Bitcoin Traders Eyes $50K After Critical Support Level Breach

Within the past day, Bitcoin’s valuation dwindled by 3.84%, settling at $58,291.31 as of May 1. Insight gathered from on-chain data, as reported by Cointelegraph and sourced from CryptoQuant, links this depreciation to a junction of waning enthusiasm among devoted investors and an uptick in bearish speculations.

In April, demand from so-called permanent holders of Bitcoin—investors who buy and hold without selling—plummeted by 50%. Late March figures showed over 200,000 BTC held, which dramatically fell to approximately 90,000 BTC by the end of April. This decline in holding behavior has reached levels last seen in early March, during which Bitcoin faced a significant correction of 7% after hitting all-time highs.

Additionally, the report highlighted a slowdown in demand for spot Bitcoin ETFs and an uptick in futures market short positions as contributing factors to the recent price downturn. Traders exhibit increasing hesitation to initiate extensive positions, with a noticeable ascendancy of sell orders over buying ones.

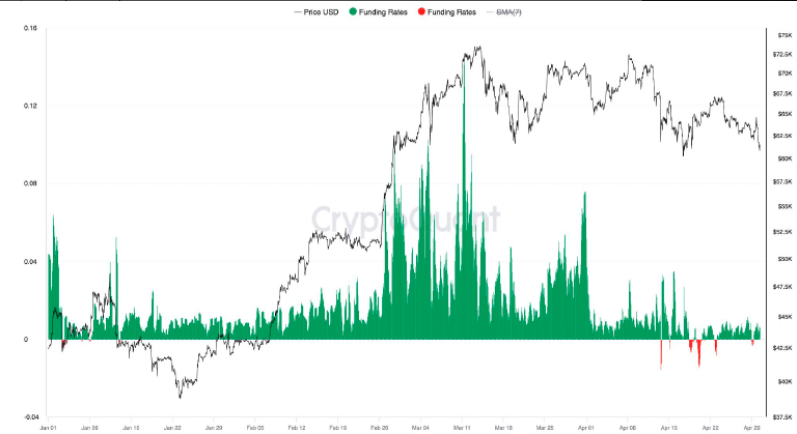

Besides, Bitcoin’s funding rate has plummeted to its lowest level for the year, reflecting traders’ diminished inclination to finance prolonged engagements. This hesitance is reflected in an uptick in short position activities as traders foresee additional downturns in Bitcoin’s valuation.

Analysts from CryptoQuant have noted that such corrections in the Bitcoin market are often driven by a decrease in demand from large investors, commonly referred to as whales. The recent trends suggest a cautious or bearish outlook among these significant stakeholders, impacting the overall market sentiment.

Bitcoin Price Predicted to Fall Further, Analysts Say

Market analysts predict a prolonged descent in Bitcoin valuations, foretelling bottoms unprecedented in the records of recent months. Subsequent to Bitcoin’s incapacity to uphold the pivotal $60,000 threshold, experts’ perspectives incline towards a sustained depreciation.

Esteemed market analyst Scott Melker interprets the prevailing financial turbulence as a transitory moderation within an overarching bull trend, remarking that the daily Relative Strength Index (RSI) has yet to signify oversold conditions. Melker anticipates Bitcoin’s depths in the imminent term to hover around $52,000.

$BTC Daily

Broke and retested range lows as resistance. Nothing but air until around $52,000 on the chart.

My biggest concern I have been discussing for months (in newsletter) is that RSI never made the trip to oversold.

Almost there now, all lower time frames oversold.

This… pic.twitter.com/5YZTWipBo8

— The Wolf Of All Streets (@scottmelker) May 1, 2024

Adding to the analysis, Tuur Demeester, another prominent Bitcoin analyst, observed Bitcoin trading at $60,409. Demeester posits that with the critical $60,000 support level breached, the next threshold could likely be $50,000. This perspective aligns with broader market sentiments that anticipate further declines.

I agree with @ChrisDunnTV, if bitcoin drops below $60k, the next technical support level is $50k. Such a move would not invalidate the bull market thesis. pic.twitter.com/SwqzmhR1S0

— Tuur Demeester (@TuurDemeester) April 30, 2024

Further emphasizing the bearish outlook, trader and analyst Mags highlighted the significance of the weekly closing prices. Should Bitcoin close below $60,000 on the weekly chart, Mags warns of a potential deep retracement. According to his analysis, such a scenario could drive Bitcoin’s price down to $40,000 or even lower.

The post Bitcoin Traders Eyes $50K After Critical Support Level Breach appeared first on Coinfomania.