Bitcoin’s Halving: The Splendor & Misery

Welcome to the CoinStats Q2 2024 Newsletter, your concise but comprehensive overview of the latest updates and groundbreaking innovations in crypto markets. Stay in the loop with all the key market moves, emerging trends, and exciting developments in the crypto space.

In March and April 2024, the crypto world has been buzzing with notable events and shifts. Bitcoin's recent halving event has left the crypto market on edge, with plenty of twists and turns.

We’ve got you covered weekly and when it matters the most, bringing you the power to trade like a pro!

🔄 Bitcoin's Wild Ride: Will History Repeat Itself?

Bitcoin continued its thrilling climb in March, shattering all-time highs on two occasions, only to face rapid corrections each time.

After reaching its first ATH, Bitcoin dropped as low as ~$59k before making a speedy recovery and soaring past $70,000. A wave of nearly 1,000 BTC worth of sell orders (around $70 million) on Binance and OKX pumped the brakes, causing the price to dip. We can't help but draw comparisons to the cryptocurrency's 2020 bull run, when it also faced sharp corrections twice before a brief consolidation period led to an even bigger breakout.

This rally, fueled by speculations of easing inflation and potential interest rate cuts, came just ahead of the halving event. Speaking of inflation, if adjusted for its effects, Bitcoin would need to break $78,905.45 to truly set a new all-time high. Hold on tight—this ride is just getting started!

😂 Jeo Boden (BODEN) Meme Coin

Jeo Boden (BODEN) is a playful token based on the Solana blockchain that launched in March and quickly gained attention with its name—a deliberate misspelling of President Joe Biden’s name—and its humorous approach to poking fun at him through memes and jokes.

What really propelled BODEN into the spotlight was a contest held by the token's creators: they offered 1,000 tokens to anyone who displayed a BODEN sign at a Trump rally in Grand Rapids, Michigan, on April 2. Surprisingly, several attendees showed up with BODEN signs, and the lucky winners walked away with their prize.

🌌 Is Crypto’s AI Future NEAR?

NEAR, the native token of the Layer 1 (L1) public blockchain NEAR Protocol, has been the talk of the town lately, surging 74% in the last 30 days! What's behind NEAR's impressive climb, and how can you take advantage of this momentum to boost your NEAR gains?

AI-related stocks have been soaring in traditional finance, and now crypto investors are diving headfirst into any token even remotely tied to AI.

NEAR Protocol has emerged as a frontrunner in this space, with many bullish on its AI potential. This enthusiasm was amplified by the news that NEAR's founder, an AI researcher by trade, will join Nvidia CEO Jensen Huang at the company's upcoming AI conference for an expert panel.

Analysts believe the bullish momentum may continue, so keep an eye on NEAR as it climbs even higher!

🚀 Bitgert Steals the Show

Bitgert’s BRISE might be the wildest crypto coin of the year! The coin has soared 80% in just one month. Bitgert is all about sustainability, using the eco-friendly Proof-of-Authority consensus mechanism. Plus, it’s got a killer ecosystem with DeFi apps, NFT marketplaces, and a BRC20 blockchain processing over 100,000 transactions per second—lightning-fast compared to Bitcoin and Ethereum!

Bitgert's market cap is over $104.6 million, and one BRISE coin is still super cheap at around $0.0000002646. The recent dip means it's the perfect time to buy the dip!

The biggest boost for Bitgert is its upcoming listing on Binance's futures platform, which could launch the coin's value up 200%!

🔥 Solana (SOL) on Fire!

Solana has seen a record-breaking surge in adoption, with the daily count of new addresses hitting over 691,000—an all-time high! This impressive uptick is driven by people flocking to the network, showing keen interest in its capabilities.

Tristan Frizza, founder of Zeta Markets, is bullish on Solana's future, stating that this surge in new addresses could set the stage for the network to reach new all-time highs. Solana is already ahead of other major blockchains in daily transactions, and Frizza predicts that its market cap will continue to climb, potentially placing Solana among the top three blockchains. This forecast is backed by Solana's thriving ecosystem, attracting numerous projects and developers. As Solana’s ecosystem keeps expanding, its scalability and low transaction costs are expected to draw even more users and projects, solidifying its reputation as a leading blockchain platform.

