Ethereum ETF Launch Attracts $2.2 Billion Inflows, But Here’s the Catch

Blockchain analytics platform Coinshares recently published a report showing that the launch of spot Ethereum ETF last week attracted $2.2 billion in inflows to the crypto market last week. Thus, this was the highest weekly inflows registered by the market since December 2020. However, the incumbent selling in the existing products like Grayscale’s ETHE spoiled the complete show.

Grayscale Ethereum ETF Plays the Spoilsport

Within the first week of launch, the Grayscale Ethereum ETF (ETHE) saw outflows to the tune of $1.5 billion, or nearly 20% of the assets under management. BlackRock, Fidelity, Bitwise, and other ETFs witnessed a total of net inflows of $1.18 billion in the first week. Thus, the net outflows for the Ether ETFs in the first week stood at $338 million. However, the Ether ETP products worldwide saw trading volumes surge by 542%.

The new Ethereum ETFs after the first week saw US$1.18bn of inflows, although the massive outflows from incumbent Grayscale have meant a net outflow of US$338m. pic.twitter.com/LdjLcuQSmF

— James Butterfill (@jbutterfill) July 29, 2024

Also Read: Nate Geraci Calls Spot Ether ETFs A Success Despite Outflows

CoinShares notes that this is a similar situation to what happened in the Bitcoin ETF market within the first week of launch. Last week, the spot Bitcoin ETFs in the US registered inflows of $519 million, thereby taking the monthly inflows to $3.6 billion and 2024 inflows to $19 billion.

With flows into either direction, the inflows into digital asset investment products last week remain muted at $245 million, reported CoinShares. However, the Ethereum ETF launch helped the trading volumes to surge to the highest levels since May at $14.8 billion last week.

Recent price appreciation has increased total assets under management (AuM) to US$99.1 billion, with year-to-date (YTD) inflows reaching a record-breaking US$20.5 billion.

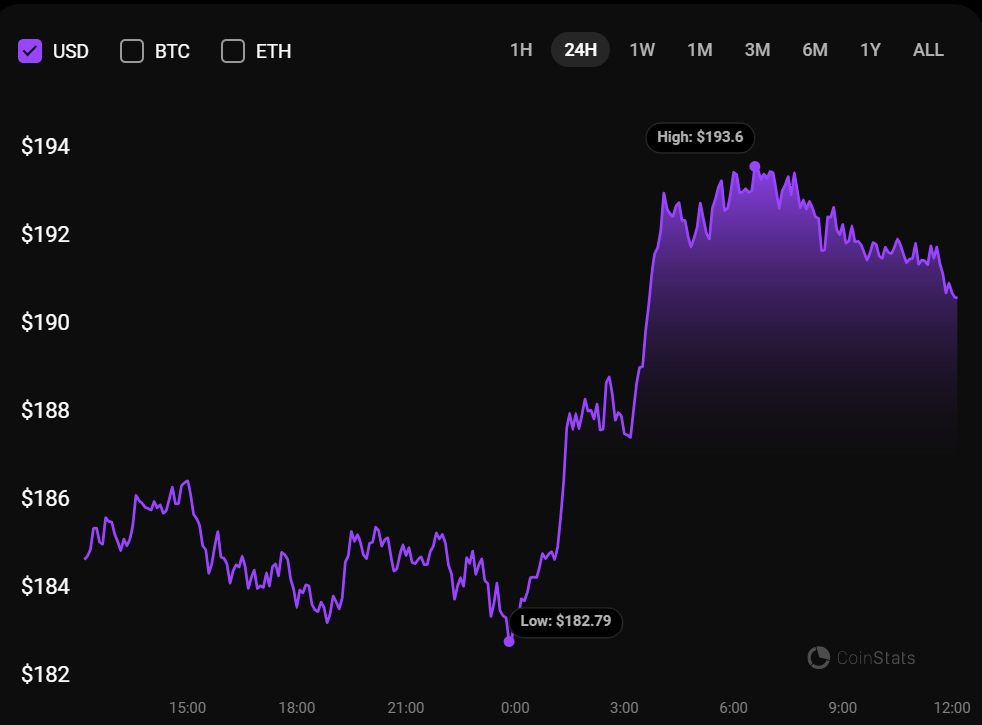

Ethereum Price Action Ahead

The Ethereum price is showing strength gaining more than 4.8% in the last 24 hours and trading closer to $3,400. As per data from CryptoQuant, the ETH open interest has surged by $1.5 billion in the last three weeks. With the surge in leveraged trading, liquidations become inevitable. CryptoQuant notes that one can expect greater volatility going ahead.

#Ethereum Open Interest data has increased by approximately $1.5 billion in the last 3 weeks

“As leveraged trading increases, liquidations become inevitable. This, in turn, brings high volatility. Therefore, I believe that OI is one of the data points that needs to be closely… pic.twitter.com/XTNz8sDuZU

— CryptoQuant.com (@cryptoquant_com) July 29, 2024

Also Read: Ethereum Price Poised for Rebound as Institutional Interest Hits Record High

The post Ethereum ETF Launch Attracts $2.2 Billion Inflows, But Here’s the Catch appeared first on CoinGape.