Investment Bank Jefferies Predicts Crypto Stocks Bull Rally Under Donald Trump Presidency

Jefferies Group says crypto-related stocks could do well in a Donald Trump administration. The leading investment banking and capital markets firm bases this speculation on the Republican ticket nominee’s pro-crypto stance.

Anticipation continues to mount regarding the impact of new political leadership in the US on the cryptocurrency market.

Crypto Stocks to Benefit from the Trump Comeback

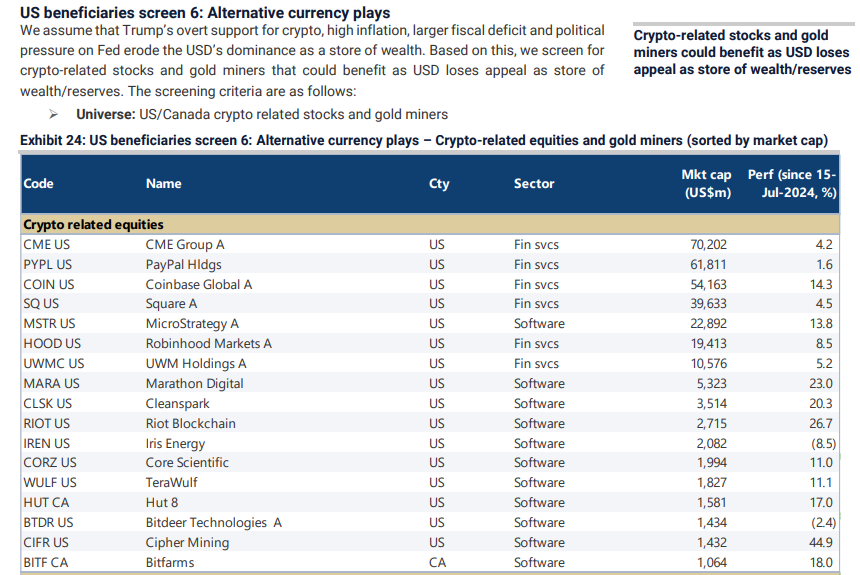

The investment bank assumes that Trump’s public support for crypto, high inflation, larger fiscal deficit, and political pressure on the Federal Reserve could bode well for cryptocurrency-related stocks. With such an outcome expected to reduce the US dollar’s (USD) dominance as a store of wealth, the bank identifies equities and gold miners primed to benefit in the aftermath.

Mathew Sigel, head of digital assets research at VanEck, commented on the list. He noted that most of what Jefferies highlighted also features among digital assets companies tracked by the VanEck Digital Transformation ETF.

Read More: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

Crypto-related Stocks that Could Rally if Donald Trump is President. Source: Jefferies bank

Crypto-related Stocks that Could Rally if Donald Trump is President. Source: Jefferies bank Donald Trump’s vocal support for cryptocurrencies and blockchain technology has been a defining feature of his leadership stance. His pro-crypto rhetoric inspires confidence among industry stakeholders and increases the chances of the crypto market expanding.

Trump’s move to choose a Bitcoin advocate as vice presidential running mate increased the optimism.

“J.D. is a great choice, former VC, and very good on crypto. Trump 2.0 is signaling a pro-tech, pro-Silicon Valley, pro-American dynamism outlook,” Nic Carter, founder of Castle Island Ventures, wrote.

Read more: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

Meanwhile, as inflation remains above the Fed’s 2% target, investors are increasingly turning towards alternative stores of value. The prospect of hedging against inflation and currency devaluation through crypto investments inspires demand for digital assets. While driving up crypto prices, it could extend to crypto-related stocks.

The US is also combatting a bloated fiscal deficit and unprecedented government spending initiatives. Amid these concerns over the sustainability of traditional monetary policies, Bitcoin presents as a possible lifeline. The appeal of crypto assets as a hedge against macroeconomic risks is also growing stronger, fueling investor interest in related stocks and ventures.

This is as fiscal stimulus measures strain national budgets and central bank balance sheets, alongside political pressure mounting on the central bank to address economic challenges and maintain market stability.

Crypto-related stocks positioned at the intersection of technological innovation and crypto’s financial disruption would, therefore, offer a compelling opportunity for diversification and growth in a shifting political environment. This explains Jefferies Bank’s optimism about such financial instruments rallying.