Zero Rate Loan and Elections: What You Need to Know!

The zero-interest loan is experiencing growing success with the explosion in credit costs. Over the past two years, the household borrowing rate for housing has almost doubled. With the recent extension of the zero-interest loan, nearly 3 out of 4 French people are potentially eligible. But this state aid has a significant cost, while public deficits continue and worsen. The legislative elections at the end of June have also revived political promises concerning the zero-interest loan. The latter could be extended beyond the current framework. Breakdown of the zero-interest loan: this additional state aid in times of credit difficulties…

What is the zero-interest loan?

The zero-interest loan was created in 1995 in France. Its main objective is to facilitate access to homeownership for first-time buyers (that is, people who have not owned their primary residence in the past two years) by allowing them to benefit from an interest-free loan. However, this loan does not allow for financing the entire primary residence and must be supplemented by credit. To be eligible for the PTZ, several criteria must be met:

- First-time buyers: the PTZ is reserved for first-time buyers. Beneficiaries must not have owned their primary residence in the past two years prior to the loan application.

- Resource Conditions: household incomes must not exceed a certain ceiling, which varies depending on the geographical area where the property is located and the household composition. The income considered is that of year N-2 (two years before the loan application). For a couple with two children, the ceiling ranges from €60,000 to over €100,000 depending on the geographical zones.

- Geographical Zone: the PTZ is allocated based on the location of the property, divided into zones A, B1, B2, and C, which determine resource ceilings and loan amounts.

- Nature of the Property: the PTZ can finance the purchase of a new or old home with renovation work representing at least 25% of the total cost of the operation. It can also finance the construction of a new home, including the land purchase.

Up to what amount?

On its part, the maximum amount of the PTZ is determined by a percentage of the total cost of the operation, which varies depending on the geographical area and the nature of the property. For example, up to 40% of the total cost of the operation for a new home (in zone A or B1).

According to the government, up to 29 million tax households are “potentially eligible” for the zero-interest loan. This would represent 73% of the population. This extension of the zero-interest loan, announced in 2023, could thus concern “households earning up to €4,500 per month can now benefit from the PTZ. The maximum loan amount will increase to €100,000”, according to Les Echos.

