Optimism (OP) Recovery Signals Amidst Bitcoin (BTC) Cyclical Struggles: Investors Accumulate

- Amid a bearish trend in Bitcoin (BTC), altcoin peaks remain elusive in July 2024.

- Investors demonstrate a shift from selling to accumulating certain altcoins.

- An analysis of Optimism (OP) reveals potential recovery signals despite the overarching market downturn.

Explore why Optimism (OP) might present an investment opportunity amidst Bitcoin’s continued bearish trend and market volatility.

Why is Optimism (OP) Important Now?

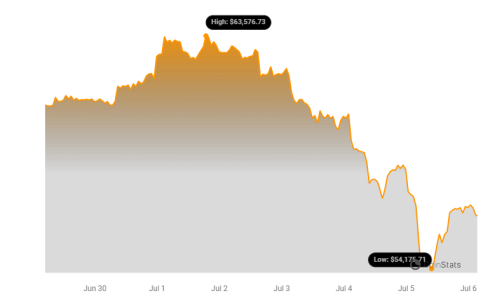

Bitcoin (BTC) is showing signs of prolonged weakness, with prices attempting another dip below the $60,000 mark, having briefly touched $59,600. Meanwhile, Optimism (OP) has hit new lows but there’s a growing sense that the altcoin market may be in the process of bottoming out. The current ratio of profitable investors to active addresses has fallen below 5%, indicating diminishing selling pressure and a potential shift towards accumulation.

Moreover, the Market Value to Realized Value (MVRV) ratio over the past 30 days stands at -28%. Historically, an MVRV ratio within the range of -15% to -30% has often been a precursor to significant rallies. This metric, coupled with broader market sentiment, suggests a recovery for OP Coin might be imminent, making current levels potentially attractive for new and existing investors.

What Does the OP Coin Price Forecast Say?

Optimism (OP) recently experienced a price drop to $1.68, representing a 6% decline attributed to macroeconomic influences and potential BTC liquidations. Bitcoin’s sideways trading pattern, characterized by an absence of movement through key resistance or support levels, hints at likely forthcoming volatility. Should the positive scenario for OP Coin materialize, prices could rise to $2 and possibly target $2.82 next. Conversely, if prices fall below the $1.66 support level, a further decline to $1.55 might occur.

Key Takeaways for Investors

• The transition from selling to accumulating OP indicates a potential recovery phase.

• The MVRV ratio suggests that OP Coin could be undervalued, highlighting possible investment opportunities.

• Bitcoin’s price volatility remains a significant factor influencing altcoin market movements, including OP Coin.

As of now, Bitcoin trades at $60,400, while Ethereum (ETH) faces resistance at the $3,300 threshold. Despite anticipated positive macroeconomic data later this week, the influx of Bitcoin supply from various jurisdictions, including Germany, the US, and MTGOX, remains a critical concern for investors.

Conclusion

In light of the current market dynamics, Optimism (OP) emerges as a compelling altcoin to watch. The shifting investor behavior from selling to accumulation, along with favorable MVRV indicators, suggests that OP may be poised for recovery. However, the broader market’s volatility, driven by BTC’s performance, continues to be a decisive factor. Investors should remain cautious, keep abreast of market developments, and consider these insights when navigating the cryptocurrency landscape in the upcoming months.