Bitcoin Market Analysis: Ivan on Tech Spotlights Key Buy Zones Amid Market Turbulence

- The Bitcoin market has recently faced notable shifts, sparking interest and concern among investors.

- An in-depth analysis by crypto analyst Ivan Liljeqvist sheds light on these developments, discussing the implications for both Bitcoin and the broader cryptocurrency landscape.

- “This period presents a generational wealth buying opportunity,” Ivan commented, reflecting on the market’s potential rebound.

Discover the latest insights into Bitcoin’s market dynamics, potential recovery, and strategic considerations for investors in our detailed analysis.

The Immediate Market Reaction to Bitcoin’s Price Decline

Crypto analyst Ivan Liljeqvist addressed the recent sharp decline in Bitcoin’s price, emphasizing the emotional response from the investor community. Bitcoin’s drop to approximately $50,000 was identified as a critical buying range, with Ivan highlighting the significance of the support levels between $53,000 and $49,000. This price area is anticipated to potentially foster a rebound, crucial for market stability.

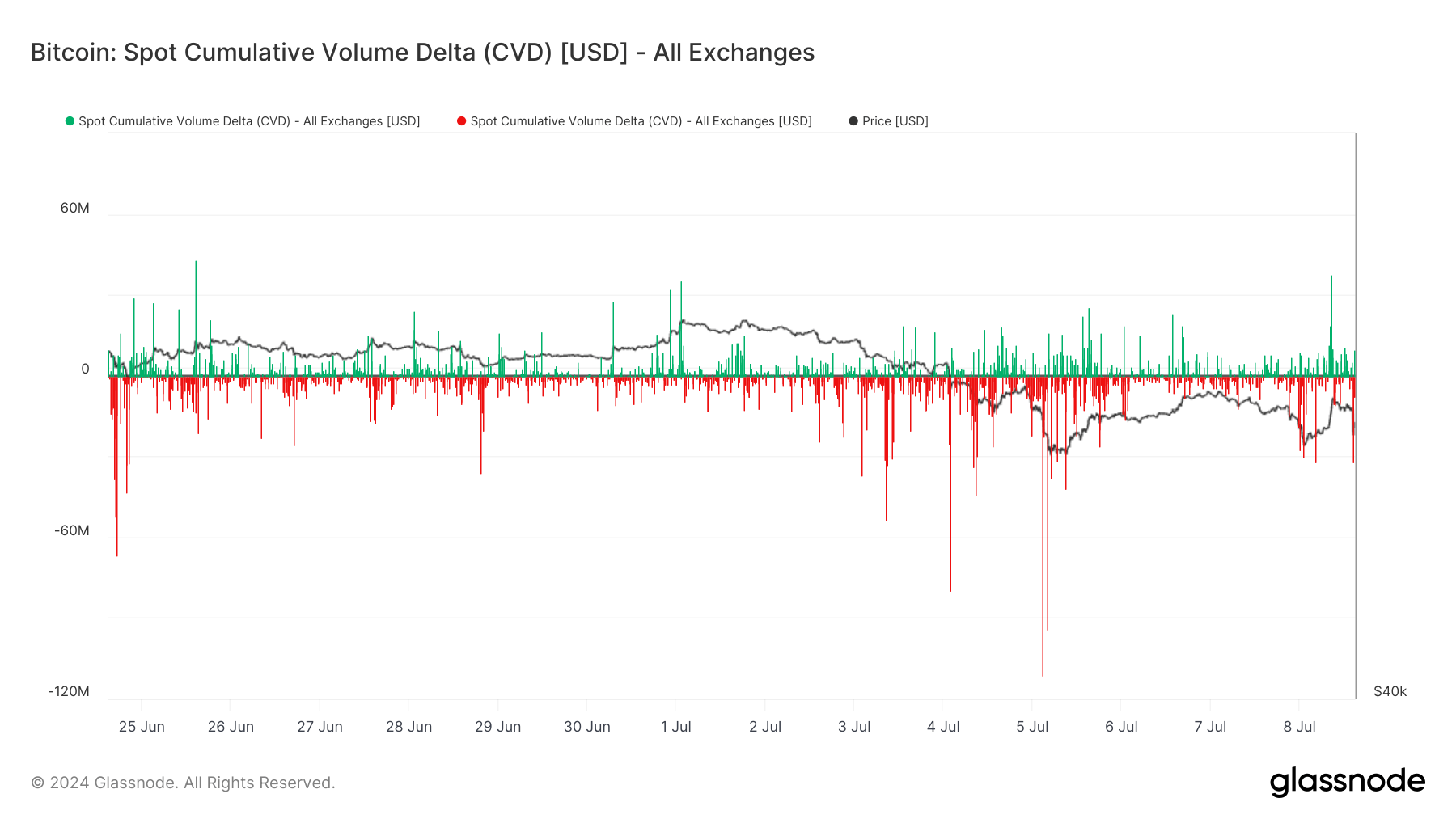

The Nature of Market Dumps and Recovery Potential

Ivan pointed out the speed of the recent market dump, suggesting that a rapid decline can often be more favorable than a prolonged downturn. By comparing it to past market events, he explained that swift capitulation might lead to quicker recovery phases. This contrasts with slow declines that tend to have longer-lasting negative effects on the market.

Accumulation During Negative Sentiment

Highlighting the current negative sentiment in the market, Ivan described it as an ideal time to accumulate Bitcoin. He referred to historically similar periods marked by negativity, which eventually proved to be optimal buying opportunities. Emphasizing the market’s mood since the FTX collapse, Ivan suggested that investors consider the long-term potential of Bitcoin.

Government Actions Impacting Market Dynamics

A portion of Ivan’s analysis focused on recent activities by the German government, which has been liquidating seized Bitcoin. He criticized this move, arguing that selling for fiat currency, which can be indefinitely produced by governments, lacks strategic foresight. Despite potential short-term market depressions, Ivan maintained that such actions do not undermine Bitcoin’s fundamental value.

Long-term Projections and Market Comparisons

Ivan drew parallels between the current market conditions and past events, such as the market dump and subsequent recovery in 2020. He maintained that Bitcoin’s intrinsic value and technological utility remain unaffected by short-term volatility. Ivan forecasted that, akin to historical patterns, significant dumps could precede substantial recoveries.

Opportunities in the Altcoin Market

Extending his analysis beyond Bitcoin, Ivan commented on the altcoin market’s dynamics. He indicated that altcoins generally mirror Bitcoin’s trends but can exhibit more pronounced gains during recovery periods. Investors are advised to identify and invest in key altcoins poised for significant appreciation in the next market uptrend.

Investor Strategies and Market Outlook

Ivan recommended a calm, strategic approach to the current market scenario. Investors should adopt a probabilistic view, recognizing inherent risks while acknowledging the considerable potential rewards. Monitoring pivotal developments such as regulatory updates and major institutional movements will be crucial in navigating the evolving crypto markets.

Conclusion

In conclusion, Ivan Liljeqvist’s analysis underscores the importance of understanding both immediate reactions and broader implications in the cryptocurrency market. By remaining informed and strategically positioned, investors can capitalize on potential market recoveries and navigate the intricate landscape of Bitcoin and altcoins effectively.