The rise in interest rates weighs on households…

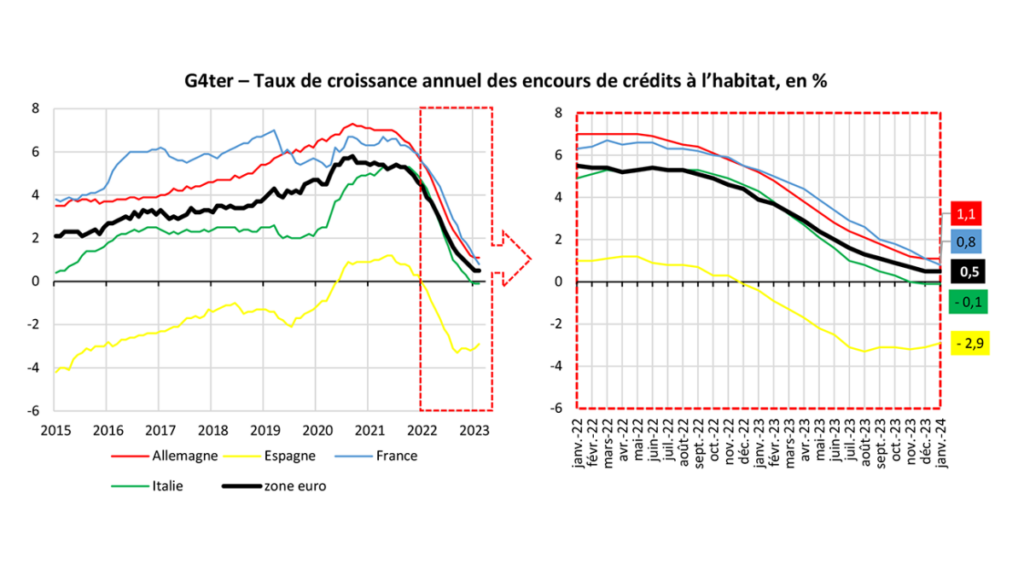

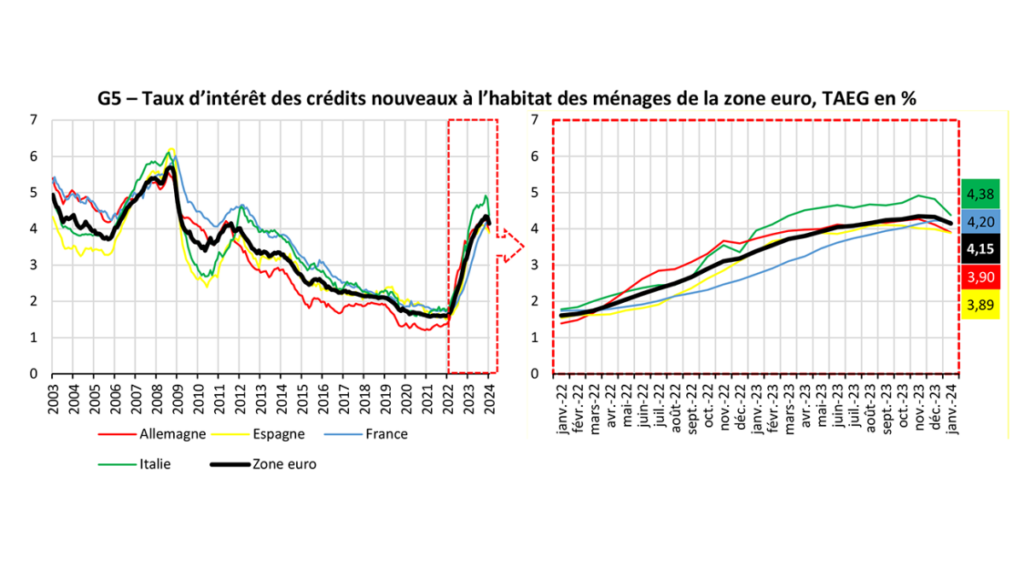

Since 2022, the growth of housing loans has collapsed. Consequently, the number of housing loans is entering a stagnation period. This phenomenon limits the proper functioning of the real estate market and especially adds an interest cost for households purchasing a property. The explosion in credit costs therefore seems to have increased the urgency for the government to respond to the housing demand. But the cost of this measure is necessarily borne by taxpayers…

The effective global rate paid by households has thus risen from less than 2% in 2020-2022 to over 4% in 2024. This sharp increase in credit costs, whose price has doubled, necessarily affects households’ projects. However, it should be noted that the decrease in the number of potential buyers has also reduced demand, and consequently prices. The price of real estate has mainly reduced in most major cities, thus ensuring a form of “compensation” for the increase in credit costs.

Zero-interest loan: a concrete effect on access to housing?

