How Wall Street is teaching Washington to love crypto

Senior Democrats broke ranks last week and voted in favour of repealing SAB 121, a controversial crypto accounting rule.

Thank Wall Street banks.

That’s according to Bitwise chief investment officer Matt Hougan, who wrote that the vote “signals a much bigger trend: the emerging alliance between Wall Street, crypto, and Washington.”

“It is a massive positive catalyst that I think will lift crypto to new all-time highs,” Hougan added.

Political shift

The vote to repeal SAB 121 was an overture to two political bombshells in the industry.

First, the Securities and Exchange Commission asked spot Ethereum exchange-traded fund applicants to resubmit their applications, sparking speculation that approval is all but a done deal.

Then, the Republican-led pro-crypto bill known as the FIT21 Act passed with a bipartisan vote of 279 in favour and 136 in opposition.

Both votes and the potential ETF change came as crypto is increasingly being seen as a potential issue for voters in the November presidential election.

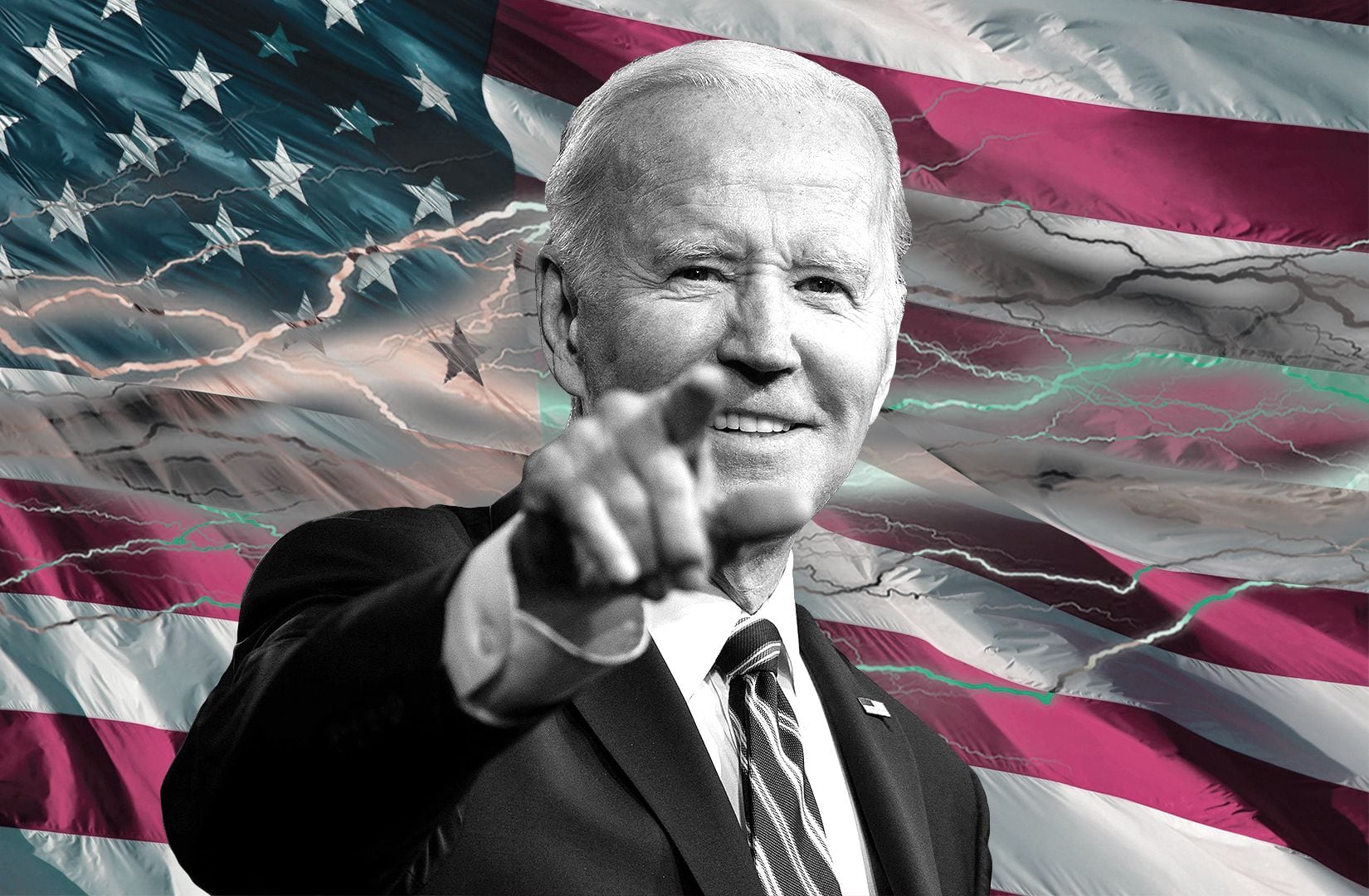

President Joe Biden has sided with anti-crypto party members, while his rival and Republican frontrunner Donald Trump has planted himself in the pro-crypto camp.

Biden appointee Gary Gensler, whose SEC has lead a crackdown on the digital asset industry, is often a target of industry ire.

So what happened?

“It feels like someone at the Biden White House made a call and said ‘Guys, we can’t be the party against crypto anymore,’” Galaxy Digital CEO Mike Novogratz told CNBC.

The vote

Biden threatened to veto the vote to repeal the SAB 21 provision if approved.

A number of prominent Democrats — including Senate majority leader Chuck Schumer — sided with Republicans and defied Biden to vote for the repeal.

Top Democrat Nancy Pelosi also voted with the majority and sided against Biden, saying in a statement:

“Digital currency is already integrated into our economy and will only grow in significance in the years to come.”

Until then, the Democrats’ voice on the crypto issue was lead by Massachusetts Senator and crypto critic Elizabeth Warren.

Wall Street steps in

The success of spot Bitcoin ETFs “woke Wall Street up to the reality that there is a lot of money to be made in custodying crypto assets,” Hougan said.

For every $1 million worth of, say, Bitcoin that banks have on their balance sheet, they need to hold $1 million in cash.

Banks and financial firms saw the SAB 121 rule, unique to crypto, as expensive and hindered the advent of new crypto products for consumers.

Goldman vs Tether

Banking giant Goldman Sachs posted a net profit in the first quarter of $4.13 billion. Stablecoin company Tether says it made $4.52 billion in profit over the same period.

Hougan pointed out that a coalition of bank lobbying groups that pressured the SEC in February to loosen its grip on crypto regulation.

Wall Street firms are among the largest industry donor to Schumer’s campaign fund, Hougan noted, adding that Wall Street’s pressure on Washington will benefit crypto in the long-run.

“If Wall Street cares about crypto custody, the things that increase demand for crypto custody — like more ETFs — become more likely. If Wall Street cares about stablecoins, the things that increase demand for stablecoins become more attractive,” Hougan said.

“Compared to the overt hostility we’ve faced from DC over the past decade, this is huge progress.”

Tom Carreras is a markets correspondent at DL News. Got a tip? Reach out at [email protected]