BTC Price Drops Below $67,000: What Is Going On With Bitcoin, Ethereum ETFs?

- Despite recent inflows, Bitcoin (BTC) price corrected sharply from $70,000 to $66,480, down 4.1% over the last 24 hours.

- Total Bitcoin liquidations reached $76.89 million in the past 24 hours, with long liquidations at $69.71 million and short at $7.18 million.

Bitcoin spot ETFs recorded their fourth consecutive day of net inflows on July 29, while Ethereum ETFs experienced continued outflows, highlighting divergent investor sentiment in the cryptocurrency ETF market.

What Bitcoin ETFs Did: Bitcoin spot ETFs attracted a total net inflow of $124 million on July 29, maintaining a positive streak that has now lasted four days, according to data from SoSo Value.

The total net asset value of Bitcoin spot ETFs has reached $61.732 billion, underscoring growing investor interest in these products.

BlackRock‘s IBIT emerged as the frontrunner among Bitcoin ETFs, drawing in a substantial $206 million in new investments.

However, not all funds shared this success, as evidenced by Grayscale‘s GBTC, which saw outflows of $54.2931 million on the same day.

What Ethereum ETFs Did: In contrast, Ethereum (ETH) spot ETFs faced challenging conditions, marking their fourth straight day of net outflows, data shows.

On July 29, these funds experienced a total net outflow of $98.2856 million, indicating a shift in investor sentiment towards Ethereum-based products.

Grayscale‘s ETHE bore the brunt of the Ethereum outflows, with investors withdrawing $210 million in a single day. However, the picture was not uniformly negative across all Ethereum ETFs.

BlackRock‘s ETHA and Fidelity‘s FETH managed to attract inflows of $58.1696 million and $24.8242 million, respectively.

Interestingly, Grayscale’s mini ETF ETH also saw positive movement, with inflows of $4.8967 million.

These contrasting fund flows occurred against the backdrop of a volatile cryptocurrency market.

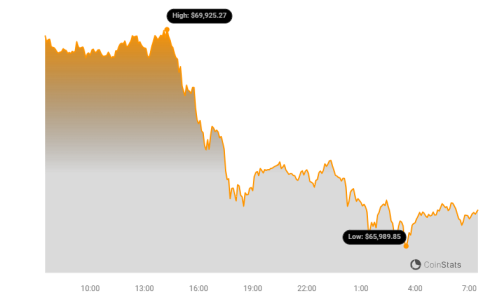

Bitcoin’s price saw a sharp correction, falling from a recent high of $70,000 to $66,480, a 4.1% decline over 24 hours.

This price action triggered significant liquidations in the Bitcoin futures market, totaling $76.89 million, with long positions accounting for $69.71 million of these liquidations, according to CoinStats data.

Similarly, Ethereum’s price dipped 1.6% to $3,332 over the same period, aligning with the outflows seen in its ETF products.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.