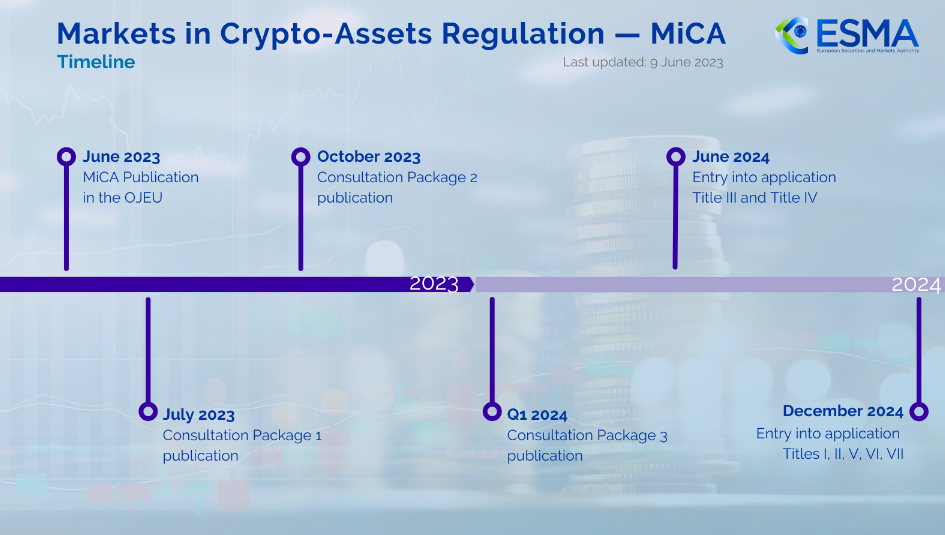

Circle Becomes First Licensed Stablecoin Issuer Under MiCA: A New Era for Digital Fiat Tokens

Circle has become the first stablecoin issuer to receive regulatory approval under the European Union’s Markets in Crypto-Assets (MiCA) framework. This milestone positions Circle’s USDC and EURC stablecoins as fully compliant digital fiat tokens, offering a new level of security and trust for investors.

Circle’s Regulatory Milestone

On July 1, Circle’s co-founder and CEO, Jeremy Allaire, announced the company’s achievement of becoming the first stablecoin issuer in the EU to gain this significant regulatory approval. This development comes as a relief to investors who feared they might need to redeem their stablecoins or move their assets to remain compliant with the new rules. Effective immediately, Circle’s USDC and EURC are now recognized as compliant stablecoins under the MiCA framework.

Establishing a European Headquarters

Circle has chosen France as its European headquarters, citing the country’s progressive stance on digital asset regulation and the positive relationship with the French Prudential Supervision and Resolution Authority (ACPR). Allaire highlighted the historical significance of this regulatory achievement, noting that just a few years ago, the concept of fiat digital currency was largely unknown outside early crypto circles. The MiCA framework represents the first comprehensive regulatory system for digital assets, marking a significant evolution in the financial industry.

Impact on the Stablecoin Market

The implementation of MiCA has led several exchanges to adjust their stablecoin policies and product offerings. In June, Uphold, a crypto exchange and custodial platform, announced the delisting of six stablecoins for its European users, including Tether, Dai, TrueUSD (TUSD), Gemini Dollar (GUSD), Pax Dollar (USDP), and Frax Protocol (FRAX). Bitstamp also delisted Tether’s EURT stablecoin in anticipation of the new regulations.

Binance, the world’s largest centralized exchange, has taken a more cautious approach. Instead of delisting, Binance has adopted a “sell-only” strategy for certain stablecoins in the European market. This means European users can only sell these stablecoins, not buy or trade them, while the exchange labels these digital assets as either compliant or non-compliant under the new regulatory framework.

Also Read: MiCA’s Impact On Global Crypto Regulation