Eager investors will pour $500m into Ethereum ETFs in opening week, OKX says

Institutional investors are ready to pour $500 million into Ethereum ETFs over the next week if they are approved Thursday, according to analysis by OKX, the crypto exchange.

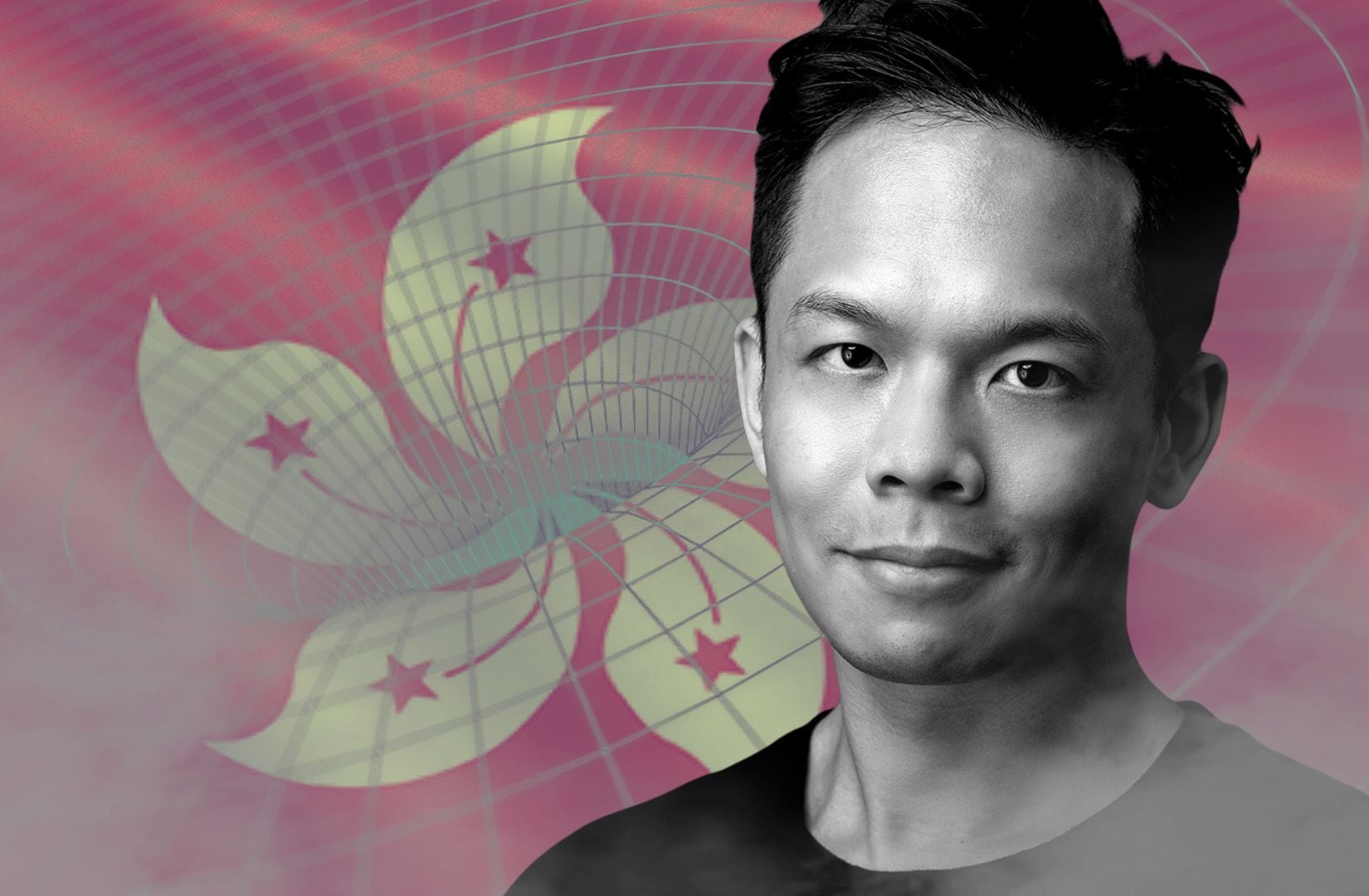

“It’s probably just as, if not more, important as the Bitcoin ETF approval,” Lennix Lai, OKX’s global chief commercial officer, told DL News.

“The potential approval of Ethereum to be traded as a proxy under a traditional framework could bring about the next wave of institutional demand,” Lai said.

Fever pitch

Anticipation is building to a fever pitch after the US Securities and Exchange Commission appeared this week to drop its long-held resistance to approving a spot price exchange traded fund for Ethereum.

Ethereum has soared 24% since Monday and boosted the proof-of-stake sector — Lido Staked Ether, for instance, is up 27% in the last seven days, according to CoinGecko.

Several applicants — such as BlackRock, Invesco Galaxy, Fidelity, and Franklin Templeton— are eagerly awaiting the SEC’s decision.

Asset manager VanEck is, however, first in line to get either a thumbs up or down from the regulator.

While Van Eck’s head of digital assets research said on Wednesday that it expects the SEC to respect the queue, any approval will likely be extended to other applicants to avoid the agency being seen as kingmaker.

Investors expect Ethereum ETFs to follow a similar course to the rollout of Bitcoin funds in January.

Ten such products have been trading at volumes exceeding $1.5 billion since January.

Record rally

The advent of Bitcoin ETFs and Wall Street’s embrace of the asset class spurred a record rally across crypto. This year, the sector’s market value has skyrocketed 50% to $2.7 trillion.

An Ethereum counterpart could excite animal spirits even more. Bernstein analysts’ predicted this week that Ether will surge to $6,600 if the funds are approved.

“Ethereum could potentially surpass its all-time high soon after a potential ETH ETF approval,” Lai said.

An Ethereum ETF will make it easier and cheaper for retail investors to buy exposure to the second most valuable cryptocurrency.

“Like the Bitcoin ETF before it, an Ethereum ETF will be a significant milestone for the industry,” Jean-Baptiste Graftieaux, CEO of Bitstamp, told DL News.

Cost for exchanges

Yet there may be a cost for crypto exchanges such as Coinbase and Kraken.

ETFs enable traders to access the asset class without using digital wallets or industry-native exchanges. Going mainstream, in other words, has many effects.

Yet Lai downplayed the long-term risk for exchanges and said the ETFs will provide a gateway for newcomers to crypto.

“It may actually expand the overall market size, including volume and participants, meaning it’s complementary rather than cannibalistic,” he said.

Crypto market movers

- Bitcoin is down 1% over the past 24 hours to $69,550.

- Ethereum is up 2.5% to $3,830.

What we’re reading

- Solana dev says new crypto phone ‘feels like madness’ — but it already has $65m in pre-orders — DL News.

- Coinbase, Meta, And Ripple Unite To Fight Pig Butchering Scams — Milk Road.

- Why Spot Ether ETFs Are Now Likely to Be Approved on Thursday — Unchained.

- SEC Chair Gary Gensler Warns Crypto Bill Poses Risks To Investors And Capital Markets — Milk Road.

- Three experts on when you can buy an Ethereum ETF — DL News.

Eric Johansson is DL News’ News Editor. Got a tip? Email on [email protected].