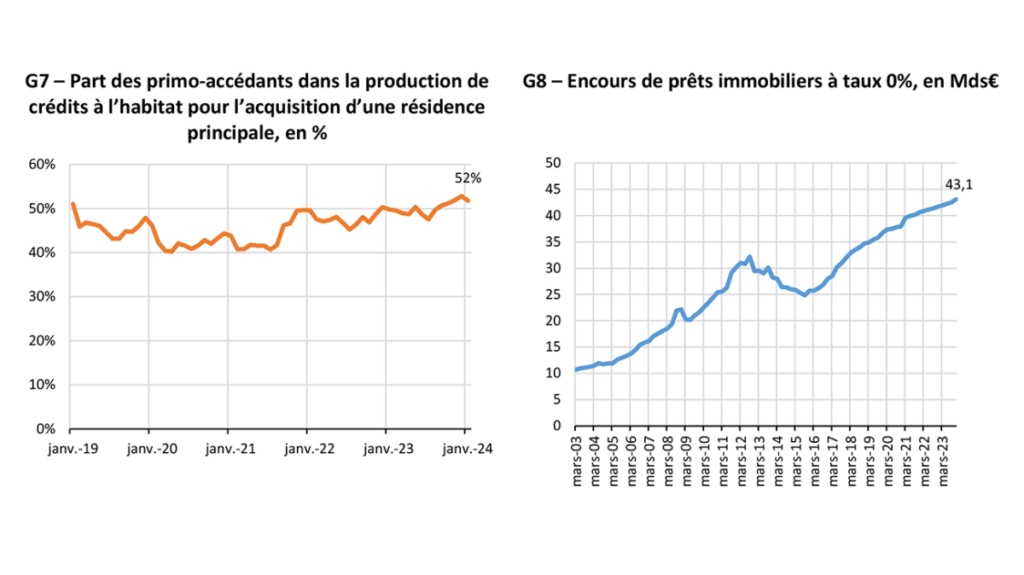

Moreover, the amount of zero-interest loans granted to households has risen from a little over 35 billion euros in 2019 to over 43 billion at the beginning of 2024. An increase of over 23% in just 5 years. Furthermore, the share of first-time buyers seems to be increasing, certainly due to the zero-interest loan. At the beginning of 2024, 52% of the loans granted for housing concerned the acquisition of a first property.

What do political parties propose?

The zero-interest loan is an integral part of the bidding in political programs for the legislative elections. For example, the Nouveau Front Populaire wants to expand the zero-interest loan “without geographical distinction, or between new and old properties.” Income conditions would therefore remain required, even though the details of the proposal remain ambiguous.

Similarly, the Rassemblement National promises to “create a 0% loan for young French families, turned into a grant for couples who have a third child.” In the race for proposals, Gabriel Attal’s government preferred to consider another path…

The exact cost of the proposed measures remains very ambiguous. But the desire to extend this measure to a large part of the population seems clearly stated. In this case, it is possible that the number of eligible French people will increase to 80% or more, even if these proposals remain very vague.

And the taboo of notary fees?…

Why favor first-time buyers with aid rather than reducing purchase costs? The administrative complexity of the zero-interest loan once again shows the difficulty of such a system. So why not reduce notary fees?

Indeed, notary fees represent a significant cost when acquiring a property, most of which goes to the state in the form of taxes and transfer duties. The transfer duties represent the majority of notary fees and are paid to the Public Treasury. These duties vary between 5% and 5.81% of the property’s sale price. Additionally, there are notary fees and disbursement costs for the completion of the sales deed. In particular, the fees paid to the notary for their work. The fees are fixed by decree and depend on the property’s sale price. In short, acquiring a property is expensive…

This transaction cost is a real obstacle to purchase. Several political parties in France have proposed reforms to reduce these fees and facilitate access to homeownership, although approaches and degrees of reform vary. In the legislative race, French Prime Minister Gabriel Attal has proposed to eliminate notary fees for purchases under €250,000 for “young middle and working-class people”. Similarly, the RN has already proposed to reduce transfer duties to encourage homeownership and stimulate the economy.

In conclusion

The zero-interest loan concerns more and more French people as the legislative elections revive political proposals. The increase in zero-interest loan commitments also shows households’ interest in this aid, while credit costs have doubled over the past two years. Indeed, loans granted for housing are experiencing unprecedented stagnation.

This situation reflects two phenomena. On one hand, households’ difficulty in finding housing or carrying out projects. On the other hand, the reduction in the long-term growth of the housing supply. Through the zero-interest loan, the state seeks to mitigate the effects of rate hikes and the tensions related to the housing crisis.

Finally, the legislative elections have revived proposals to expand the zero-interest loan. The Nouveau Front Populaire and the Rassemblement National seem to opt for an expansion of the system. This expansion could cover all geographical regions for the Nouveau Front Populaire, or young families for the Rassemblement National.

However, is helping not hypocritical? Indeed, the significant cost of notary fees is also an obstacle to households’ first acquisition. Some proposals thus seem to target the issue of notary fees.