Solana's decentralized exchanges (DEXs) are also seeing a substantial surge in trading volumes, consistently surpassing $2 billion daily since March. This boost is fueled by the recent upswing in Bitcoin’s value, which has led to shifts in market capital. Solana is definitely a blockchain to watch!

Solana’s memecoins’ craze:

Solana Hits All-Time High in Daily New Addresses!

However, Solana faces ongoing congestion issues, with ~75% of transactions failing at the end of March. While the issues are being fixed, they haven’t been fully resolved for the time being.

🛠️ Monad Launches Devnet

The highly-anticipated EVM-compatible Layer 1, Monad, has launched its Devnet for developers.

After raising a whopping $200 million and hitting an impressive 10,000 TPS in testing, Monad is poised to expand the Ethereum Virtual Machine significantly, which will ultimately contribute to Ethereum's growth. Packed with prominent funds and angel investors, this funding will bring Monad from testnet to a full production mainnet later this year. Keep an eye on Monad as it paves the way for a new era in blockchain development!

🎢 BTC Rollercoaster

Bitcoin had another wild ride, dipping around the FOMC meeting before shooting up and then coming down again. Prices swung between ~$60k and ~66k, influenced by significant ETF outflows from Grayscale, which saw $643 million in outflows on Monday and kept selling throughout the week.

But don't worry—only ~365k BTC remains for GBTC to sell, down from 619k two months ago.

💼 BlackRock's BUIDL Fund

TradFi giant BlackRock is diving deeper into crypto with the launch of its BUIDL fund this week—a tokenized treasury fund on-chain. This Ethereum-based tokenized fund saw strong demand in its first week, pulling in $245 million in deposits. A $95 million transfer from Ondo Finance helped fuel BUIDL's growth even further. U.S. Treasuries are paving the way for tokenization of real-world assets (RWA), as both crypto firms and major financial institutions race to move traditional assets like bonds onto blockchain platforms.

🔒 SBF Sentenced to 25 Years in Prison

Sam Bankman-Fried, the former CEO of FTX, has been sentenced to 25 years in federal prison following his conviction on multiple fraud charges related to the collapse of the FTX exchange and Alameda Research trading firm in November 2022. He will serve his time in a federal facility near his family in the San Francisco Bay Area. Due to the Sentencing Reform Act of 1984, he is eligible for a maximum of 15% reduction for good behavior.

💰 Layer 2s to $1 Trillion

Layer 2s are making waves in the crypto world, with projections suggesting the market could reach a whopping $1 trillion by 2030, according to VanEck. These L2s are essential for providing affordable, scalable solutions to blockchain challenges, especially with ongoing issues affecting networks like Solana and L2s such as Base—even after Dencun.

VanEck's outlook is based on factors like transaction revenues, maximal extractable value, and the overall health of the ecosystem. However, they warn that intense competition could lead to just a few dominant players in the Layer 2 space.

⚖️ Uniswap Faces SEC Scrutiny

The SEC has issued Uniswap a Wells Notice, marking another combative move against crypto. The regulatory body claims Uniswap operates as an unregistered securities broker and exchange. Uniswap quickly assured users that its services remain functional and the tokens it handles are simply digital files. The company vowed to contest the SEC's allegations.

This development follows the SEC's case against Coinbase, where a judge ruled that Coinbase's Wallet was not a broker. This ruling bodes well for Uniswap's fight against the SEC, according to Uniswap's Chief Legal Officer, Marvin Ammori. Ammori also condemned the SEC's overreach, pointing out that Gary Gensler acknowledged the agency's lack of authority to regulate the crypto industry as it does.

🌟 EigenLayer's Mainnet Goes Live

EigenLayer has made its debut on the blockchain's mainnet, bringing over $13 billion in assets into the fold. Although the mainnet launch is a big milestone, some key features are still in the works and will roll out throughout 2024.

EigenLayer announced the launch on April 9, stating that in-protocol payments to operators from actively validated services (AVS) such as apps and cross-chain bridges are yet to be implemented. Additionally, a slashing mechanism—where validators risk losing their staked crypto for poor performance—is also on the horizon.

Both features are set to arrive later this year once the EigenLayer marketplace has had time to "develop and stabilize." In the meantime, restakers can delegate their restaked ETH balance to EigenLayer operators, who will then manage AVS. Stay tuned for more updates as EigenLayer continues to evolve!

