Crypto: Solana’s “Liquid Staking” is Booming – Investors are Flocking

Far from the usual ups and downs of the cryptocurrency market, the Solana blockchain and its crypto SOL continue to make sparks. Despite fluctuations and uncertainties, Solana shows impressive performance thanks to the rise of liquid staking. With a notable increase in its staking ratio, the network demonstrates undeniable resilience and attractiveness, attracting more and more investors and projects. But what are the keys to this dazzling success and what are the future challenges?

Solana and the rise of liquid staking

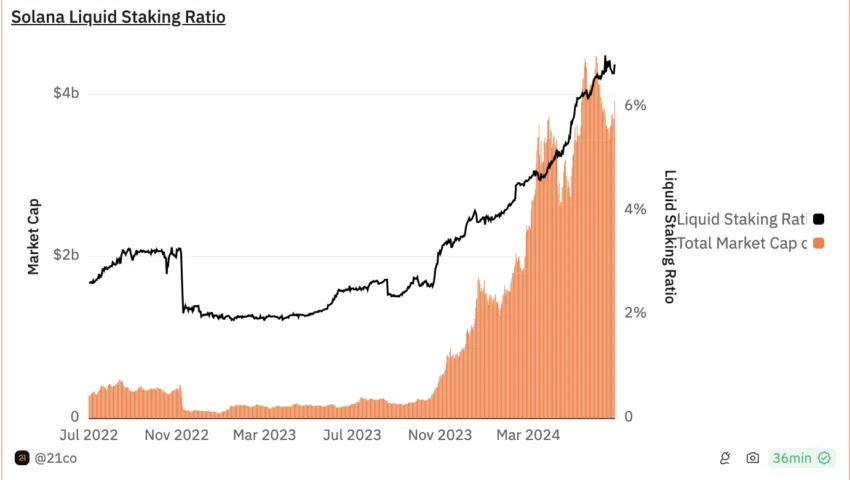

Solana, this Ethereum rival blockchain network, is experiencing a genuine boom with “liquid staking”. According to Dune Analytics data, more than 23 million SOL, valued at over 3.6 billion dollars, are now at stake on liquidity platforms.

This represents a huge untapped potential, especially considering that only 6% of the staked SOL is via liquid staking, while Solana’s staking ratio reaches around 60%, even surpassing Ethereum.

One of Solana’s major assets lies in its unbonding period of only two days, much shorter than many other blockchains.

This could positively influence the popularity of liquid staking on Solana.

Konstantin Boyko-Romanovsky, CEO of Allnodes, explains that “this short unbonding period could make liquid staking less crucial on Solana compared to blockchains like Polkadot or Ethereum“.

Indeed, on the latter, unbonding periods can last several weeks, making liquid staking more attractive for maintaining liquidity.

Companies and platforms like Sanctum and Jito Labs, or even the STRADER protocol (supported by SwissBorg), play a key role in this dynamic.

Jito Labs, for example, attracts around 91,000 Solana investors with an annual percentage yield (APY) above 8% and more than 10.6 million SOL staked.

Tom Wan, researcher and analyst, highlights in the columns of BeInCrypto that “Sanctum has lowered the entry barrier for projects looking to develop their own liquid staking tokens (LST)“.

These initiatives pave the way for an explosion of the liquid staking sector on Solana.

Growth potential of SOL crypto and influence of emerging trends

Liquid staking on Solana is not just growing; it is supported by emerging trends such as re-staking. This technology could become a crucial lever for the adoption and development of liquid staking on Solana.

Boyko-Romanovsky specifies that “re-staking offers continuous liquidity, increases yield opportunities and provides greater flexibility, even on platforms with short unbonding periods like Solana“.

Re-staking, by allowing more efficient market and liquidity management, could enhance the attractiveness of liquid staking. That said, the security and reliability of these emerging technologies will be crucial for their success and widespread adoption.

The growing popularity of liquid staking could thus attract more users to Solana, thereby increasing the network’s security and strengthening its position in the cryptocurrency market.

So far, two significant applications to create a Solana ETF have been submitted in the United States. If the trend continues, Solana could benefit from a significant competitive advantage, attracting investment companies and consolidating its place among the crypto market leaders.

Liquid staking platforms, by lowering entry barriers and facilitating investor access, play a key role in this dynamic.