Bitcoin [BTC] Struggles Below $65k Amid Dovish FOMC and Anticipation of July Jobs Report

- Bitcoin [BTC] continues to show divergence from US equities in response to recent economic events.

- The Federal Open Market Committee (FOMC) meeting on July 31st did not spur a BTC rally despite signaling upcoming rate cuts.

- Analysis from industry experts highlights the influence of US government actions on the cryptocurrency market.

Exploring Bitcoin’s Stagnant Response to Economic Indicators

Recent FOMC Meeting and Its Impact on BTC

Despite the Federal Reserve’s dovish stance during the FOMC meeting on July 31, which left interest rates unchanged and hinted at a potential rate cut in September, Bitcoin failed to capitalize on this positive cue. While US stocks experienced significant gains, Bitcoin slid below $65k, showcasing an atypical decoupling from traditional equities.

The Influence of Governmental Involvement

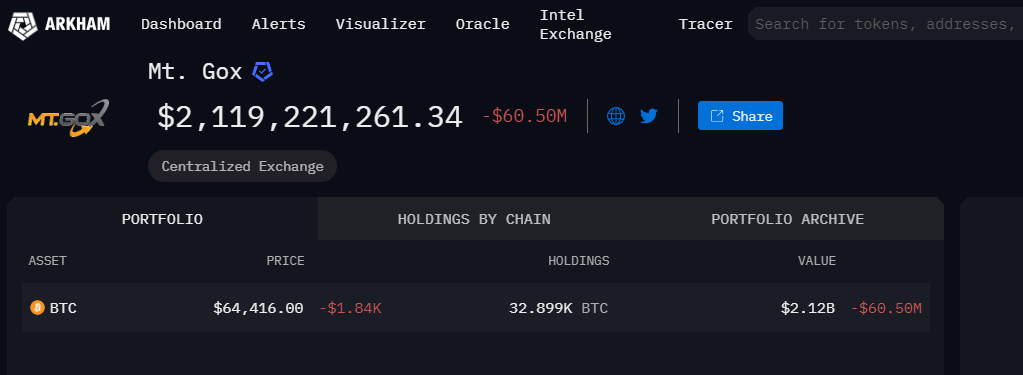

Galaxy Digital’s Mike Novogratz pointed to the US government as a significant risk factor, suggesting that political motives could drive potential Bitcoin sales. This perspective is supported by recent actions, including the movement of $2 billion worth of BTC related to the Silk Road case, which has contributed to market uncertainty.

The Role of Employment Data

The upcoming US July 2024 Jobs Report, scheduled for release on August 2nd, is anticipated to be another crucial determinant of Bitcoin’s price movement. Historically, reports indicating fewer added jobs have correlated with BTC rallies, as they suggest a cooling labor market that could prompt the Federal Reserve to consider rate cuts more favorably.

Market Speculations and Analyst Views

Economic analysts, including QCP Capital and Quinn Thompson of Lekker Capital, have highlighted the importance of macroeconomic data in shaping Bitcoin’s short-term trajectory. Thompson remains optimistic about the medium-term outlook for H2 2024, predicting that Friday’s jobs report could be pivotal.

Conclusion

The cryptocurrency market remains highly sensitive to macroeconomic indicators and governmental actions. As Bitcoin navigates these turbulent times, monitoring employment data and political developments will be essential for understanding its potential price movements. With BTC trading below $65k, the upcoming jobs report could either provide the momentum for a recovery or push the cryptocurrency further down.

The post Bitcoin [BTC] Struggles Below $65k Amid Dovish FOMC and Anticipation of July Jobs Report appeared first on COINOTAG NEWS.

![Bitcoin [BTC] Struggles Below $65k Amid Dovish FOMC and Anticipation of July Jobs Report](https://en.coinotag.com/wp-content/uploads/2024/05/cryptocurrencies-5.webp)