Mt Gox Begins Bitcoin (BTC) Repayments as Market Faces Potential Downward Pressure

- The beleaguered cryptocurrency exchange Mt Gox has finally started the process of reimbursing creditors a decade after declaring bankruptcy.

- The Mt Gox Rehabilitation Trustee has announced that initial repayments, in both Bitcoin (BTC) and Bitcoin Cash (BCH), were made on July 5 to some creditors via chosen cryptocurrency exchanges.

- The trustee emphasized that the entire repayment process should be finalized by October 31, despite a few remaining logistical hurdles.

Mt Gox begins creditor repayments with initial distributions, shedding light on the path to restoring investor settlements after a decade-long battle.

The Start of Mt Gox Repayments

The trustee for the bankrupt crypto exchange Mt Gox confirmed that repayments to creditors have begun. Initial repayments in Bitcoin (BTC) and Bitcoin Cash (BCH) were processed through specific crypto exchanges aligned with the rehabilitation plan. This repayment process, which aims to return funds to eligible creditors, comes nearly ten years after the exchange’s collapse.

Steps Needed for Further Repayments

The trustee highlighted several conditions that need to be met for continuing distributions. These include verifying the authenticity of registered creditor accounts, finalizing discussions with partner exchanges, and ensuring that distributions can be executed safely. Creditors are being asked to remain patient as these requirements are addressed. The trustee has set a goal to complete all repayments by October 31.

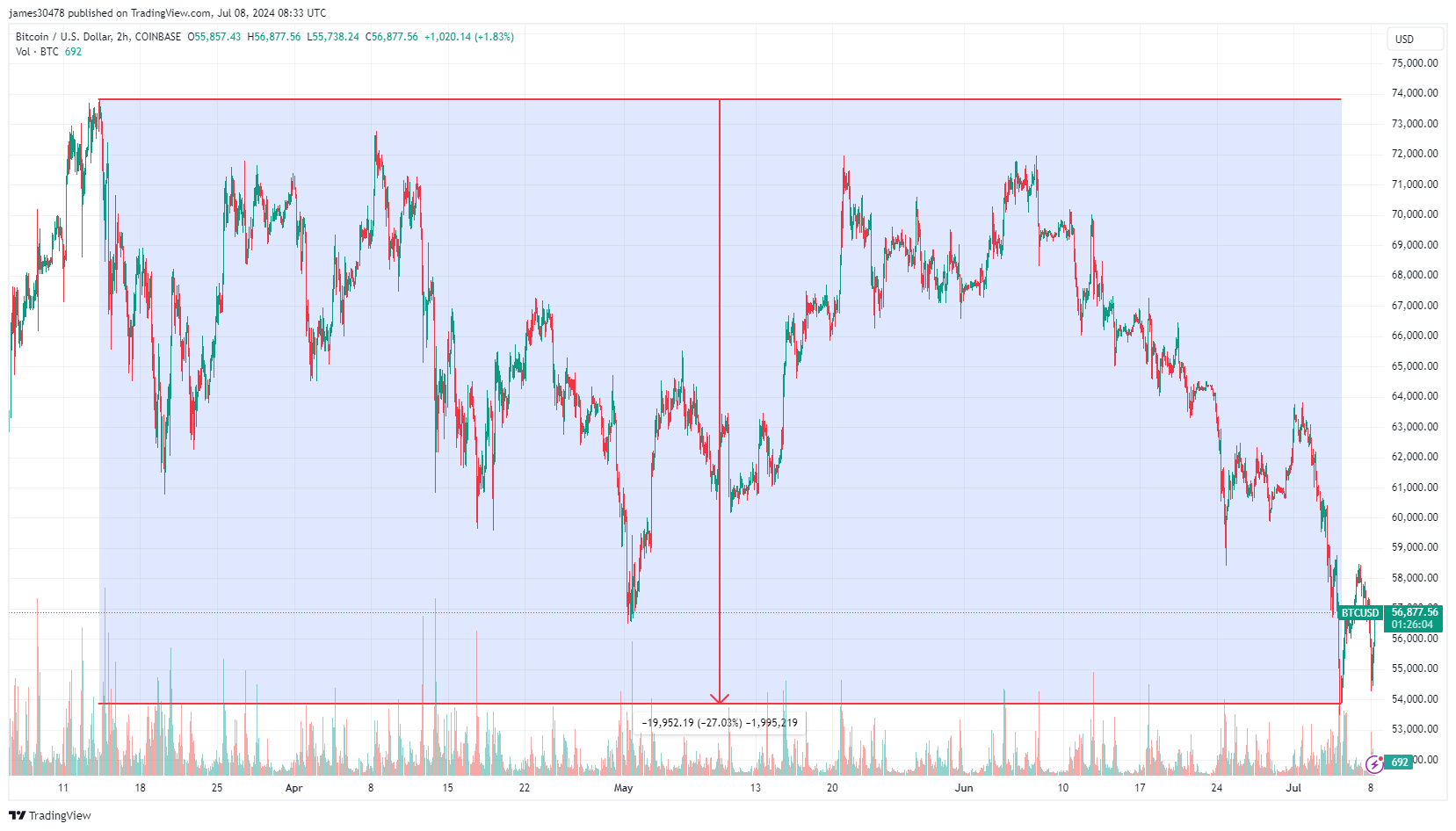

Potential Impact on Bitcoin Price

The announcement of Mt Gox’s repayments coincided with Bitcoin’s struggle to maintain its price above $54,000. BTC experienced a 5% drop in value within the past 24 hours, while BCH fell by 12%, settling at around $300. Concerns have mounted regarding the potential market impact of these payouts, as large volumes of BTC could potentially flood the market.

Market Concerns and Expert Opinions

There has been speculation that the selling pressure from Mt Gox repayments could catalyze a significant BTC price correction. Despite reassurances from on-chain analysts that the movement of BTC from Mt Gox should not cause immediate panic, recent BTC chart trends suggest otherwise. On Friday, Bitcoin briefly dipped below $54,000 as the Mt Gox trustee moved $2.7 billion in BTC to a new address for repayments, mirroring a similar price drop in May when BTC fell 4% amid Mt Gox-related transfers.

Ongoing Challenges and Future Implications

As the exchange continues these repayments, Bitcoin faces the risk of a price drop to potentially $50,000, exacerbated by creditors possibly liquidating their assets upon receipt. Additionally, this downward pressure might be further intensified by ongoing BTC sales from the German government, which has recently offloaded 9,641 BTC worth over $539 million. The German government still retains a significant BTC balance, which could influence market dynamics.

Crypto Market Liquidations and Analyst Predictions

The broader cryptocurrency market has also seen escalating liquidations, exceeding $660 million, with expectations of further increases. Nonetheless, some analysts maintain an optimistic outlook, suggesting that Bitcoin is poised for another upward trend, pointing to the prevailing bullish sentiment in the market.

Conclusion

In summary, the commencement of Mt Gox creditor repayments marks a significant milestone in the long-standing case of the collapsed exchange. While the process brings closure for many investors, it also introduces potential volatility in the cryptocurrency market, particularly for Bitcoin. Stakeholders will need to closely monitor these developments as they unfold, with an eye on both immediate impacts and longer-term market health.