Tether Recruits Chainalysis Expert Amidst Ongoing Legal Battle

Tether, the issuer of the world’s largest stablecoin, has appointed Phillip Gradwell as the new Head of Economics. Gradwell joins the company amid a lawsuit alleging market manipulation involving USDT.

Stablecoins remain a crucial focus for digital asset regulators and the public. Their backing and dollar peg are some of the areas of interest.

Phillip Gradwell To Enhance Tether’s Communication

In a Monday announcement, Tether revealed its intention to leverage Gradwell’s experience engaging regulators, among other skills, to further its mission. He will help the firm advance its understanding of digital asset adoption, focusing on how Tether’s USDT stablecoin supports dollar hegemony.

“As the first and most widely used stablecoin, USDT conveniently and securely brings the US dollar to people globally. This enhances the liquidity and stability of the US financial system. It also reinforces the role of the dollar in global finance thereby supporting dollar hegemony. Philip’s expertise will enable Tether to bring even further understanding to our indispensable role in supporting the dollar,” Tether CEO Paolo Ardoino wrote.

Phillip Gradwell transitioned from a six-year career as chief economist at the blockchain analytics firm Chainalysis. Tether’s interest in his experience measuring digital asset activity and communicating with regulators comes amid an ongoing market manipulation lawsuit.

Read more: What Is a Stablecoin? A Beginner’s Guide

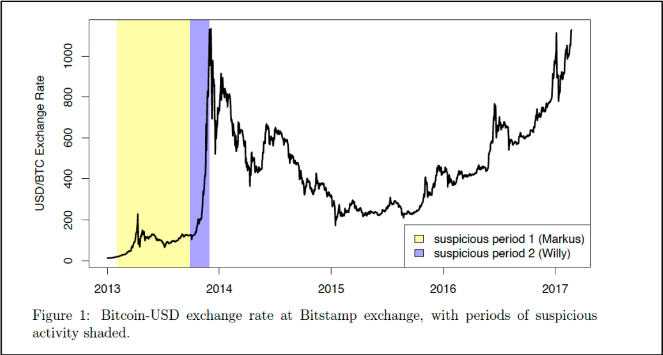

In the long-standing class-action lawsuit, which traces back to 2019, Shawn Dolifka and Matthew Anderson claim Tether and Bitfinex conspired to manipulate cryptocurrency prices using USDT stablecoin. Reportedly, Bitcoin is among the cryptocurrencies whose prices the defendants manipulate.

“[Tether and Bitfinex] executed a sophisticated scheme to fraudulently inflate the price of cryptocurrencies, including Bitcoin. They orchestrated massive, carefully timed purchases […] to signal to the market that there was enormous demand. Thus, caused the price of those commodities to spike,” an excerpt in the court documents read.

With this, the plaintiff claims Tether and Bitfinex violated the Commodities Exchange Act (CEA) and the Sherman Antitrust Act. The plaintiff also challenges the stablecoin’s status, that its one-to-one backing by the US dollar is false.

“In reality, Tether issued billions of USDT to itself with no US dollar backing — simply creating the USDT out of thin air. This ultimately resulted in billions of dollars of damage to innocent crypto commodity purchasers.”

Exhibit From Alleged Suspicious Trading Activity on Bitstamp. Source: CourtListener

Exhibit From Alleged Suspicious Trading Activity on Bitstamp. Source: CourtListener Tether and Bitfinex Denounce Manipulation Lawsuit

Since its inception, the lawsuit has suffered multiple delays, amendments, and settlements. In 2021, Tether signed an $18.5 settlement with the New York Attorney General over USDT backing. In October 2021, the US Commodity Futures Trading Commission (CFTC) also imposed a $41 million fine against Tether regarding the same matter.

Throughout the ongoing litigation, Tether and Bitfinex assert that the plaintiffs lack evidence to support their market manipulation claims. Nearly three weeks ago, Judge Katherine Failla of the US District Court for the Southern District of New York permitted the plaintiffs to proceed with a proposed Second Amended Complaint. Despite this, Tether remains confident in their defense, believing the plaintiffs’ “conspiracy theories” will ultimately be rejected.

“The decision does not suggest that plaintiffs’ claims have any merit, as leave to amend a complaint is freely granted and the Court must accept plaintiffs’ allegations as true, however baseless they might be in reality. As with the prior complaint, the claims asserted in plaintiffs’ proposed amendment are wholly without merit. Ultimately, it is the facts and evidence that matters, not plaintiffs’ false and misleading allegations,” Tether stated.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This development reflects the ongoing strife between crypto firms and industry regulation. Tether’s onboarding of Gradwell’s knowledge and experience highlights its commitment to defending its position and bringing in personnel with skill sets that could deliver a favorable outcome.