Why Crypto Prices Are Taking A Dip Today?

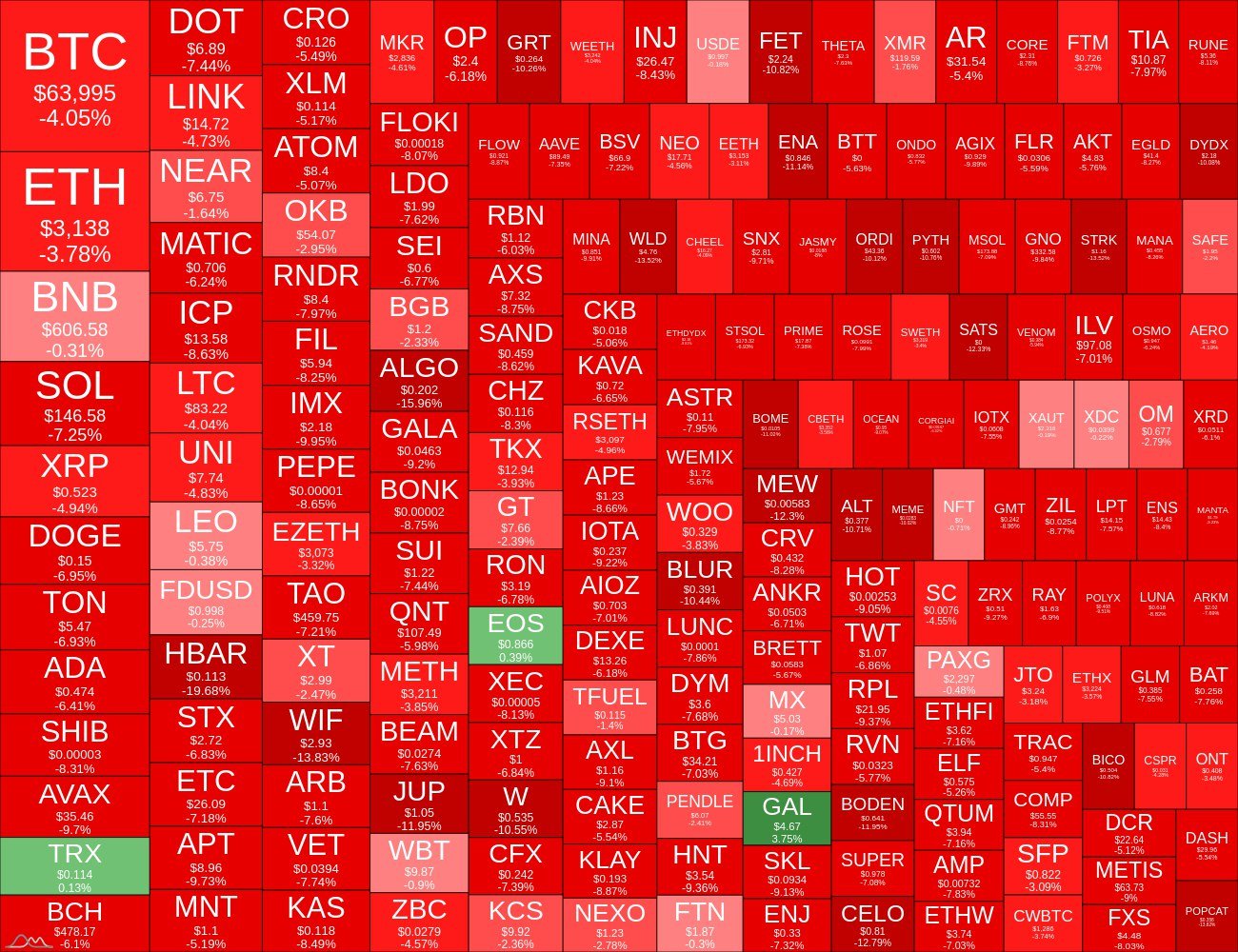

The crypto market has taken a dip in the last 24 hours after failing to maintain the upside momentum post-Bitcoin halving. The global crypto market cap tumbled over 4% to $2.36 trillion from $2.47 trillion, which means over $110 billion in market value was lost in the last 24 hours.

