Michael Saylor Champions Long-Term Bitcoin Strategy Amidst Market Volatility: MicroStrategy’s $700M Fundraise

- Michael Saylor encourages a long-term investment approach amidst recent fluctuations in Bitcoin’s market price.

- MicroStrategy’s recent $700 million fundraising effort reaffirms its strong commitment to Bitcoin investment, even amidst price volatility.

- Institutional interest in Bitcoin remains robust, with strategic moves like MicroStrategy’s ongoing accumulation reinforcing its value proposition.

Explore Michael Saylor’s insights on Bitcoin volatility and how MicroStrategy’s strategic actions continue to bolster institutional confidence despite market fluctuations.

MicroStrategy’s Commitment to Bitcoin: A Strategic Fundraise

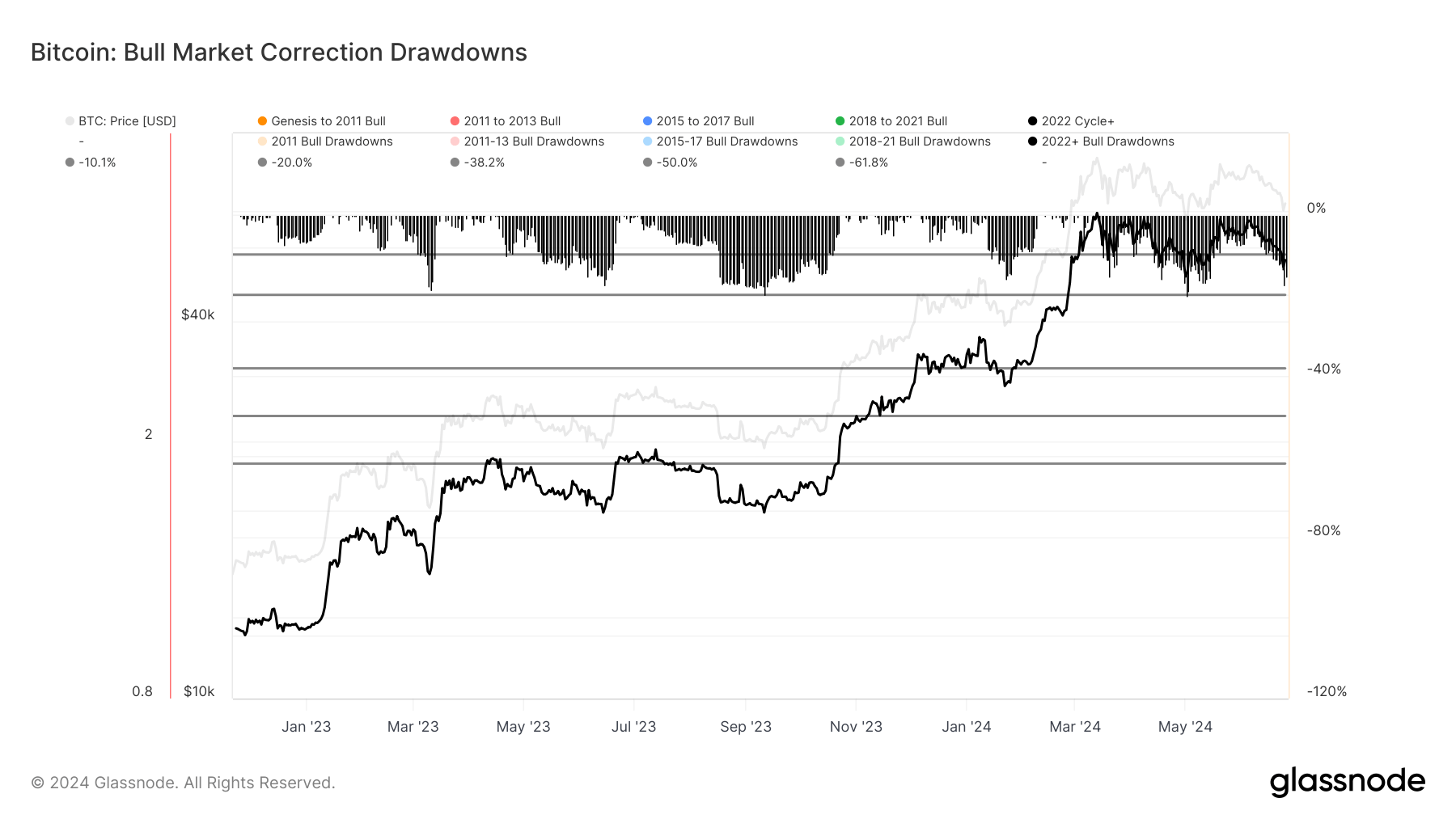

As Bitcoin experiences a period of significant price volatility, MicroStrategy co-founder Michael Saylor advocates for a long-term perspective on the cryptocurrency. Saylor remains unphased by short-term price movements, viewing them as potential windows of opportunity for strategic investments.

A $700 Million Statement of Confidence

MicroStrategy has recently announced its intention to raise $700 million through convertible senior notes, a move that underscores the company’s unwavering faith in Bitcoin. These funds are earmarked for expanding MicroStrategy’s Bitcoin holdings and managing operational expenses, reflecting the company’s strategic approach to navigating volatility.

Institutional Interest Remains Unwavering

Despite recent dips in Bitcoin’s price, institutional interest has not waned. Over the past week, Bitcoin-based exchange-traded funds (ETFs) witnessed inflows amounting to $101 million, indicating growing confidence among investors. During this period, Bitcoin’s price dipped to $65,180 before making a slight recovery to approximately $66,900.

Navigating Market Uncertainty with Strategic Insight

Michael Saylor’s leadership and proactive guidance have resonated with the crypto community. His comments about leveraging market corrections as buying opportunities reflect a strategic mindset crucial for long-term success. Saylor’s approach reinforces Bitcoin’s role as a significant financial asset amidst market uncertainty.

MicroStrategy’s Strategic Accumulation of Bitcoin

Since August 2020, MicroStrategy has been on a strategic mission to accumulate Bitcoin. The recent $700 million fundraise is a testament to its continued commitment to this strategy, which is designed to capitalize on market fluctuations and strengthen the company’s position in the crypto space.

The Broader Implications for Institutional Investors

MicroStrategy’s actions are being closely watched by the broader financial community. The company’s significant capital increase, despite frequent market price swings, sets a strong example for other institutional investors. This strategic accumulation signals confidence in Bitcoin’s long-term potential, encouraging other institutions to consider similar approaches.

Conclusion

In conclusion, Michael Saylor’s emphasis on long-term investment strategies and MicroStrategy’s significant financial moves underscore a strategic approach to navigating Bitcoin volatility. As institutional interest remains strong, these actions highlight the evolving role of Bitcoin as a key financial asset. Investors are encouraged to adopt a long-term perspective, viewing market corrections as opportunities for strategic accumulation rather than setbacks.