Bitcoin Dips to February Low as $540 Million Long Position Gets REKT. Why?

Bitcoin continues to decline as it sees fresh selloffs. It saw an over 5% drop during the previous intraday session with over $150 million in liquidations in derivatives.

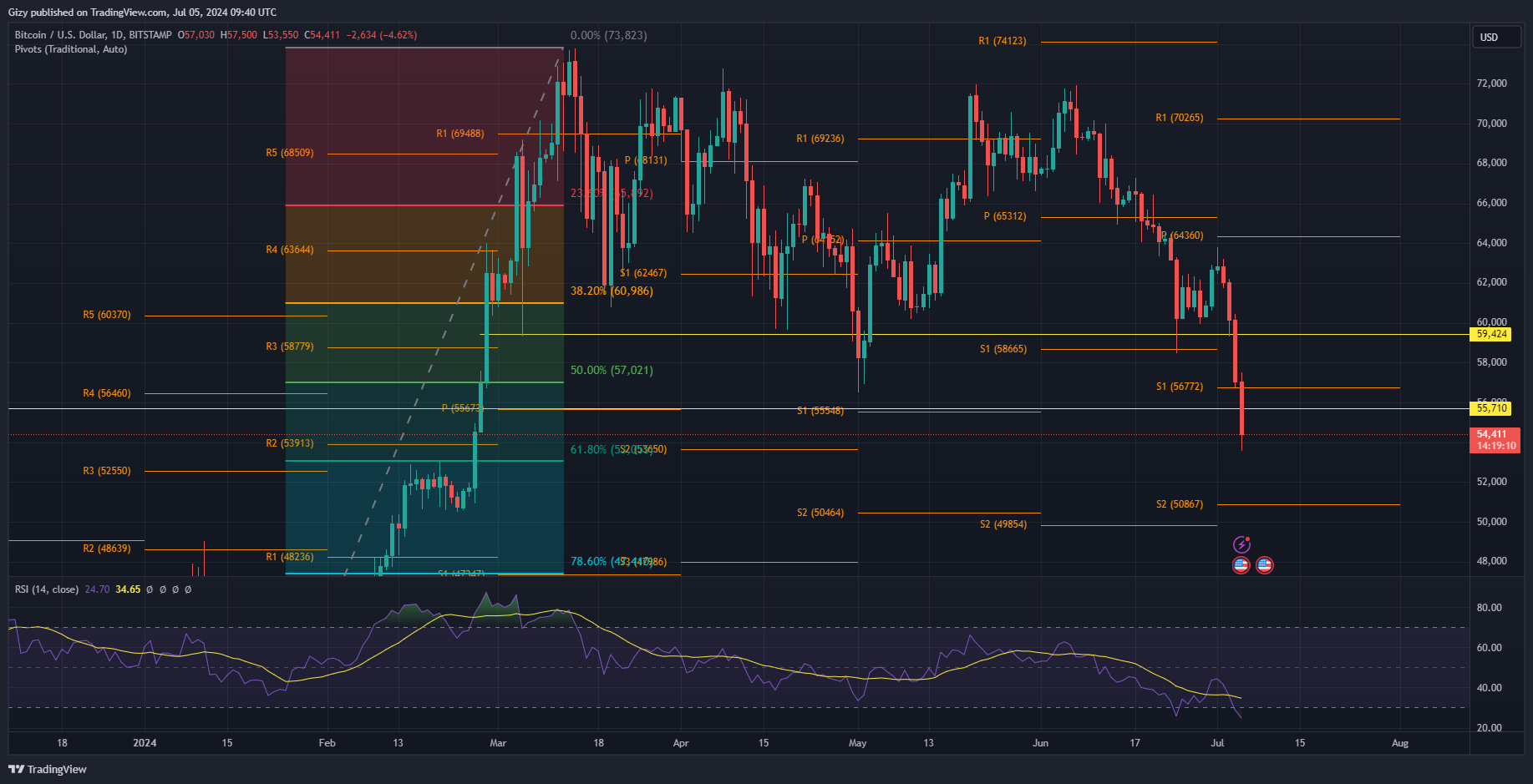

The downtrend continues on July 5 as it loses another 5%. It started trading at $57k but retraced after a small hike. It dropped to February’s low, rebounding at $53,550.

BTC’s current decline marks the fourth consecutive day of notable corrections. It started on July 2 with an almost 2% drop and lost 3% the next day as it dipped below $60k. Thursday continued the trend with a retracement from $60,000 to $56,748.

Mt.Gox Moves BTC

The most recent downtrend is due to scares from the defunct exchange, Mt.Gox. It recently moved over $2 billion worth of bitcoin from one wallet to another. With its previous announcement that it plans to pay its traders, many fear that it is about to dump its bag.

The latest asset transfer follows a May report that the firm transferred over $9 billion worth of the coin in May.

Nonetheless, many speculate that the current selloff on the news of Mt. Gox is baseless as the exchange did not reveal plans to sell its bag. One X user speculated that the firm may “send these bitcoins to many exchanges and give its customers access to trade like everyone here.” However, it does not remove the possibility that the customers may sell.

The previous day’s downtrend also happened because of another massive selloff. The German government sold off over 1000 $BTC. The major remains that it may continue the selloffs as it holds over 40,000 units of the cryptocurrency, estimated at over $2 billion.

Amidst the current market trend, the coin is seeing notable attempts at halting the decline. Tron founder Justin Sun proposes buying the remaining asset from Germany off the market. Receiving no response yet, a German parliament member also urged the government to halt its sales.

Liquidation is on the Rise

Amidst the selloffs, traders continue to see massive losses. The derivatives market is at the forefront of these losses, losing over $650 million in the last 24 hours.

Data from Coinglass shows that the long position, which amounted to over $540 million, comprised over 80% of the liquidated funds. The bears also lost almost $100 million.

The latest liquidation shows an over 100% increase compared to the previous intraday session. Nonetheless, the outcome remained the same, with the bulls seeing the largest REKT funds.

Bitcoin is Oversold

Due to the latest downtrend, the apex coin is seeing more indicators flip bearish. One such is the relative strength index. It sank below 30 and is currently at 24. The current reading is the lowest this year, with the coin dipping this low since August 2023. The latest decline is the second time the asset is oversold in the last fourteen days.

Following the previous phenomenon, many analysts speculated a massive rebound. However, they are largely silent as the panic of more selloffs looms. Nonetheless, the cryptocurrency is due for a significant surge following its dip below 30.

The apex coin lost the 200-day EMA during the previous session and sank further due to the latest decline. The moving averages continue to descend, with the 50-day MA and 200-day MA dropping as low as $62. The only positive aspect of this decline is that a golden cross is certain with the first month of the uptrend.

Nonetheless, the pivot point standard bears more bad news as BTC flipped the first pivot support. If the decline continues, the coin is set to attempt the second pivot support.

The Fibonacci retracement points to $63k as a strong support due to notable demand concentration. Price actions a few hours ago also confirmed this assertion by the metric.

The post Bitcoin Dips to February Low as $540 Million Long Position Gets REKT. Why? first appeared on Cointab.