Bitcoin price plunges below $64,000 due to lack of trading volumes and rising uncertainty, with BTC hitting a low of $63,589. Traders are bullish on the crypto market this cycle amid bull market and anticipated post-Bitcoin halving rally. However, certain factors are causing them to become cautious in the short-term.

Second-largest crypto Ethereum price also fell over 3% to $3,100, with other altcoins including Solana, XRP, Cardano, Dogecoin, Toncoin, and Shiba Inu tumbling 5-10% in the last 24 hours.

$9.4 Billion In Crypto Market Expiry

The Fear & Greed Index indicates an uptick in sentiment, with an increase in value from 57 to 72 within this week. The market participants are waiting for some headwinds to disappear before taking new positions and $9.4 billion monthly crypto options expiry is the key headwind.

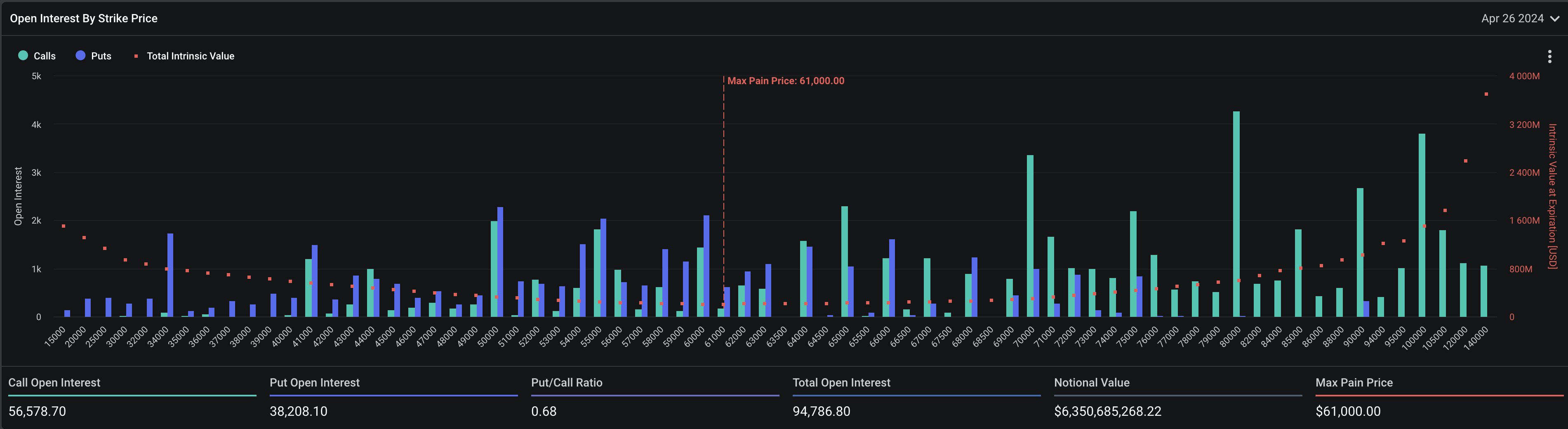

Over 96k Bitcoin options of $6.3 billion in notional value are set to expire on Deribit on Friday. The put-call ratio is 0.68, indicating a rise in put options recently as monthly expiry approaches. The max pain point is $61,000, below the current price. The market can expect huge volatility with a pullback in price expected on the expiry day, but derivatives traders remain careful of maintaining the position as funding rates are negative.