💸 Toncoin’s (TON) Rally

Toncoin (TON) is rapidly emerging as one of the hottest Layer 1 ecosystems, backed by major Web2 and Web3 investors. With over $162 million in Total Value Locked (TVL) and support from DWF Labs and $1.71 billion in funding, Toncoin leverages the massive Telegram user base for growth.

Recent innovations include Oyster Labs' Universal Basic Smartphone (UBS) and a surge in tap-to-earn meme coins like Notcoin (NOT) and Hamster Kombat. Toncoin boasts a $38 billion valuation and a daily trading volume of $751 million, surpassing Cardano (ADA) and targeting Dogecoin (DOGE) next. To boost community engagement, Toncoin offers Telegram users over $150 million in TON coins for participating in on-chain activities.

However, Telegram's integration with the TON blockchain and Toncoin token is becoming a hotspot for scammers running referral pyramid schemes. Watch out and verify before getting involved!

₿ Bitcoin’s Halving

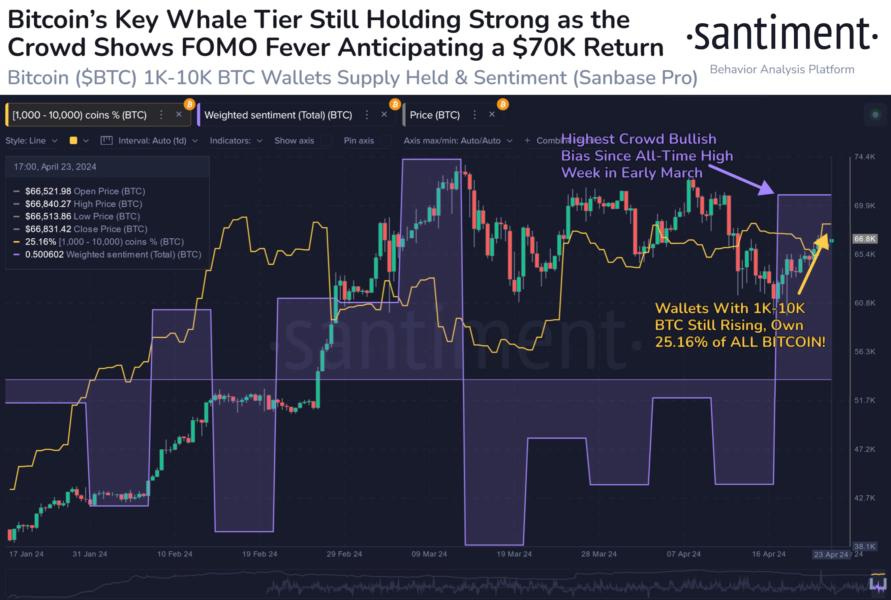

Bitcoin’s fourth-ever halving went live, leaving the crypto market full of surprises. While many expected a big boost for Bitcoin, the reality has been more restrained, staying below the peaks seen back in March 2024.

During this time, altcoins have taken a serious blow. Investors have been sticking to Bitcoin, leading to significant losses in the altcoin market. Since March, the total market cap for altcoins has plummeted from $1.27 trillion to a low of $908 billion by April 13, though it has since bounced back a bit to around $1.06 trillion as of April 23. The last month has been rough for altcoins, with around 80% of the top 100 altcoins experiencing losses between 2% and 50%.

Even Ethereum, the top altcoin by market cap, has struggled. After hitting a high of $3,727 on April 8, it has been sliding down and is now trading around $3,200 as of April 23.

Runes, a fresh token standard on the Bitcoin blockchain, has been dominating the network with more than two-thirds of all transactions since its launch right after Bitcoin's halving on April 20. Created by Ordinals inventor Casey Rodarmor, these new fungible tokens have sparked significant buzz and could be a game-changer for DeFi and NFTs on Bitcoin.

Yet, not everyone is thrilled about the block space being used up by Runes transactions lately.

💱Binance Converts Its Billion-Dollar 'SAFU' Emergency Fund into USDC

Binance, the world's largest crypto exchange, has converted its entire emergency fund known as SAFU into the stablecoin USDC, issued by Circle Internet Financial. The Secure Asset Fund for Users (SAFU) was set up in 2018 to act as a safety net for customers in critical situations. Binance's decision to shift the fund's assets to USDC is a strategic move under CEO Richard Teng, who took charge after Changpeng “CZ” Zhao and a November 2023 plea deal with US agencies. The fund is usually maintained at around $1 billion but can fluctuate with market trends.