Roblox stock price forecast: Right time to buy after Macquarie’s ‘Outperform’ rating?

Macquarie recently initiated coverage on Roblox Corp (NYSE:RBLX) with an “Outperform” rating, highlighting the company’s unique position in the evolving metaverse. The analysts at Macquarie, led by Aaron Lee, described Roblox as a key player in the virtual world, emphasizing its growing social and gaming platform.

They noted that Roblox stands out not just as a gaming platform but as a social hub where users can engage in various forms of entertainment through user-generated content.

The Macquarie team pointed out that Roblox’s social component is a significant advantage. Unlike many mobile gaming companies that face high user acquisition costs, Roblox benefits from organic growth driven by social interactions.

This dynamic has helped Roblox achieve substantial scale in terms of users and bookings. The firm sees a bright future for Roblox, driven by factors such as user growth, better monetization strategies, international expansion, and a new advertising initiative.

Macquarie projects a compound annual growth rate (CAGR) of 17% in revenue and 31% in EBITDA over the next three years, setting a target price of $46 for the stock, which implies a potential 30% upside.

Q1 shocker

Despite the bullish outlook from Macquarie, Roblox’s recent financial performance has shown mixed results. In the first quarter of 2024, the company reported a GAAP EPS loss of $0.43, which was better than expected. However, bookings of $923.76 million missed the target by $5.34 million.

Revenue for the quarter reached $801.3 million, marking a 22% increase year-over-year. The platform also saw growth in its user base, with average daily active users (DAUs) rising by 17% to 77.7 million and average monthly unique payers increasing by 13% to 15.6 million.

Despite these positive indicators, Roblox faces challenges as it announced a weaker-than-expected bookings forecast for the coming quarter and lowered its full-year bookings outlook.

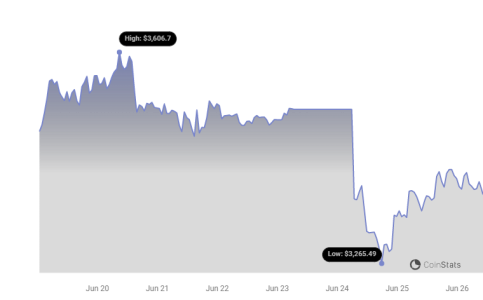

This led to a sharp decline in investor confidence, with the stock plummeting by more than 23% following the Q1 result announcment.

Analysts from MoffettNathanson upgraded their rating on Roblox from “Sell” to “Neutral” after the steep decline, indicating some cautious optimism about the company’s recovery potential.

Valuation and analyst views

Analysts have varied perspectives on Roblox’s valuation and future potential. While Macquarie is optimistic, others remain cautious due to the company’s slowing booking growth and the challenges in monetizing its user base.

Roblox’s monetization model, which relies heavily on free-to-play mechanics and microtransactions, faces scrutiny, particularly because its primary audience consists of younger users. The focus on this demographic has led to concerns about the platform’s ability to sustain high engagement levels amidst growing anxiety among parents about screen time.

Roblox’s valuation remains a contentious topic. The company is expected to generate nearly $450 million in free cash flow this year, a significant improvement from 2023. However, the market’s willingness to pay a premium for Roblox hinges on the company’s ability to reignite its growth story and maintain its revenue trajectory above 20% CAGR.

Management remains optimistic

Despite the short-term setbacks, Roblox’s management remains optimistic about the future. The company is focusing on improving user engagement through live events and enhancing its content discovery system.

These initiatives aim to boost user interaction and drive bookings growth back to the desired levels. Additionally, Roblox is making strides in optimizing its app performance, particularly on lower-end devices, to ensure a smoother user experience.

As we have seen, Roblox presents a complex picture with both strong potential and significant challenges. So, let’s turn our attention to the charts to better understand the stock’s price trajectory and identify potential entry points. By analyzing the charts, we can gain insights into the stock’s movements and forecast where it might be headed in the near term.

Trading the range

A few months after its IPO, Roblox’s stock saw a dramatic surge that took it to above $140. Immediately after making that high, the stock entered a downtrend that saw it crashing to below $25 by May 2022. Since then the stock has mostly traded in a $25-$50 range for more than two years.

After the most recent decline following the Q1 result announcement, the stock finds itself at the medium point of this range, suggesting that neither bulls nor bears are in control of the stock. Hence, short-term traders should refrain from taking a long or short position.

Investors who are bullish on the stock must ideally wait to accumulate it under $30 with a stop loss at $24.8. They can also initiate a long position at current levels, but the stop loss level will remain the same. If bullish momentum emerges, we can again see the stock going back to the $50 level, where one can book partial profits and hold the remaining shares for a breakout above $50.

The post Roblox stock price forecast: Right time to buy after Macquarie's 'Outperform' rating? appeared first on Invezz