Central Bank of Brazil Targets Complete Crypto Regulation by 2024

On May 20, the Central Bank of Brazil (BC) reaffirmed its commitment to finalizing crypto regulations by the end of 2024. This initiative seeks to establish clear operational standards and authorization processes for virtual asset service providers (VASPs).

The BC aims to ensure a secure environment for crypto transactions in Brazil by enhancing transparency and investor protection. This regulatory framework will target inappropriate practices harming consumers, such as scams and fraud.

Central Bank of Brazil’s Comprehensive Crypto Regulation Timeline

This regulatory approach follows Decree 11,563 of 2023. It grants the BC authority to oversee VASPs while maintaining the roles of the Securities and Exchange Commission (CVM) and the Special Secretariat of the Federal Revenue of Brazil (RFB).

According to Nagel Lisanias Paulino from the BC Financial System Regulation Department, the goal is to refine operating standards and authorization processes for VASPs by establishing minimum requirements and promoting proper customer interaction. Under Law 14,478 of 2022, VASPs must obtain BC authorization to operate in Brazil. VASPs’ operational activities include offering, intermediating, and custody of crypto assets.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

“The regulation aims to offer minimum requirements for service providers to carry out virtual assets activities, also dedicating themselves to providing appropriate practices when dealing with their customers. The idea is to evolve in constructing normative acts that will deal with virtual asset service providers,” Paulino explained.

The regulatory process will evolve through phases, reflecting the growing understanding of regulators and international guidelines. Key steps for 2024 include developing a second public consultation on providers’ performance and authorization, establishing internal planning for stablecoin regulation, and improving the complementary framework for VASP activities.

Additionally, the BC will collaborate with other bodies to address specific virtual asset issues, particularly regulating stablecoins within payments and the foreign exchange market. The BC aims to finalize the regulatory proposals using insights from public consultations. This collaborative approach ensures that the regulations benefit from public and market input, producing high-quality, well-informed standards.

Furthermore, the regulation seeks to maintain the stability of the National Financial System. It will focus on various aspects, such as anti-money laundering, combating terrorist financing, and monitoring suspicious activities.

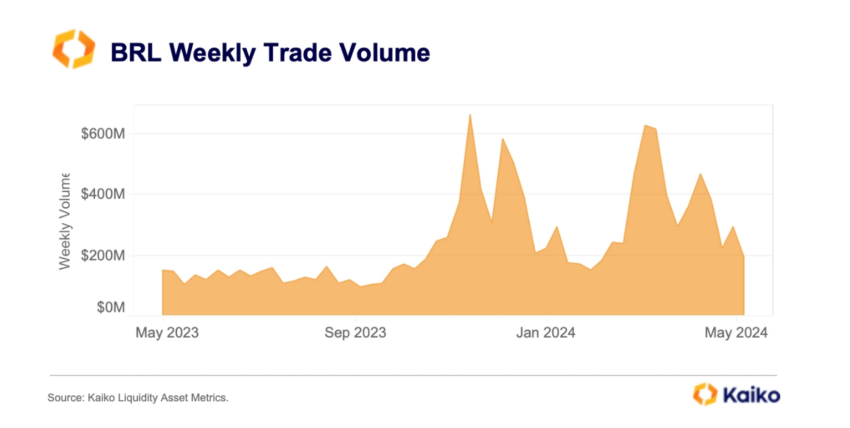

Regulatory clarity in Brazil comes at a pivotal time. A recent report from Kaiko reveals significant growth in the Brazilian crypto market. Despite recent market corrections, Brazilian real (BRL) trade volumes are up 30% compared to last year.

Read more: Stablecoin Regulations Around the World

Weekly Trading Volume in BRL. Source: Kaiko

Weekly Trading Volume in BRL. Source: Kaiko Furthermore, from January to early May 2024, BRL-denominated crypto trading volume reached $6 billion. This figure makes Brazil the largest Latin American (LATAM) market and places it seventh among global fiat currencies.