Bitcoin (BTC) on course for new highs despite FUD

In spite of plenty of FUD in the cryptocurrency market, the price of Bitcoin (BTC) is continuing to rally. A weekly stochastic RSI cross up could be confirmed next week, leading to increased momentum that can push Bitcoin to new highs.

Many are still calling this a relief rally, and are expecting Bitcoin to eventually turn back down - likely leading to the entry into Bitcoin’s next bear market.

Brandt says no bull flag

Famed trader Peter Brandt has said that while he is impressed with Bitcoin’s current price surge, a series of lower highs and lower lows are continuing to be made, despite (in his words) “the hype”.

That said, a series of lower highs and lower lows after a big price surge are commensurate with the formation of a bull flag. Brandt counters this by referring to “Edwards, Magee, Schabacker”, who say that a bull flag that extends past a couple of months should be disregarded as such.

Source: TradingView

The above weekly chart allows the reader to make up their own mind. Even if the pattern should be dispelled as a bull flag, it is certainly a downward-sloping channel, and this is a bullish pattern that would be much more likely to see the price exit the top of the channel rather than the bottom.

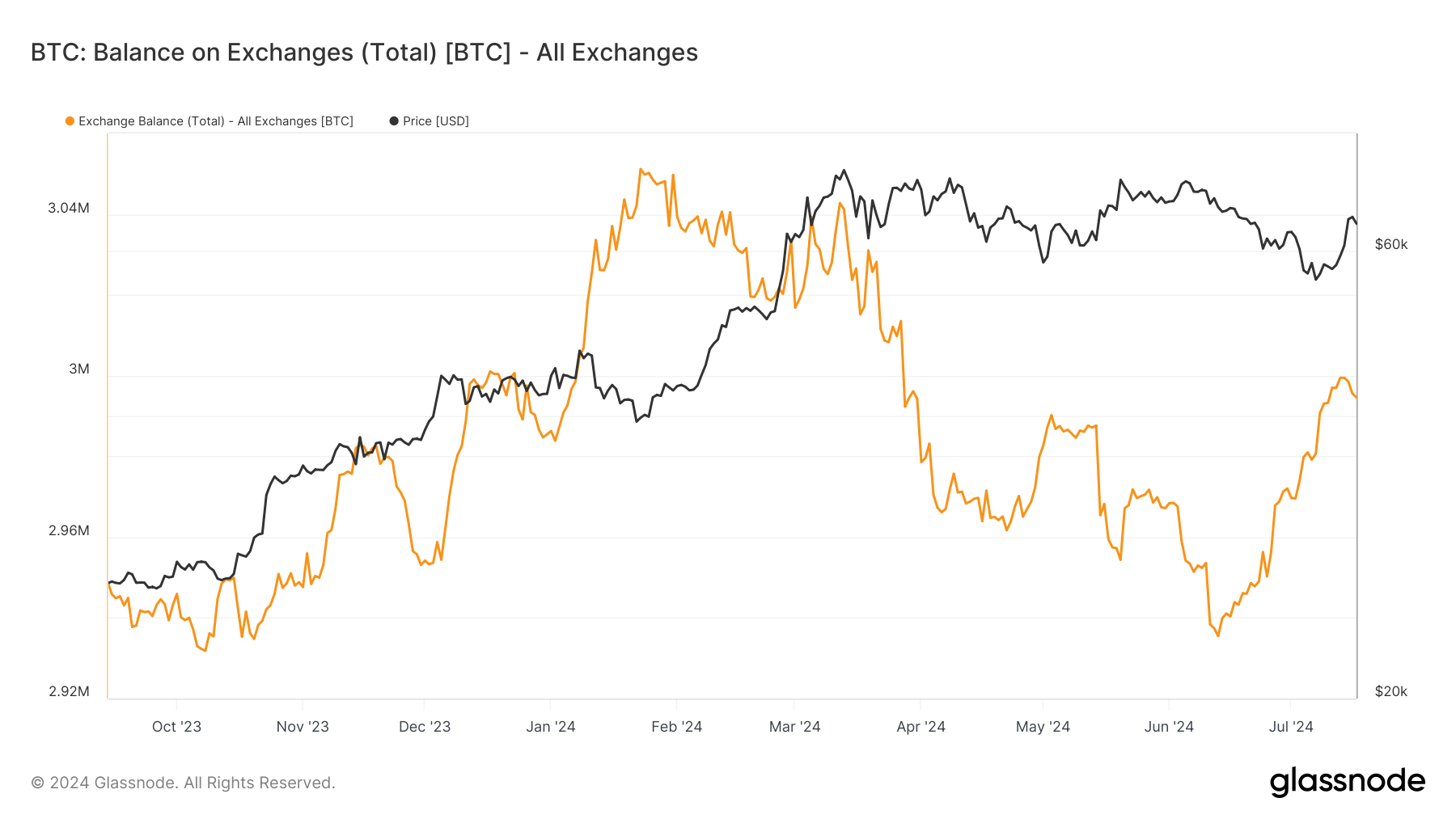

Bitcoin ETFs buy $1 billion in BTC in 3 days

Brandt also mentioned the Spot Bitcoin ETFs as also being responsible for the “hype”. If they are, then perhaps this is well deserved. 9 straight days of inflows have seen the ETFs swell their Bitcoin coffers. Over the course of the 3 days from Friday to Tuesday, the ETFs bought just over $1 billion in $BTC.

Why it’s Bitcoin and not gold

Back to the technicals, the catalyst for the breakout of the top of the bull flag/channel is a cross up on the weekly stochastic RSI past the 20 level. This would likely bring huge momentum under the Bitcoin price; potentially enough to take the alpha currency to new highs.

Source: TradingView

It might also be mentioned that many analysts are pointing to gold as the safest bet during these times of a possible economic breakdown. If one looks at the gold chart compared to Bitcoin, it should be noted that not only has Bitcoin outperformed gold by nearly 1,000% just since the pandemic, but it is potentially poised to go to new highs, having bounced from the 0.618 fibonacci level. The stochastic RSI for the weekly BTC/GOLD pair should also be noted. Just as for BTC/USD, a cross up has just taken place.

Both bulls and bears will have their say, but the market will do as it will do. If the bears are right, Bitcoin will roll over and sink into a bear market ahead of time. If the bulls are right, Bitcoin is beginning its next huge price surge. Which side are you on?

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.