Andre Hakkak Net Worth 2024: A Financial Titan’s Journey

Introduction

Andre Hakkak is a prominent figure in the financial world, known for his astute investment strategies and leadership at White Oak Global Advisors. As we step into 2024, his influence and success continue to grow, drawing attention to his net worth and the factors contributing to his financial success. This article delves into the life, career, and financial accomplishments of Andre Hakkak, offering a comprehensive analysis of Andre Hakkak net worth in 2024.

Andre Hakkak Biography

| Name | Andre Hakkak |

| Date of Birth | 5 January 1973 |

| Nationality | Iranian-American |

| Education | University of California, University of Chicago |

| Profession | Entrepreneur, Investor Banker, Business Consultant |

| Net Worth | $10 Billion |

Who is Andre Hakkak?

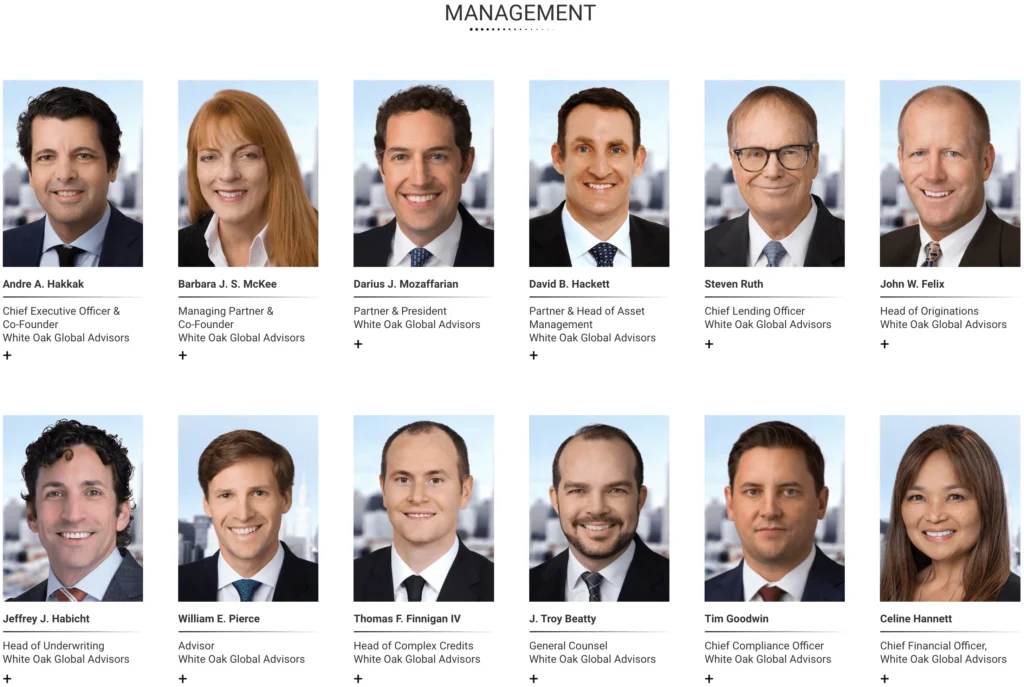

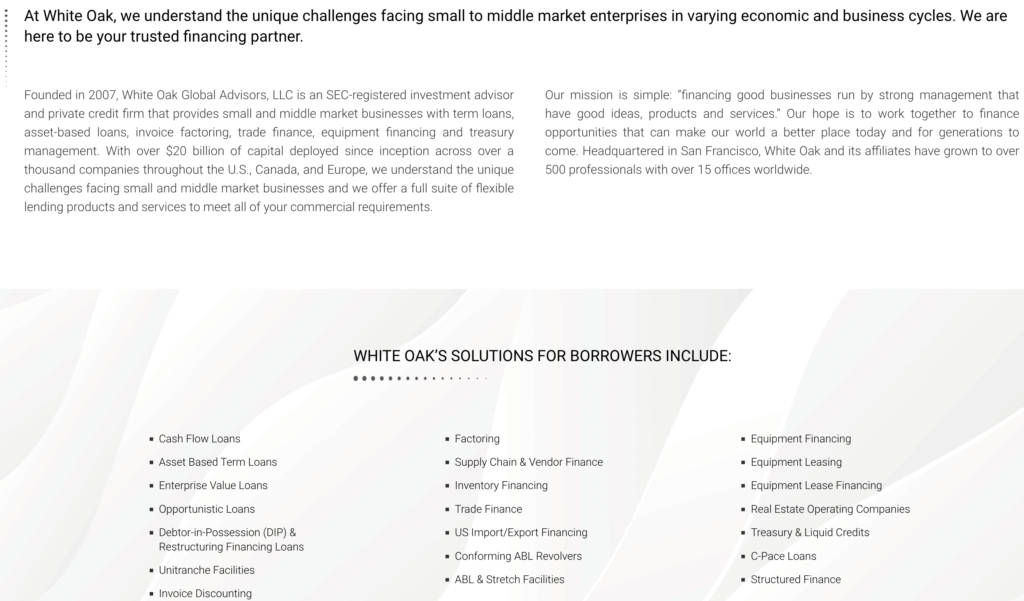

Andre Hakkak is the co-founder and CEO of White Oak Global Advisors, a San Francisco-based investment firm specializing in providing customized capital solutions to small and middle-market enterprises. With a career spanning several decades, Hakkak has built a reputation for his expertise in finance, investment, and asset management. His strategic vision and commitment to fostering business growth have positioned him as a key player in the investment community.

Early Life and Career

Andre Hakkak’s journey to becoming a financial titan began in his formative years. Born into a family that valued education and hard work, Hakkak developed a keen interest in finance and economics from a young age. He pursued his higher education at a prestigious institution, earning a degree that laid the foundation for his future endeavors in the financial sector.

Hakkak’s early career was marked by a series of strategic moves that showcased his investment acumen and leadership capabilities. He started in investment banking, where he gained valuable experience in mergers and acquisitions, capital markets, and financial advisory services. This early exposure to the intricacies of financial markets equipped him with the skills needed to navigate complex investment landscapes.

In 2007, Andre Hakkak co-founded White Oak Global Advisors with the vision of providing bespoke financial solutions to underserved markets. Under his leadership, the firm quickly gained traction, distinguishing itself through its innovative approach to lending and investment. Hakkak’s ability to identify lucrative opportunities and manage risk effectively has been instrumental in the firm’s success.

What is Andre Hakkak Net Worth?

Estimating the exact net worth of private individuals, especially those in the financial sector, can be challenging due to the dynamic nature of their investments and holdings. However, based on available data, industry insights, and the performance of White Oak Global Advisors, it is possible to make an educated estimate of Andre Hakkak’s net worth in 2024. Several factors contribute to Andre Hakkak net worth, including:

