Over 20% of Large Cap Crypto Have Major Risk of Token Unlocks

A recent study on the top 300 cryptocurrencies by market capitalization reveals that over 20% of these coins have a large portion of their tokens yet to be unlocked.

This finding is crucial for investors and market analysts, given the potential impact on market prices and investor sentiment.

Most New Crypto Projects Will Unlock Significant Supply

Utilizing data from CoinGecko as of May 8, 2024, the analysis excluded stablecoins and wrapped assets. It focused on the market cap to fully diluted valuation (FDV) ratio.

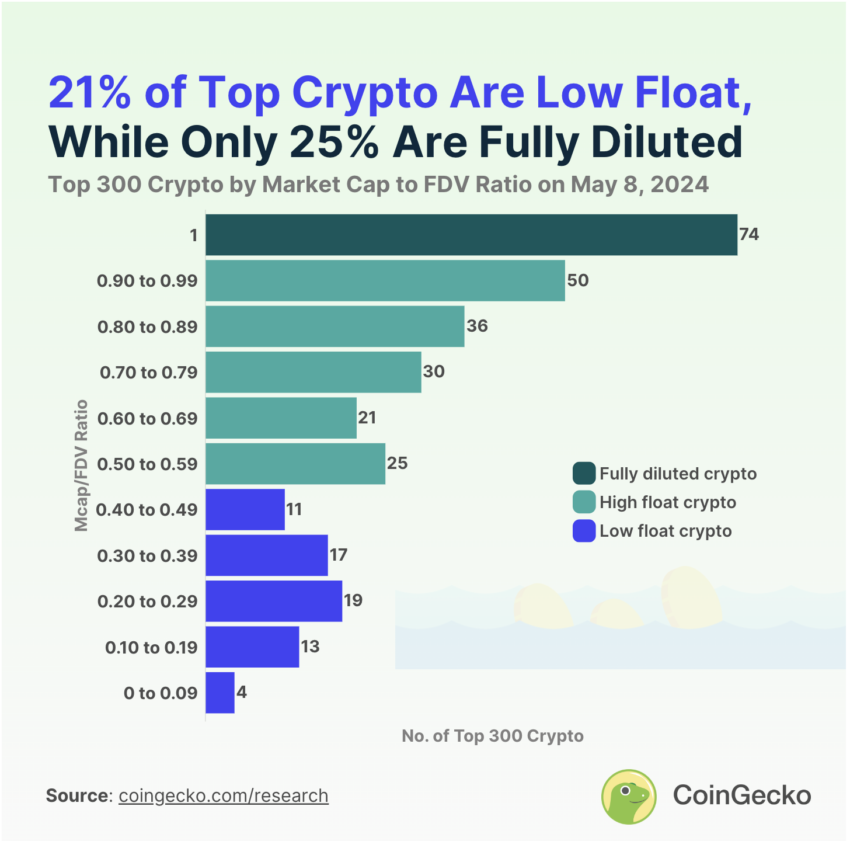

“For the purpose of this study, low float crypto was defined as having a market cap to FDV ratio of 0 to 0.49, high float crypto had ratios of 0.50 to 0.99, and only crypto with a ratio of 1 were considered as fully diluted,” CoinGecko explained.

Significantly, low-float cryptocurrencies account for 21.3% of these top 300 coins. This suggests a large upcoming supply set to enter the market. Among them, Worldcoin (WLD) has the lowest ratio at 0.02, followed by Cheelee (CHEEL) at 0.06, Starknet (STRK) at 0.07, and Saga (SAGA) at 0.09.

These cryptocurrencies, all launched in either 2023 or 2024, represent the newer additions to the market.

Read more: Tokenomics Explained: The Economics of Cryptocurrency Tokens

Top 300 Crypto by Market Cap to FDV Ratio. Source: CoinGecko

Top 300 Crypto by Market Cap to FDV Ratio. Source: CoinGecko This trend of low float is predominantly seen in cryptocurrencies introduced in the last four years. Indeed, 54 out of the 64 low float large-cap cryptocurrencies were launched during this period. This influx of new projects indicates a dynamic expansion within the crypto space and signals potential market shifts as these tokens become available.

Looking at the near future, the market faces immediate impacts from scheduled token unlocks.

For example, according to data from Token Unlocks, on May 12, Aptos will release 11.31 million APT tokens, worth nearly $100 million, which represents 2.64% of its circulating supply. Moreover, on May 16, Arbitrum will unlock 92.65 million ARB tokens, worth over $96 million, 3.49% of its circulating supply.

These releases might create significant selling pressure on the respective tokens.

Additionally, BeInCrpto reports that around $3.58 billion worth of tokens will be unlocked this month across various projects. This substantial amount highlights the scale at which these unlocks could influence the broader market, potentially increasing volatility.

Read more: What is Tokenomics? A Basic Guide

In contrast to newer cryptocurrencies, older ones generally have higher FDV ratios. Notable examples include Maker (MKR), Aave (AAVE), and Near Protocol (NEAR), with ratios of 0.95, 0.93, and 0.90, respectively. This indicates that most of their potential supply is already circulating, differing sharply from less than half of the newly launched cryptocurrencies achieving full dilution.