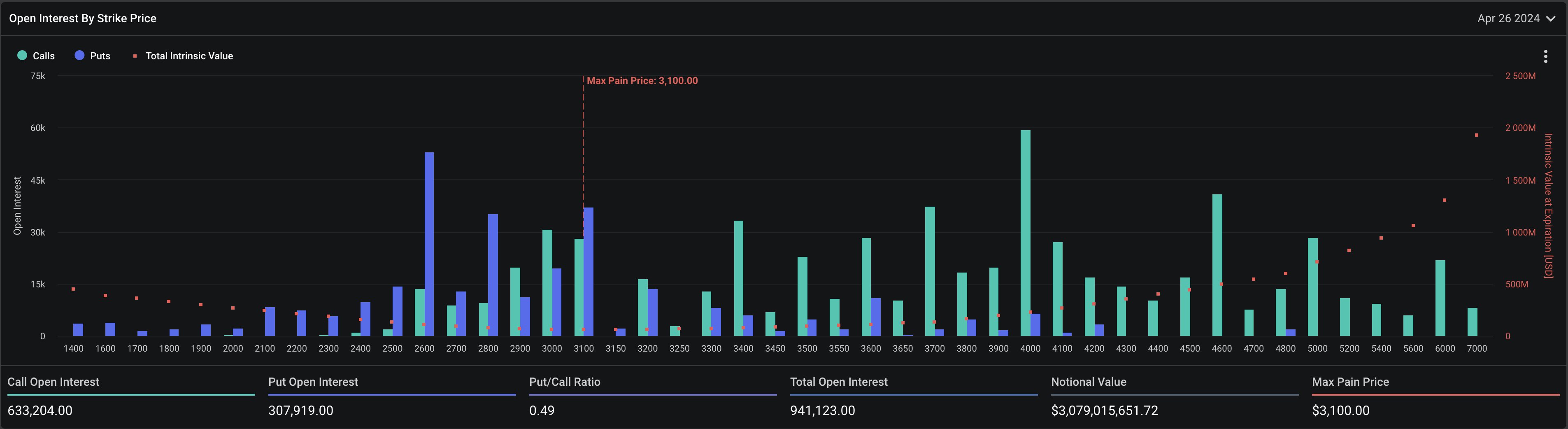

Moreover, 977k Ethereum options of notional value $3.1 billion are set to expire, with a put-call ratio of 0.49. The max pain point is $3,100, with the ETH price currently trading above the max pain point at also higher than the current price of $3,252.

The trades in the last 24 hours indicate an increase in put open interest with a put/call ratio of 0.94. The price could witness a decline to max paint point and begins a rally after the expiry.

US PCE Inflation Data

The week is seen as macro heavy because of multiple economic events including GDP, PCE inflation, initial jobless claims, and others. The Bureau of Economic Analysis estimates robust GDP growth in the U.S. despite a slowdown for the second consecutive quarter from 3.4% to 2.5%.

However, the key figures on watch is PCE inflation on Friday as global investors await the U.S. Federal Reserve preferred gauge to show some signs of falling inflation after CPI and PPI inflation data came in hotter. As per the economists, annual PCE inflation to come in hotter at 2.6%, 0.1% higher than 2.5% previously. Also, Core PCE inflation is expected to come in at 2.6%, down from 2.8% last month.

The Fed rate cuts are a key factor this year to confirm the bottom in stock and crypto markets, with other central banks likely to follow the U.S. central bank pivot.

Also Read: Binance Founder Changpeng “CZ” Zhao Requests Probation, Gets Unprecedented Support

Leveraged Crypto Liquidations

High-leverage positions in crypto are causing massive liquidations, with potential liquidation expected in the short-term. Bitcoin price risks liquidation and fall to $60,000 in the event of multiple selloffs.

Coinglass data shows more than $220 million were liquidated across the crypto market amid the pullback. Among them, $180 million long positions were liquidated and nearly $40 million short positions were liquidated.

Over 92K traders were liquidated and the largest single liquidation order happened on crypto exchange OKX as someone swapped ETH to USD valued at $5.66 million.

Two sell signals were presented on the #Bitcoin 12-hour chart: A death cross between the 50 and 100 SMA and a red 9 candlestick from the TD Sequential.

If $BTC falls below $63,300, brace for possible dives to $61,000 or even $59,000. pic.twitter.com/24A3YtbgTb

— Ali (@ali_charts) April 25, 2024

Also Read: Bitcoin ETF Volume At Four Week High, But Net Inflows Turn Negative Again

The post Why Crypto Prices Are Taking A Dip Today? appeared first on CoinGape.