- White Oak Global Advisors’ Performance: As the CEO of a leading investment firm, Hakkak’s wealth is closely tied to the performance of White Oak Global Advisors. The firm’s portfolio, consisting of various assets and investments, significantly impacts his financial standing.

- Investment Strategies: Hakkak’s personal investments and financial strategies also play a crucial role. His ability to diversify his portfolio and leverage market opportunities has undoubtedly contributed to his wealth.

- Market Trends: The overall economic environment and market trends influence the valuation of assets and investments held by Hakkak, impacting his net worth.

Based on these factors, it is estimated that Andre Hakkak’s net worth in 2024 is around $10 billion. This estimate considers the continued growth and success of White Oak Global Advisors, Hakkak’s personal investments, and prevailing market conditions.

The Influence of White Oak Global Advisors

White Oak Global Advisors is a leading investment firm specializing in providing capital solutions to small and middle-market companies. The firm focuses on delivering flexible and tailored financing options, enabling businesses to achieve their growth objectives. Under Andre Hakkak’s leadership, White Oak Global Advisors has achieved numerous milestones, including:

- Significant Asset Under Management (AUM): The firm has grown its AUM substantially, reflecting its ability to attract and manage large-scale investments effectively.

- Innovative Investment Solutions: White Oak Global Advisors is known for its innovative approach to investment, offering a range of financial products that cater to diverse client needs.

- Global Expansion: The firm has expanded its footprint globally, establishing a presence in key financial markets and enhancing its ability to serve a diverse client base.

The success of White Oak Global Advisors is a significant driver of Andre Hakkak net worth in 2024. As the firm’s CEO and co-founder, he holds a substantial stake in the business, directly benefiting from its financial performance and growth.

Financial Philosophy and Investment Strategies

Andre Hakkak’s investment philosophy is grounded in a deep understanding of market dynamics and a commitment to creating value through strategic investments. He emphasizes the importance of thorough research, risk management, and long-term planning in achieving sustainable financial success.

Key Strategies

Hakkak employs several key strategies in his investment approach:

- Diversification: By diversifying his investment portfolio, Hakkak mitigates risk and enhances the potential for returns. This approach involves investing in various asset classes, sectors, and geographic regions.

