Bitcoin Market Value to Realized Value Ratio. Source: Santiment An asset’s MVRV ratio compares its current price to the average acquisition price of all its coins or tokens. If the MVRV ratio is above zero, the asset’s current market value is higher than the average purchase price for most investors.

Conversely, an MVRV ratio below zero indicates the asset’s market value is lower than the average purchase price of all its tokens in circulation, suggesting the asset is undervalued.

A negative MVRV ratio presents a good buying opportunity because the asset trades at a lower price, and traders can accumulate it at that level to sell it at a higher price later.

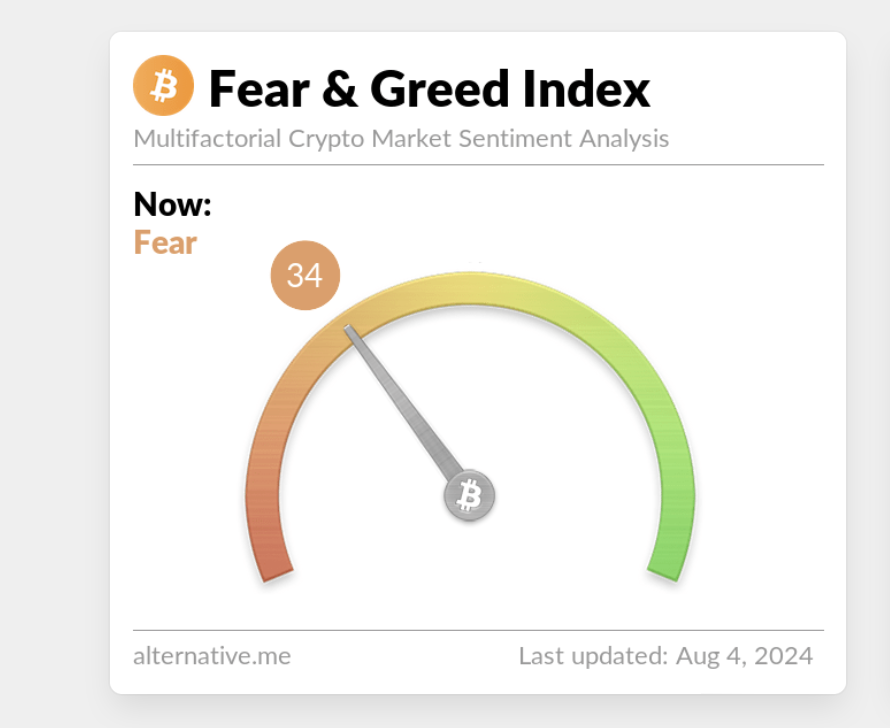

However, while the price dip may have presented a buying opportunity, retail traders are not interested in accumulating the king coin. This is mostly due to the fear of a further price decline. As of this writing, BTC’s Fear and Greed Index is at 34, indicating that market participants are fearful.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Bitcoin Fear and Greed Index. Source: Alternative

Bitcoin Fear and Greed Index. Source: Alternative Also, in a post on X, on-chain data provider Santiment said that despite the current price dip being similar to the one witnessed in early July, the same enthusiasm for buying the dip has yet to emerge among market participants.

BTC Price Prediction: Coin May Fall to $50,000 or Lower

Analysts predict that rising negative sentiment in the cryptocurrency market and unfavorable broader macroeconomic conditions put BTC at risk of falling to the $50,000 price region or below.

According to pseudonymous CryptoQuant analyst Abramchart, BTC holders have failed to maintain the crucial short-term support level of $64,580, representing the average purchase price over the last six months. If the coin holds below this support level, its price is likely “to target the range of $53,000 to $54,000, which corresponds to the lower edge of the descending channel,” Abramchart finds.

Also, crypto research firm 10x Research notes that BTC may fall below $50,000. According to it, the weakening ISM Manufacturing Index and potential stock market decline increase this risk.

Additionally, 10x Research states that if the Federal Reserve responds to a declining stock market with an emergency rate cut, it might signal economic distress rather than recovery, exacerbating BTC’s decline.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Daily Analysis. Source: TradingView

Bitcoin Daily Analysis. Source: TradingView According to readings from the coin’s Fibonacci Retracement levels,if the current downtrend persists, BTC’s next price target is $58,699. However, if it witnesses an uptrend, its price will climb to $61,466.