Stronger than expected macro data pushes U.S. investors to short Bitcoin

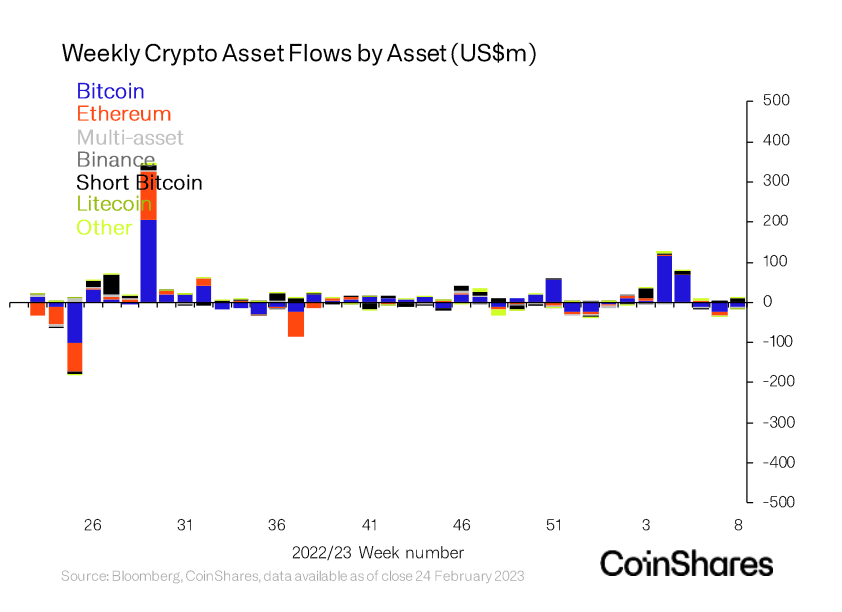

The crypto industry has yet to exit a period of heightened volatility as asset outflows remain the dominant market trend.

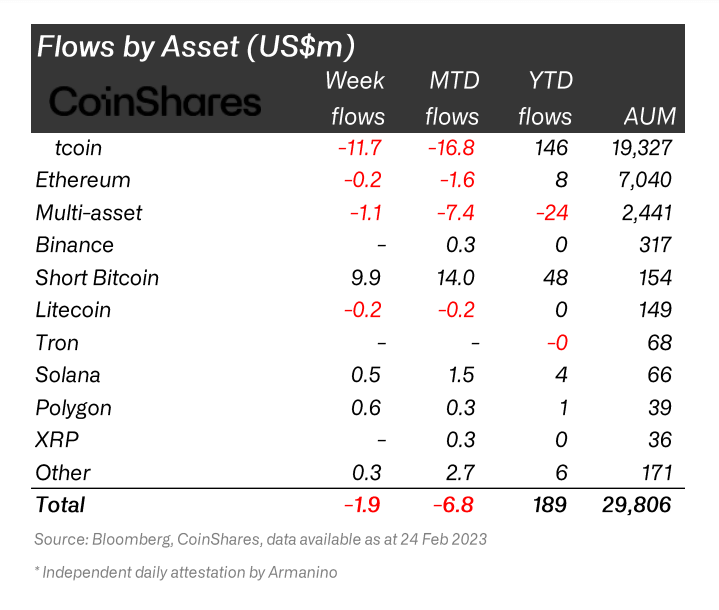

Despite its slowly rising price, Bitcoin saw outflows for the third week in a row. Data from CoinShares showed that the outflows totaled $12 million last week — while inflows reached $10 million.

While the $2 million in outflows isn’t noteworthy, the amount of inflows is. The entirety of the $10 million in inflows was into digital asset investment products shorting Bitcoin.

Ethereum remained unscathed — seeing only $200,000 of outflows in the past week — while minor inflows were seen in Polygon (MATIC), Solana (SOL), and Cardano (ADA).

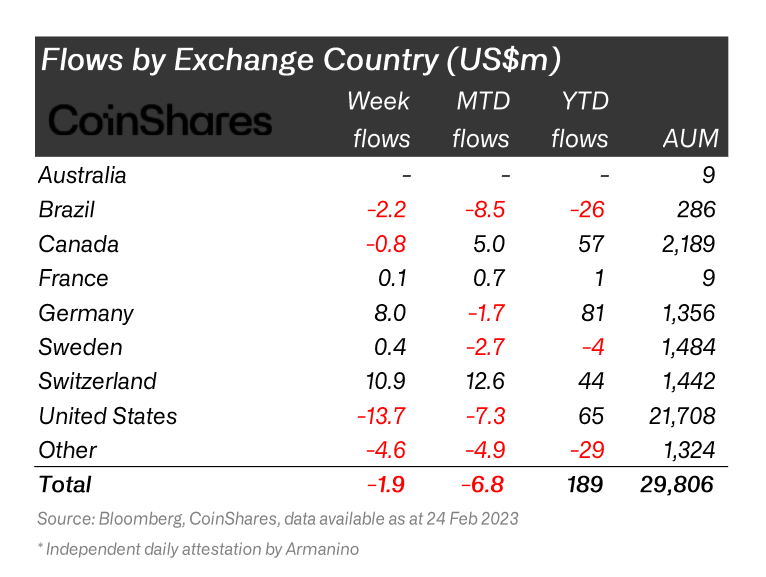

The rise in short-bitcoin inflows can be attributed to increased negative sentiment in the U.S. Investors in the country have become increasingly nervous following the coveted FOMC meeting last week, as the Federal Reserve released stronger-than-expected macro data.

The vast difference between the outflows seen in the U.S. and the rest of the world can be attributed to the U.S. market’s sensitivity to regulatory crackdowns. Less regulated markets are less likely to see significant outflows or an increase in short positions following announcements or enforcement from government agencies.

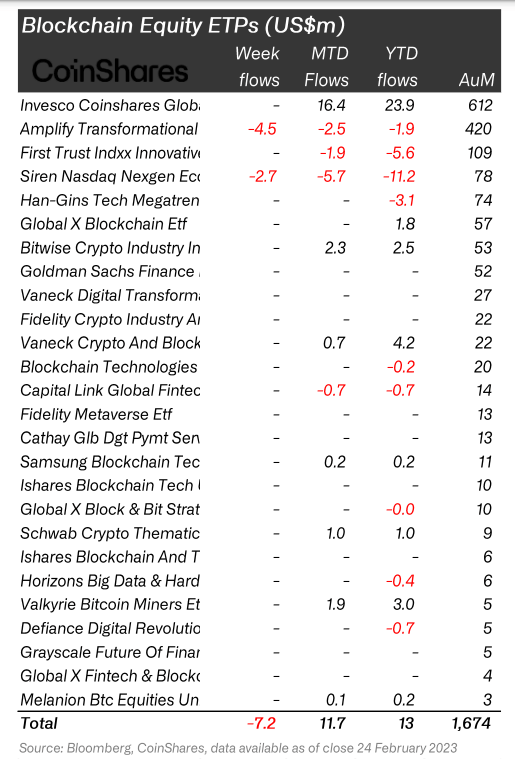

This is evident in blockchain stocks — a regulated product available to investors in the U.S. and Canada. Negative sentiment also hit them, leading to $7.2 million in outflows.

Since reaching their peak in November 2021, publicly-listed blockchain companies have become increasingly sensitive to broader market movements. Most publicly-listed blockchain companies are focused on growth — meaning that even the slightest changes in interest rates leave them vulnerable and prone to volatility.

The post Stronger than expected macro data pushes U.S. investors to short Bitcoin appeared first on CryptoSlate.