BlackRock Sets New Standard in Tokenization of Real World Assets With BUIDL’s Success

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has become the world’s largest treasury fund tokenized on a blockchain.

This achievement follows its surpassing of Franklin Templeton’s Franklin OnChain US Government Money Fund (BENJI) in market cap. The milestone highlights a pivotal moment in integrating digital asset management with traditional financial systems.

BlackRock’s BUIDL Achieves 36.5% Monthly Growth

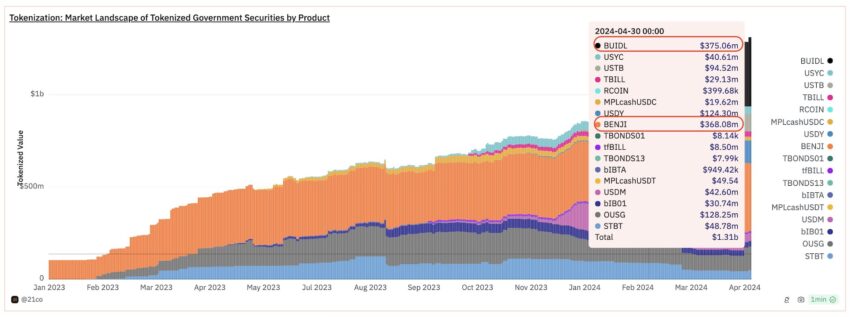

Launched merely six weeks ago, BUIDL quickly captured the market’s attention, amassing a market cap of $375 million. In contrast, the BENJI fund, previously the leader in this space, currently holds a market cap of $368 million.

According to on-chain analyst Tom Wan, in April, BUIDL’s value surged 36.5%, increasing from $274 million to $375 million. In contrast, BENJI’s growth was modest, rising just 2.1% from $360 million to $368 million during the same period. Moreover, BUIDL’s recent surge included $95 million from Ondo Finance’s OUSG token.

Read more: What is Tokenization on Blockchain?

Market Landscape of Tokenized Government Securities by Product. Source: Dune

Market Landscape of Tokenized Government Securities by Product. Source: Dune Franklin Templeton pioneered BENJI in 2021, establishing it as the first US-registered fund to leverage public blockchain for enhancing transaction processing and share ownership recording. BENJI tokens, based on the Stellar (XLM) and Polygon (MATIC) blockchains, uniquely represent the fund shares.

Despite BENJI’s innovative approach, BlackRock’s BUIDL has swiftly ascended to the top, highlighting the rapid adoption and potential of blockchain within mainstream financial services.

BlackRock CEO Larry Fink advocates for tokenization of real-world assets. He believes that on-chain implementations can bring more efficiency to capital markets. This sentiment resonates with the broader trend of asset tokenization, which now extends beyond government securities to include stocks and real estate.

Although the general demand for these tokenized products remains in its nascent stages, specific segments, as exemplified by BUIDL, show promising interest. Wan points out that liquidity remains a primary concern for potential investors in tokenized equities, funds, or bonds.

“Even if the end investors are crypto natives, they would be reluctant to invest in tokenized equities given the thin liquidity. As a result, creates a chicken and egg problem. Issuers don’t see a clear benefit in tokenizing their assets on-chain with low-demand,” Wan said.

However, he acknowledges the substantial market for US Treasuries within the crypto domain. He then cited the example of Ondo’s holdings, which cost approximately $350 million.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

The proportion of tokenized government securities has notably increased, climbing from 0.1% in January 2023 to approximately 1.4% of the total tokenized value today. Hence, Wan predicts that this trend will likely accelerate, propelled by technological advances and evolving investor preferences.