- Value Investing: Hakkak focuses on identifying undervalued assets with strong growth potential. This value-oriented approach enables him to capitalize on market inefficiencies and generate substantial returns.

- Active Management: As an active manager, Hakkak takes a hands-on approach to his investments, continuously monitoring performance and making adjustments to optimize outcomes.

Case Studies

Several case studies illustrate the effectiveness of Hakkak’s investment strategies as well as the Andre Hakkak net worth:

- Turnaround Successes: Hakkak has a track record of investing in distressed assets and turning them around through strategic interventions. These successes highlight his ability to identify opportunities and implement effective recovery plans.

- Growth Investments: His investments in growth-oriented companies have yielded significant returns, showcasing his ability to identify high-potential opportunities and support business expansion.

Philanthropic Endeavors and Social Impact

Andre Hakkak’s philanthropic endeavors highlight his commitment to using his success for the greater good. His contributions to education, healthcare, and environmental sustainability reflect a holistic approach to philanthropy, one that seeks to address various dimensions of societal well-being:

1. Commitment to Philanthropy

Beyond his financial success, Andre Hakkak is also known for his dedication to philanthropy and social impact. He believes in leveraging his wealth and influence to make a positive difference in society. His philanthropic endeavors focus on various causes, including education, healthcare, and environmental sustainability.

2. Educational Initiatives

Hakkak has a strong commitment to improving access to quality education. He has funded scholarships and educational programs aimed at empowering underprivileged students and providing them with the resources they need to succeed. By supporting educational initiatives, Hakkak aims to create opportunities for future generations and bridge the gap between different socio-economic backgrounds.

3. Healthcare Contributions

Recognizing the importance of healthcare, Hakkak has contributed to numerous healthcare projects and organizations. His donations have supported medical research, the construction of healthcare facilities, and the provision of medical services to underserved communities. Hakkak’s contributions to healthcare are driven by a desire to enhance the well-being and quality of life for individuals globally.

4. Environmental Sustainability

Hakkak is also a proponent of environmental sustainability. He supports various environmental conservation efforts and invests in sustainable technologies and practices. His initiatives aim to address climate change, promote renewable energy, and protect natural resources. Through his commitment to sustainability, Hakkak strives to leave a positive environmental legacy for future generations.

5. Impact on Society

The impact of Andre Hakkak’s philanthropic efforts extends beyond immediate benefits to the recipients. By addressing critical issues such as education, healthcare, and environmental sustainability, he contributes to the long-term development and stability of communities. His philanthropic philosophy is rooted in the belief that giving back to society is not only a responsibility but also a means to create lasting positive change.

6. Future Plans

Looking ahead, Hakkak plans to expand his philanthropic activities and continue supporting causes close to his heart. He aims to collaborate with other philanthropists, organizations, and stakeholders to amplify the impact of his efforts. By fostering partnerships and leveraging his resources, Hakkak envisions a future where his philanthropic initiatives can create even greater societal benefits.

Conclusion

Andre Hakkak net worth in 2024 is a testament to his expertise, strategic vision, and leadership in the financial sector. As the co-founder and CEO of White Oak Global Advisors, he has played a pivotal role in the firm’s success, leveraging his investment acumen to create substantial wealth.

Hakkak’s financial philosophy and investment strategies continue to drive his success, positioning him as a prominent figure in the world of finance. As we look to the future, his influence and contributions to the investment community are set to endure, solidifying his legacy as a financial titan.

Who is Andre Hakkak?

Andre Hakkak is the co-founder and CEO of White Oak Global Advisors, an investment firm specializing in providing customized capital solutions to small and middle-market enterprises. He is known for his expertise in finance, investment, and asset management.

What is Andre Hakkak’s estimated net worth in 2024?

Andre Hakkak’s net worth in 2024 is estimated to be around $10 billion, considering the performance of White Oak Global Advisors, his personal investments, and market conditions.

How did Andre Hakkak start his career in finance?

Andre Hakkak began his career in investment banking, gaining experience in mergers and acquisitions, capital markets, and financial advisory services. This early exposure helped him develop the skills needed to navigate complex investment landscapes.

What are some key strategies employed by Andre Hakkak in his investments?

Andre Hakkak’s investment strategies include diversification, value investing, and active management. He focuses on identifying undervalued assets with strong growth potential and continuously monitors performance to optimize outcomes.