Altcoin Season Looms as 18 Top Cryptos Outshine Bitcoin

As the market awaits the launch of exchange-traded funds (ETFs) that will track the spot price of Ethereum (ETH), speculation is growing that it will mark the beginning of the altcoin season.

This period is typically characterized by a surge in the value of alternative cryptocurrencies compared to Bitcoin.

Only a Few Coins Have Outperformed Bitcoin

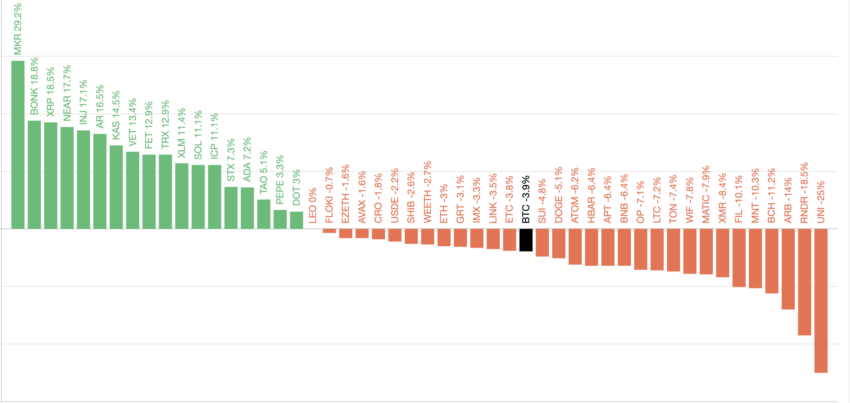

Altcoin season commences when at least 75% of the top 50 altcoins outperform Bitcoin over 3 months.

Only 18 of these assets have surpassed Bitcoin’s performance in the last 90 days, suggesting that we might be venturing into the early stages of this season.

Altcoin Season Index. Source: Blockchaincenter

Altcoin Season Index. Source: Blockchaincenter The top three assets that have outperformed Bitcoin in the past three months include the decentralized finance (DeFi) token MakerDao (MKR), the meme coin Bonk (BONK), and Ripple (XRP).

Maker Crosses Above 50-day SMA and is poised for more gains

Maker’s (MKR) price has climbed significantly in the past week. Exchanging hands at $3,024 at press time, the altcoin’s price has grown by 33% in the past seven days.

During that period, the token crossed above its 50-day small moving average (SMA) – which measures its average price over the past 50 trading days.

When an asset’s price rallies past this key moving average, it indicates a positive shift in momentum. This is often considered a bullish signal by traders and investors. It confirms that an asset’s price is uptrend and could continue.

Maker Price Analysis. Source: TradingView

Maker Price Analysis. Source: TradingView If MKR maintains this trend, its price will rally to $3,277.

BONK Bulls Have the Upper Hand

Over the past 90 days, Bonk’s (BONK) price has gained by 19%. Its value has risen by over 20% in the last month alone. As of this writing, the altcoin trades at a monthly high of $0.00002836.

Readings from its Elder-Ray Index assessed on a one-day chart show that the bullish bias toward the meme coin remains significant. The indicator’s value at press time rests above the zero line at 0.0000069. It has returned only positive values since July 15.

Further, the setup of BONK’s Directional Movement Index (DMI) lends credence to the position above. At press time, the token’s positive directional indicator (+DI) (blue) rests above its negative directional indicator (-DI).

An asset’s DMI assesses its price strength and direction. When its +DI lies above its -DI, it signals that the asset’s price is experiencing more uptrend than downward movements. Traders view this as a bullish signal, suggesting that buyers are stronger than sellers.

Bonk Price Analysis. Source: TradingView

Bonk Price Analysis. Source: TradingView If BONK’s buying activity persists, its price may climb to $0.000031.

Ripple (XRP) Trades at Multi-Month High

Ripple’s (XRP) 38% price hike in the past seven days has pushed it to a multi-month. The token currently trades at $0.61, a price level it last observed on April 12.

However, the altcoin may be at risk of shedding some of these gains. Readings from its Relative Strength Index (RSI) show that XRP is overbought and due for a decline. The indicator’s value is 77.21.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a decline and values under 30 suggesting that the asset is oversold and may witness a rebound.

If XRP’s price retraces, it may drop below $0.60 to trade at $0.56.

Ripple Price Analysis. Source: TradingView

Ripple Price Analysis. Source: TradingView However, if it maintains its uptrend, it may exchange hands at $0.66.