TSLY ETF: Is this dividend paying Tesla stock a good buy?

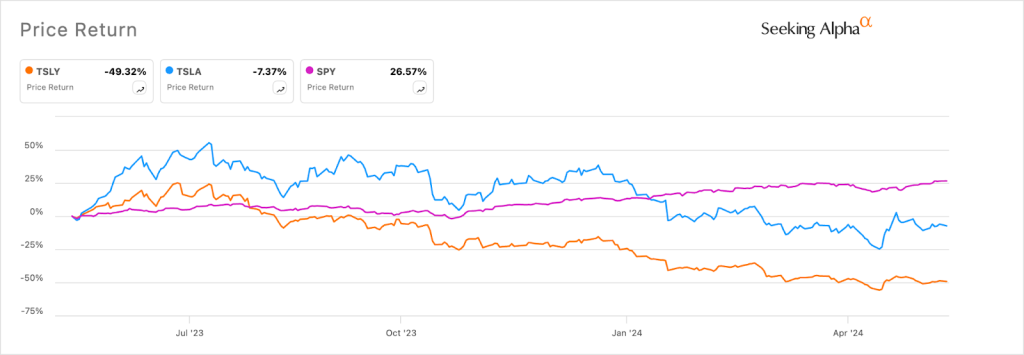

The YieldMax TSLA Option Income Strategy ETF (TSLY) ETF has been an expensive strategy to lose money in the past few years. It has crashed by almost 50% in the past 12 months while the Tesla stock has crashed by 7.37% and the S&P 500 has jumped by over 26.57%.

TSLY ETF has underperformed Tesla and S&P 500

The same trend has happened this year where the TSLY fund crashed by 37.65% while Tesla and SPY have fallen by 30% and 11.5%, respectively. This performance happened even though TSLY is one of the most expensive ETF in the industry with an expense ratio of 1.01%.

As a result, TSLY’s 55% distribution yield and the 30-day SEC yield of 4.21% have not been enough to compensate its price movements. Indeed, recent data shows that TSLY’ distribution per share has been in a downward trend in the past few months. It peaked at $2.13 in June 2023 and has plunged to $0.6940.

The TSLY ETF has plunged because of the ongoing weakness of Tesla’s stock. In a recent statement, the company said that its revenue plunged from $23.3 billion in Q1’23 to $21.3 billion in Q1’24. It was the biggest YoY revenue drop in years.

Tesla’s profit margins also dropped as the company continued slashing its prices as competition from firms like Nio, BYD, XPeng, and Li Auto rose. As a result, its net profit crashed from $2.5 billion in Q1’23 to $1.12 billion in Q1’23.

Tesla vs TSLY ETF vs SPY performance

Analysts are pessimistic about Tesla

Analysts expect the company’s slowdown will continue this year, with the average revenue forecast being $90.6 billion, down from $96 billion in 2023. Its profit per share is expected to come in at $2.3, down from $2.86 a year earlier.

TSLY’s underperformance is happening at a time when Tesla’s shares have plunged by over 50% from its highest point in 2021.

In theory, TSLY should do better than TSLA in periods of turbulence because of its synthetic covered call option strategy. In this, the fund sells a covered call based on the value of Tesla shares. In this case, it benefits when the stock rises in terms of price appreciation and the options premium.

If the Tesla stock drops, the fund takes a loss but compensates it using the premium it receives for the call option. This approach seems not to be working well for now as the TSLY’s total return has lagged behind the performance of Tesla, as I warned before.

The post TSLY ETF: Is this dividend paying Tesla stock a good buy? appeared first on Invezz