Enforcement Wave Incoming: CFTC Targets Crypto Firms

The cryptocurrency industry’s rapid growth, fueled by an influx of new investors, has significantly increased adoption rates. However, this expansion has not come without consequences.

As more inexperienced retail investors enter the market, regulatory bodies, particularly in the United States, have heightened their scrutiny over the sector. Concerns center on market manipulation, investor protection, and the potential use of cryptocurrencies in illicit activities.

Increased Scrutiny: The CFTC Takes Aim

The Commodity Futures Trading Commission (CFTC) of the United States has signaled a forthcoming intensification in enforcement actions aimed at the crypto ecosystem. During the 27th Annual Milken Institute Global Conference on May 6, CFTC Chair Rostin Behnam highlighted the anticipated regulatory response to the recent surge in cryptocurrency prices and the corresponding rise in retail investor activity. Behnam projected a new wave of enforcement within the next six to 24 months, attributing this to the increased asset values and interest from retail investors.

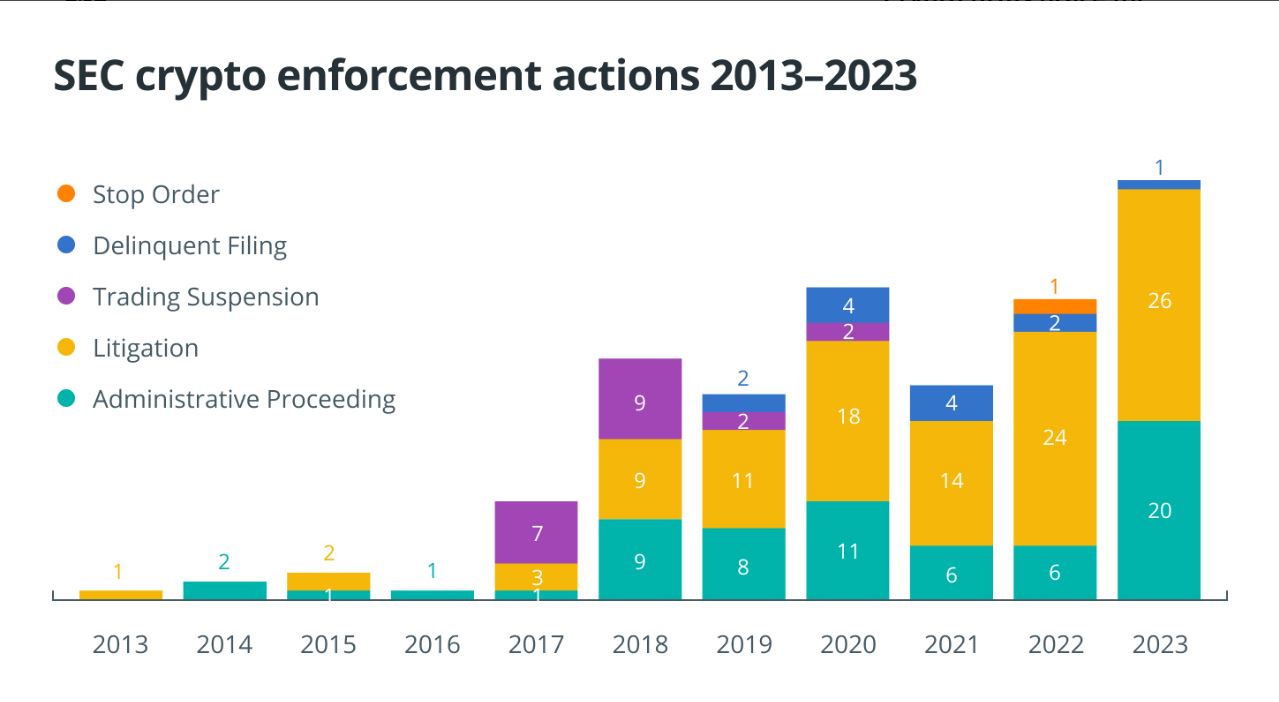

Currently, there is no established legal framework specifically governing crypto service providers, which Behnam believes will lead to more stringent actions from regulatory bodies against crypto firms. Over the past year, both the CFTC and the Securities and Exchange Commission (SEC) have increased their enforcement actions, with 2023 seeing a record number of such measures.

According to Cornerstone Research, a litigation consulting firm, the SEC’s enforcement actions hit a 10-year peak in 2023, with digital assets becoming a top priority. The SEC not only tripled its administrative proceedings in 2022 but also initiated 46 enforcement actions in 2023, resulting in $281 million in fines through settlements. Meanwhile, the CFTC undertook 47 enforcement actions in 2023, which constituted over one-third of its total actions since 2015.

Taking Down The Big Names: Crypto Firms Under Fire

High-profile U.S. crypto firms such as Kraken, Binance, and Coinbase have faced numerous cases from regulators. The enforcement efforts persisted into 2024; for instance, in April, the U.S. Justice Department arrested the founders of the privacy-focused Samurai wallet on charges of money laundering. The following month, the SEC issued a Wells notice to Robinhood.

Amid these developments, the SEC and other regulatory bodies appear to be targeting firms that operate under a broker-dealer business model, which are viewed as direct competitors to traditional financial institutions. Patrick Gruhn, a former partner at Swiss law firm Crypto Lawyers, explained to Cointelegraph that any crypto firm allowing speculation on crypto asset prices or offering interest-like payments is at risk of regulatory action, regardless of whether it considers itself decentralized.

Another focal point for U.S. agencies is privacy and mixer tools, which anonymize cryptocurrency transactions. Actions have been taken against services like Tornado Cash, and more recently, the founders of Samurai were arrested.

A Tangled Web: The Regulatory Labyrinth

The regulatory landscape is complicated by the absence of a clear legislative framework and the overlapping enforcement jurisdictions of various agencies. Keith Blackman, a partner at the Bracewell law firm in New York City, noted that while CFTC Chair Behnam has often expressed concerns about the lack of comprehensive crypto regulations in the U.S., SEC Chair Gensler has been eager to proceed with enforcement actions, even without specific regulations for cryptocurrencies.

This approach, according to Blackman, is leading to alignment between the CFTC and SEC, which might deter new crypto companies from entering the market and push existing companies to allocate more resources to legal and compliance efforts, potentially stifling innovation. Neal Levin, a partner at Rimon Law, echoed these sentiments, stating that the absence of clear policies creates uncertainty about appropriate behaviors within the industry.

Regulators are forced to apply existing laws to the crypto business models, using enforcement as a way to shape behavior and provide guidance in lieu of new legislation.

Beyond the US: A Global Look at Crypto Regulation

While the U.S. continues with its “regulation by enforcement” strategy, other jurisdictions are developing more comprehensive crypto regulations. In the U.S., this approach has already compelled several established businesses to modify their offerings or cease operations entirely. Despite the regulatory pressures, the traditional financial sector is increasingly embracing digital assets.

The launch of spot Bitcoin exchange-traded funds and investments by traditional financial institutions underscore the growing mainstream interest in cryptocurrencies. Additionally, as crypto holders become more politically active, there is a growing possibility of more crypto-friendly regulations emerging in the future.

The post Enforcement Wave Incoming: CFTC Targets Crypto Firms appeared first on Coinfomania.