Turkey on the Verge of Crypto Regulation

Turkey, a nation boasting a significant presence in the global cryptocurrency market, is poised to introduce regulations governing crypto assets in 2024. This news follows an announcement in January by Mehmet Simsek, the Turkish Treasury and Finance Minister, who indicated that local crypto legislation was nearing completion.

While many anticipated the Turkish parliament would begin regulating the crypto market in early 2024, the official draft legislation has yet to be presented. This lack of regulatory clarity has prompted questions within the Turkish crypto industry regarding the timeline for the legislation’s arrival and the current state of crypto regulation in the country.

Current State of Crypto Regulation in Turkey

Despite the absence of comprehensive crypto legislation, Turkey does have some preliminary regulations in place. These measures, however, lack the backing of the Turkish parliament, raising concerns about their enforceability.

Local cryptocurrency expert Ismail Hakki Polat describes the current state as “very slight regulations” targeting crypto assets. One such regulation, implemented by the Central Bank in 2021, prohibits the use of cryptocurrencies like Bitcoin for payments within Turkey, as they are not considered legal tender. However, Polat highlights the lack of parliamentary oversight, raising questions about potential consequences and penalties for violating this rule. He characterizes it as a regulation “with no legs on the ground.”

A second regulation exists under the purview of the Financial Crimes Investigation Board (MASAK), focusing on Anti-Money Laundering (AML) measures within the crypto sphere. This regulation requires exchanges to collect certain Know Your Customer (KYC) data from users in order to prevent illicit activities like money laundering and terrorism financing.

Further complicating the landscape, the Capital Markets Board of Turkey (CMB), also known as SPK (Sermaye Piyasası Kurulu), issued guidance in 2018 prohibiting entities under its authority, such as banks and broker-dealers, from trading cryptocurrencies. Industry leader Tansel Kaya, CEO of Mindstone Blockchain Labs, emphasizes the outdated nature of this SPK guidance.

Turkey: A Major Player in the Global Crypto Market

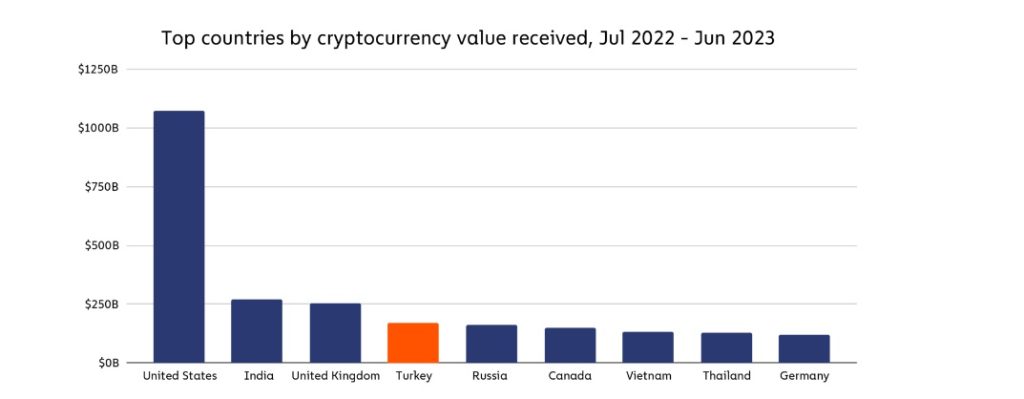

Despite the absence of comprehensive crypto legislation, Turkey stands out as a major player in the global cryptocurrency market. Boasting an estimated 20 million crypto investors out of a total population of 85 million, some studies suggest Turkey’s adoption rate has surpassed 40%, meaning potentially two in every five Turkish citizens hold crypto assets. This translates into significant trading volume, placing Turkey as the world’s fourth-largest crypto market according to Chainanalysis data, with an estimated volume of $170 billion.

This surpasses established economies like Russia, Canada, Vietnam, Thailand, and Germany. In September 2023, the Turkish Lira even became the top trading pair for crypto on Binance, accounting for a staggering 75% of all fiat trading volume on the exchange. This surge in crypto activity within Turkey is attributed to a large influx of investors seeking alternative financial instruments.

Beyond Catching Up: Turkey’s Crypto Regulations and the FATF Gray List

Turkey’s anticipated crypto legislation isn’t just about catching up with the times. The country’s aim is to improve its standing with the Financial Action Task Force (FATF), an intergovernmental watchdog promoting effective policies to combat money laundering and terrorist financing. In October 2021, the FATF placed Turkey on its “gray list” due to concerns about disproportionate regulation of the non-profit sector.

Local cryptocurrency expert Ismail Hakki Polat explains that Turkey must address 39 action items set by the FATF to be removed from the “gray list.” One of these action items specifically targets the crypto industry. The FATF requires member countries to comply with its framework to ensure virtual assets are not exploited for criminal activities. By implementing robust crypto regulations, Turkey hopes to demonstrate its commitment to combating financial crime and secure its removal from the FATF’s “gray list.”

Focus on Investor Protection: Licensing and Safe Custody Under the New Law

The upcoming Turkish crypto law will primarily focus on regulating and licensing cryptocurrency exchanges, henceforth referred to as Virtual Asset Service Providers (VASPs) under the FATF framework. These regulations will establish clear guidelines for VASP operations, defining their liabilities and responsibilities towards their customers. Additionally, the law will set standards for safe custody – how VASPs must securely store crypto assets entrusted to them by their users.

This emphasis on investor protection stems from the fallout of a major Turkish crypto exchange, Thodex. The exchange abruptly shut down operations in April 2021, leaving investors high and dry. Thodex founder Faruk Fatih Özer was eventually sentenced in 2023 for fraud estimated at a staggering $2 billion. Beyond VASP regulations, the new legislation is also expected to finally provide a legal framework for taxing cryptocurrency transactions in Turkey.

Taxation and Tokenization

Local reports suggest the Turkish Revenue Administration plans to impose low-rate transaction taxes on crypto, potentially utilizing existing taxes like the Banking and Insurance Transactions Tax (BSMV) which currently sits at 5%. Cryptocurrency earnings are also likely to be subject to income declaration, but a zero withholding tax rate is reportedly being considered.

Additionally, the upcoming bill is expected to address the regulation of tokenizing real-world assets, potentially opening doors for new financial instruments.

Timing of the Legislation

The exact release date of Turkey’s crypto legislation remains unclear despite initial expectations of progress in early 2024. Some industry observers link the timing to the upcoming June meeting of the U.S. Office of Foreign Assets Control (OFAC), which may consider removing Turkey from the FATF gray list. Industry leader Tansel Kaya suggests the law and its regulations need to be enacted before this meeting, possibly in May.

Local expert Ismail Hakki Polat offers a broader timeframe, suggesting a potential release by the end of the current parliamentary season in June. However, he acknowledges a possible delay until autumn or even the end of the year. The urgency surrounding the FATF gray list removal appears to have lessened according to Polat.

The post Turkey on the Verge of Crypto Regulation appeared first on Coinfomania.