Bitcoin Miners Hedge by Switching to Cheaper PoW Coins Amid Hashprice Plunge

- Bitcoin (BTC) miners are reportedly shifting their focus to other cryptocurrencies in response to the recent decline in BTC prices.

- The CEO of CryptoQuant, Ki Young Ju, highlights that the hashprice of Bitcoin is currently at an all-time low, influencing miners to diversify their operations.

- Ju states that many mining companies are temporarily moving their resources to alternative proof-of-work (PoW) coins to manage market uncertainties.

Miners are exploring alternative cryptocurrencies amidst Bitcoin’s hashprice decline, according to insights from CryptoQuant’s CEO.

Bitcoin’s Hashprice Hits an All-Time Low

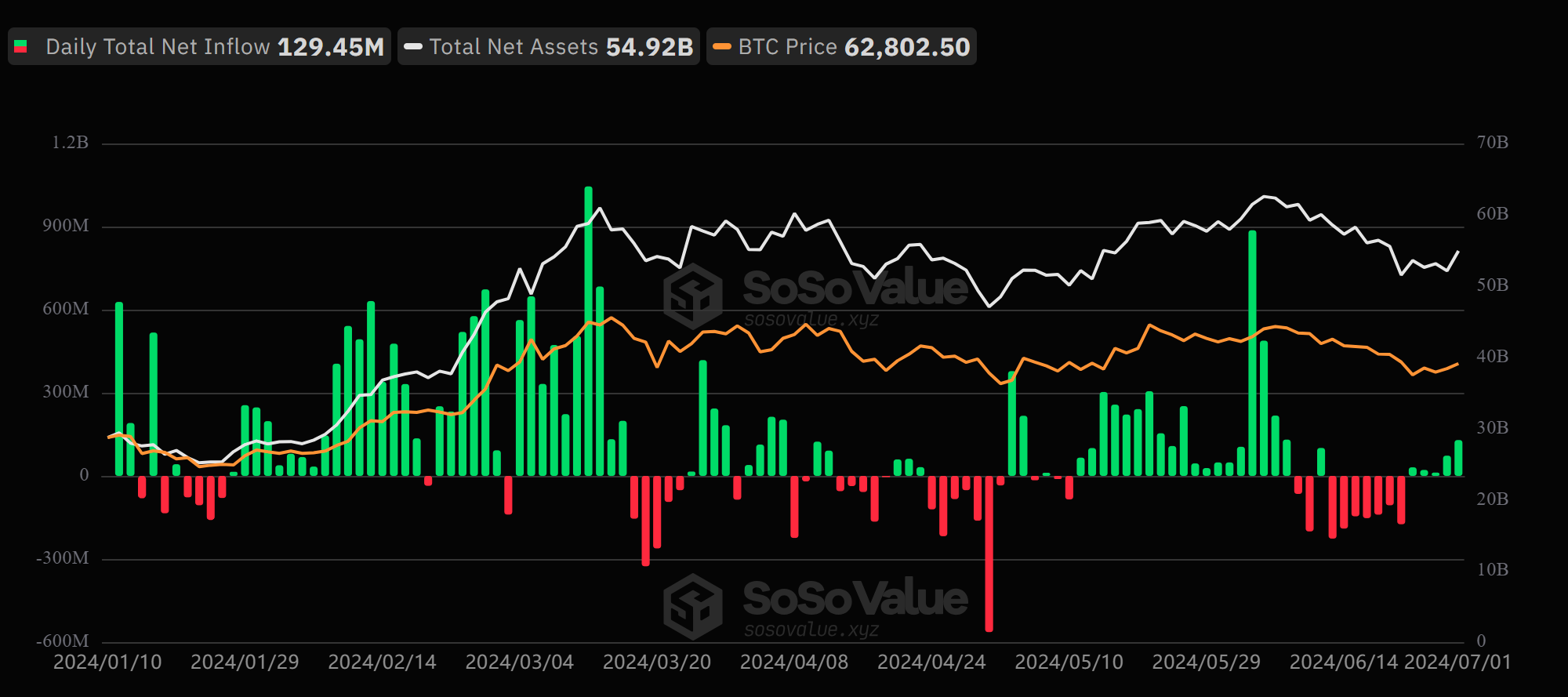

Recent data reveals a significant dip in Bitcoin’s hashprice, which measures the expected earnings a miner can achieve per terahash per second (TH/s) per day. This decline has led to a strategic slowdown in the investment of new mining rigs by several companies. As a result, these entities are turning their focus to mining other cheaper PoW cryptocurrencies, optimizing their operations in light of the market downturn.

The Strategic Move to Diversify Mining Activities

Ki Young Ju, CEO of CryptoQuant, emphasizes that this pivot to other cryptocurrencies does not signal a long-term bearish outlook on Bitcoin by these miners. Instead, they are implementing a hedging strategy to navigate the current market volatility while awaiting a recovery in buy-side liquidity. Ju mentions that this cautious approach typically precedes Bitcoin bull runs, indicating a potential upcoming surge.

Ethereum and Altcoin Season Indicators

Besides the shifts in BTC mining, Ki Young Ju has also noted a significant trend in Ethereum (ETH) and other altcoins. According to the Market Value to Realized Value (MVRV) indicator, Ethereum’s market is becoming increasingly undervalued, which historically has led to altcoin seasons. This period is characterized by altcoins outperforming Bitcoin, suggesting an imminent increase in their value.

The Impact of Ethereum’s Rising MVRV Ratio

The MVRV ratio, which compares an asset’s market capitalization to its realized capitalization, has been climbing for Ethereum at a faster rate than Bitcoin’s. This dynamic indicates a heating ETH market, potentially signaling the beginning of an altseason. Given the ongoing developments surrounding Ethereum ETFs, the current conditions might result in significant price movements, attracting more investments in ETH and other altcoins.

Conclusion

In summary, Bitcoin miners are adapting to market conditions by diversifying into other cryptocurrencies as a hedging strategy. Despite the current all-time low hashprice for Bitcoin, this shift is a tactical response and not a long-term bearish stance. Additionally, indicators point towards a burgeoning altseason spearheaded by Ethereum’s strengthening market position. Investors should keep a keen eye on these trends for potential opportunities in the crypto landscape.