Analyzing Current Trends in Cryptocurrency Engagement

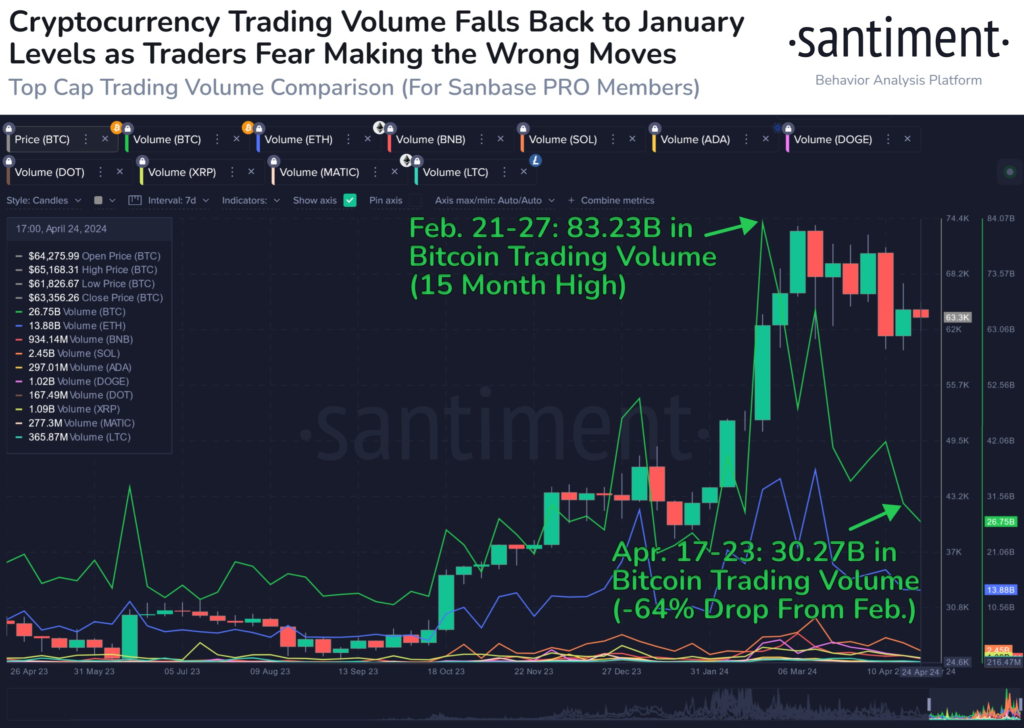

In recent times, the cryptocurrency market has witnessed a notable decrease in trading activity, reaching levels previously observed in late January. This decline has been accompanied by a change in the behavior and strategies of traders, indicating a period of uncertainty and cautious trading.

Shifts in Market Sentiment and Trading Strategies

The cryptocurrency landscape is currently experiencing a phase of hesitation among traders. The once-popular strategy of purchasing during price dips—commonly referred to as “buying the dip”—has seen a significant reduction in enthusiasm. Similarly, voices affirming a bullish future for cryptocurrencies have grown less frequent and more subdued. This shift suggests a broader sentiment of caution and indecision within the market.

Furthermore, despite the subdued trading volume, a substantial number of traders are opting to hold onto their assets. This decision is largely driven by the fear of missing out on a potential market recovery, which could see prices rebound in what is often referred to as a “relief rally.”

Implications of Reduced Bitcoin Trading Volume

Bitcoin, a leading indicator of broader cryptocurrency market trends, has experienced a sharp decline in trading volume, falling by 60-65% since a peak period at the end of February. This significant drop highlights the current wary stance of many investors, who are closely monitoring the market for signs of a turnaround.

Key Indicators to Watch in the Cryptocurrency Market

For those keeping a close eye on the market dynamics, an increase in trading volume could serve as a critical indicator of an impending rally. A surge in trading activity may suggest that confidence is returning to the market, potentially leading to increased prices and a more active trading environment.

As the market progresses into May, investors and traders alike will be vigilant for any signs that could signal a shift in market sentiment, possibly catalyzing a market-wide rally. Understanding these trends and preparing for potential shifts is essential for anyone engaged in the cryptocurrency space.

Conclusion

The cryptocurrency market is in a phase of recalibration, with reduced trading volumes and a cautious approach from traders. Monitoring key indicators such as trading volume can provide valuable insights into the future direction of the market. As we move forward, staying informed and adaptable will be crucial for navigating the ever-evolving landscape of cryptocurrency trading.