Render (RNDR) Price Faces Resistance in Bid to Reclaim All-Time High

Render (RNDR) is poised to break above the upper line of an ascending triangle in continuation of its most recent uptrend.

Logging a 10% price hike in the last two days, the bulls can push above this resistance level if the current general market trend is sustained.

Render May Face Some Difficulties

Render’s double-digit price rally in the past 24 hours may witness a pullback as some of the token key indicators showed that bearish influence remains dominant.

At press time, the dots that make up RNDR’s Parabolic SAR indicator exceed its price. This indicator identifies potential trend direction and reversals in the token’s price.

Render Price Analysis. Source: TradingView

Render Price Analysis. Source: TradingView When its dots are above an asset’s price, the market is said to be in decline. This indicates that the asset’s price has been falling and may continue to do so. Market participants interpret this as a sign to exit long positions and open short positions.

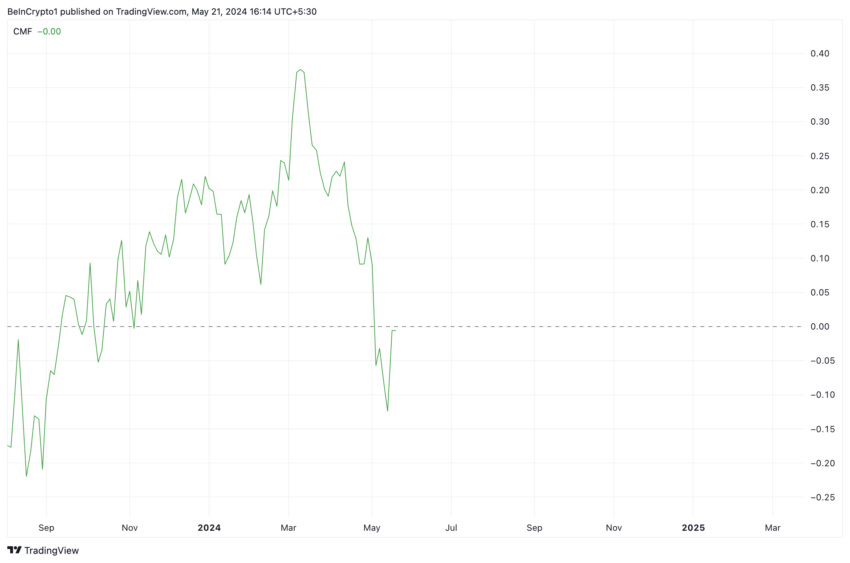

Also, the value of RNDR’s Chaikin Money Flow (CMF) was -0.01 at the time of writing. This indicator measures money flow into and out of the RNDR market.

Read More: Render Token (RNDR): A Guide to What It Is and How It Works

Render Price Analysis. Source: TradingView

Render Price Analysis. Source: TradingView A bearish signal, indicating a weakening uptrend or a developing downtrend, appears when its value falls below zero

RNDR Price Prediction: Negative Sentiments Meet High MVRV Ratio

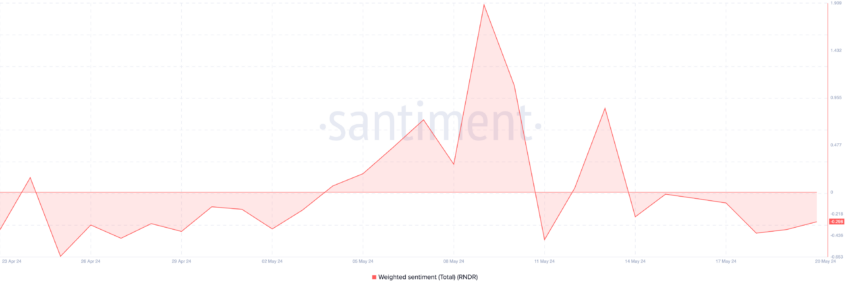

The poor sentiment currently trails RNDR is depicted in its negative weighted sentiment spotted on-chain. Subsequently, at -0.29 at press time, this metric shows a dominant negative bias in the online discourse surrounding the asset.

Render Weighted Sentiment. Source: Santiment

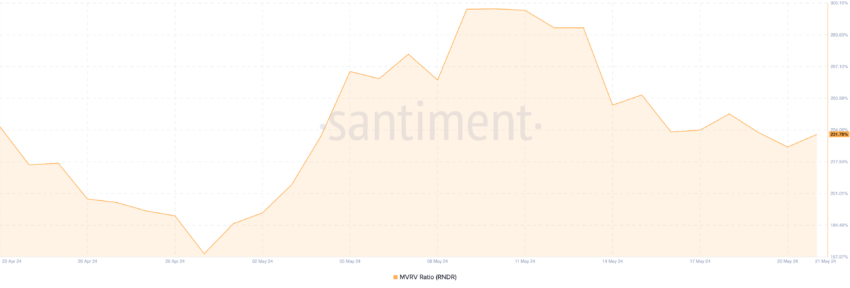

Render Weighted Sentiment. Source: Santiment This negative sentiment comes at a time when the token’s Market Value to Realised Value (MVRV) ratio is high. As of this writing, this was 231.78%

Render Weighted Sentiment. Source: Santiment

Render Weighted Sentiment. Source: Santiment A high MVRV ratio already suggests a potential correction if the price becomes unsustainable. Therefore, a negative sentiment reinforces this concern, highlighting potential selling pressure that could drive the price down.

Conversely, if selling pressure gains momentum, the token may find it impossible to break above the upper line of the ascending triangle and fall toward $9.8.

Read More: Render Token (RNDR) Price Prediction 2024/2025/2030

Render Price Analysis. Source: TradingView

Render Price Analysis. Source: TradingView However, if this bearish projection is overturned, the token’s price may exceed $12.