Arbitrum (ARB) Soars With Ethereum ETF Launch Approaching

The price of ARB, the native token of the leading Layer 2 protocol Arbitrum, has surged ahead of the July 23 launch of five spot market Ethereum (ETH) exchange-traded funds (ETFs). Exchanging hands at $0.77 at press time, the altcoin’s value has risen by more than 5% in the past week.

Apart from the rally in the value of its native token, the Arbitrum ecosystem has witnessed network-wide growth in the past seven days.

Arbitrum Sees Spike in User Activity

Arbitrum’s network-wide growth is highlighted by the increase in total value of assets locked (TVL) in its decentralized finance (DeFi) ecosystem and the surge in sales volume within its non-fungible tokens (NFTs) sector over the past week.

Per DefiLlama’s data, among the top 5 networks by TVL, Arbitrum has witnessed the most growth after Solana in the past week. At $3.25 billion, the network’s TVL has risen by 10% in the past seven days. In the last month, Arbitrum’s TVL has climbed by 14%. Its TVL currently sits at its highest since the L2 protocol was launched in August 2021.

Arbitrum Total Value Locked. Source: DefiLlama

Arbitrum Total Value Locked. Source: DefiLlama Further, the week under review has been marked by an uptick in the sales of Arbitrum-based NFTs. During this period, sales volume totaled $1.16 million, rising by 66%. This spike in sales volume is due to an increase in the number of NFT traders on the network.

According to CryptoSlam data, the total number of completed NFT sales has risen by 49% as a result.

Read More: How to Buy Arbitrum (ARB) and Everything You Need to Know

Arbitrum NFT Sales Volume. Source: CryptoSlam

Arbitrum NFT Sales Volume. Source: CryptoSlam When a network witnesses growth in DeFi TVL and NFT sales volume, it indicates an increase in user activity and engagement. As user demand for the network spikes, the value of its native token rises accordingly.

ARB Price Prediction: Is the Buying Pressure Strong Enough?

The surge in Arbitrum’s user demand in the past week has led to a rally in ARB’s price. Trading at $0.77 at press time, the altcoin’s price has increased by over 5% in the past week.

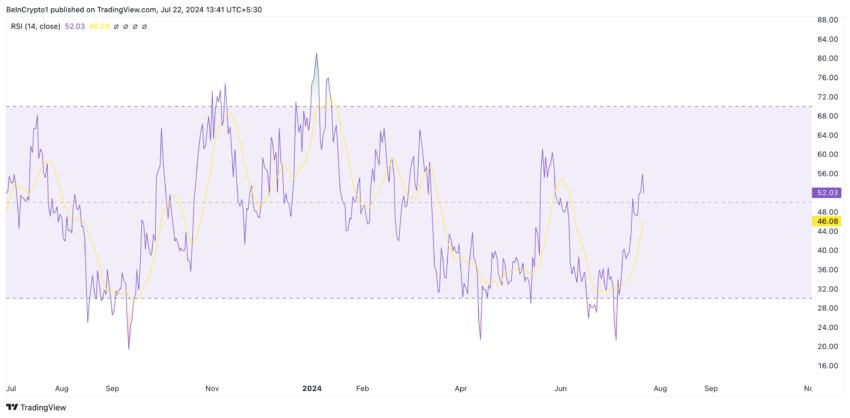

However, the current demand for the altcoin might not be enough to sustain the price rally. This is based on the readings from ARB’s Relative Strength Index (RSI), which has a current value of 51.54 and is in a downtrend.

Arbitrum Analysis. Source: TradingView

Arbitrum Analysis. Source: TradingView An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a decline, while values under 30 indicate that the asset is oversold and may witness a price rebound.

At 51.54, ARB’s RSI suggests that it is neither overbought nor oversold. There is a balance between buying and selling pressures without significant momentum in either direction. Hence, ARB may trade sideways in the short term.

If buying momentum spikes and the token witnesses an uptrend, it may rally to $0.99.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

Arbitrum Analysis. Source: TradingView

Arbitrum Analysis. Source: TradingView However, ARB’s value may plummet to $0.55 if selling pressure increases.