Coinbase References Binance Token Case in Petition to SEC

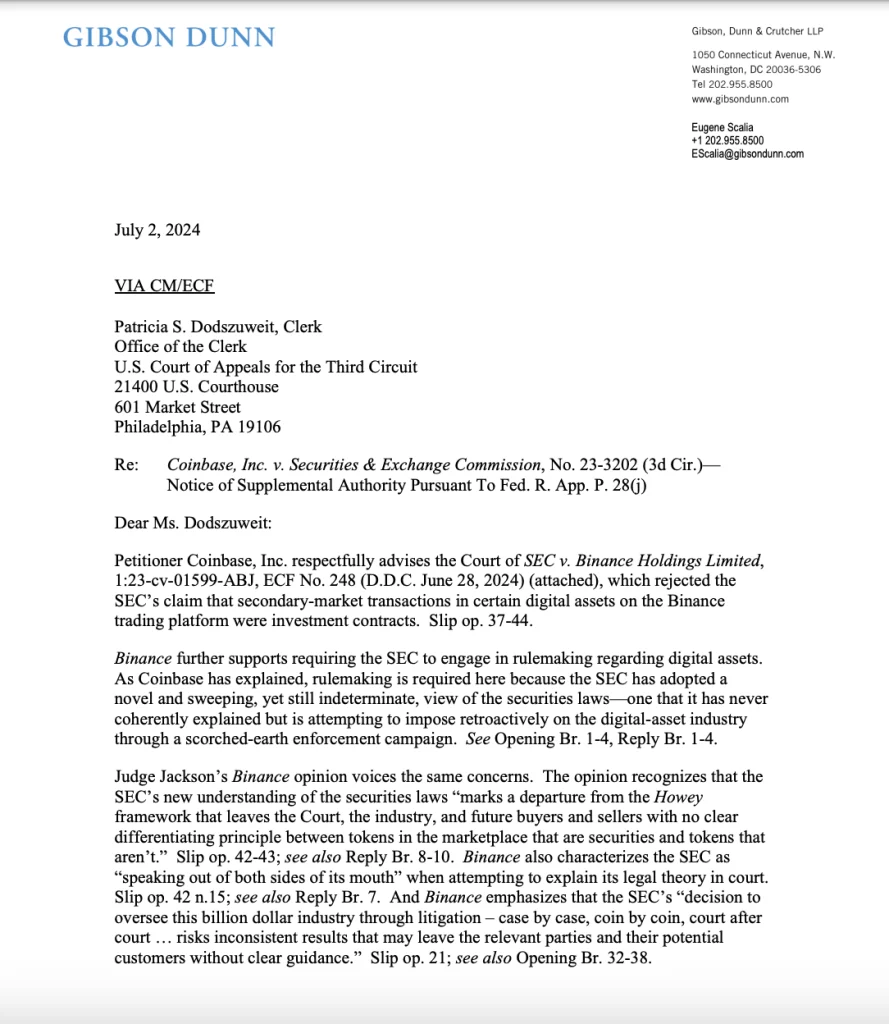

In a legal battle that has captured the attention of the cryptocurrency industry, Coinbase is leveraging a significant judicial ruling to strengthen its position against the U.S. Securities and Exchange Commission (SEC).

The ruling in question came from Judge Amy Berman Jackson in the case of SEC v. Binance, where it was determined that secondary sales of Binance’s BNB token do not qualify as securities transactions under the guidelines of the Howey test.

Accusations of Inconsistent Rule-Making

This decision has provided Coinbase with a judicial precedent to challenge the SEC’s current regulatory approach. The confrontation escalated when Coinbase accused the SEC of inconsistent and arbitrary rule-making.

In a strongly worded letter from their attorneys, Coinbase criticized the SEC for not having a clear and coherent explanation of its regulatory procedures, accusing the agency of attempting to enforce these rules retroactively on the digital asset industry through aggressive legal actions.

The tension between Coinbase and federal agencies intensified with Coinbase filing a lawsuit on June 27 against the SEC and the Federal Deposit Trust Corporation. The lawsuit alleges that these agencies conspired to exclude the crypto industry from the banking sector.

It further accuses them of violating the Freedom of Information Act by failing to provide necessary documentation on rulemaking deliberations, particularly concerning Ethereum’s transition to a staking-based digital asset ecosystem.

This legal challenge is not the first instance where the SEC’s classification of digital assets has been contested. Back in 2018, the SEC’s then Corporation Finance Director William Hinman stated that Ethereum’s cryptocurrency, ETH, was not a security, citing its decentralized smart contract protocol.

This statement later played a crucial role in Ripple Labs’ defense against the SEC’s charges that Ripple’s XRP token was an unregistered security. Ripple Labs argued that the SEC lacked consistent criteria for defining what constitutes a “securities contract.”

Internal Criticism and Judicial Complications

The inconsistencies in the SEC’s approach have not gone unnoticed within the agency itself. SEC Commissioner Mark Uyeda has openly criticized the SEC’s problematic dealings with the crypto sector, reflecting internal disagreements over the agency’s strategy.

The legal landscape was further complicated by another ruling from Judge Analisa Torres in the case of SEC v. Ripple Labs.

Judge Torres established that while secondary sales of XRP did not constitute the sale of unregistered securities, initial sales to institutional investors did, based on the nature of the transactions rather than the characteristics of the digital asset itself.

Amidst these legal entanglements, the political and regulatory environment for cryptocurrencies in the U.S. is showing signs of change.

Shifting Political and Regulatory Environment

Crypto venture capitalists have noted a shift in political attitudes towards the industry, which was evident when spot Ether exchange-traded funds received rapid approval in May. This approval significantly boosted market confidence, demonstrating a more accommodating regulatory stance.

The legislative response has also been noteworthy. The House of Representatives passed the 21st Century Act (FIT21) with bipartisan support in May.

This act aims to clarify the role of government agencies in regulating digital assets, addressing a persistent demand from the cryptocurrency sector for clearer guidelines.

Despite these positive developments, challenges remain. Cosmo Jiang, managing partner at Pantera Capital, has observed a trend of blockchain entrepreneurs relocating overseas due to the uncertain regulatory environment in the U.S. Jiang expressed concern over the loss of a generation of talented entrepreneurs who have moved their operations to more crypto-friendly jurisdictions.

The recent SEC complaint against Consensys, the parent company of the MetaMask wallet, further highlights the regulatory challenges facing the industry.

Filed on June 28, the complaint accuses Consensys of operating as an unregistered broker and engaging in the sale of unregistered securities since 2020. Consensys has countered by arguing that the SEC lacks the authority to regulate software interfaces like MetaMask.

As the political climate surrounding cryptocurrencies continues to evolve, industry stakeholders remain cautious. Carlos Pereira, a partner at Bitkraft Ventures, pointed out the varied reactions from political campaigns to the growing popularity of cryptocurrencies.

He noted that the outcomes of the upcoming November presidential election could significantly impact the industry, with different administrations potentially adopting divergent regulatory approaches.

The post Coinbase References Binance Token Case in Petition to SEC appeared first on Coinfomania.