Economic Impact on Crypto: What Every Trader Needs to Know

The post Economic Impact on Crypto: What Every Trader Needs to Know appeared first on Coinpedia Fintech News

Have you ever wondered if things like unemployment can affect the crypto market, just like they do with other investments? It turns out they can! As a crypto trader, it is crucial to pay attention to big economic developments. Not all developments affect crypto the same way, though. Some things matter more than others. This article will guide you through the important economic areas to watch. Let’s get started!

1. Economic Developments & Crypto Markets: An Intro

Economic developments, especially those from the US Federal Reserve and Inflation, hold sway over the crypto market. For instance, if the Fed decides to increase interest rates to curb inflation, investors might move funds from riskier assets like cryptocurrencies to safer options. This shift can cause crypto prices to drop. Similarly, if inflation rises unexpectedly, investors may turn to cryptocurrencies as a hedge against devaluation, leading to a surge in crypto prices.

Let’s go deeper and analyse the top factors that can affect cryptocurrency markets.

2. US Federal Reserve & Crypto Markets: An In-Depth Discussion

The US Federal Reserve’s decisions about interest rates have a strong ripple effect on cryptocurrency markets. When the Fed lowers rates or signals smaller-than-expected increase, it tends to encourage investors to pour money into assets like cryptocurrencies. This influx of investment often leads to rallies, driving up crypto prices. Conversely, if the Fed hints at aggressive rate hikes or fails to meet investor expectations, it can trigger fear and uncertainty among investors, prompting them to sell off assets, including cryptocurrencies. This sell-off can cause crypto prices to drop sharply. The link between the Federal Reserve’s actions and crypto markets movements underscores the significance of understanding central bank policies for crypto investors in navigating market volatility and making informed decisions.

The big question here is why investors fear aggressive rate hikes. There are a few strong reasons:

- Firstly, higher interest rates increase borrowing costs for businesses and individuals. This can lead to reduced corporate profits and decreased consumer spending.

- Secondly, higher interest rates make bonds and other fixed-income investments more attractive compared to riskier assets like cryptocurrencies.

- Thirdly, aggressive rate hikes may signal that the Fed is concerned about inflation, leading investors to worry about the purchasing power of their assets in an inflationary environment.

2.1. US Federal Reserve’s Communications & Crypto Markets

The Us Federal Reserve’s communications, such as press conferences, meeting minutes, and announcements, wield substantial influence over crypto markets.

- Press conferences provide clarity on the Fed’s stance on interest rates, shaping investor confidence and market sentiment.

- Meeting minutes offer transparency by elucidating the reasoning behind rate decisions, occasionally sparking minor market rallies if they align with expectations.

- Formal announcements carry even greater weight, particularly when they exceed investor forecasts, frequently igniting significant rallies across asset markets, including cryptocurrencies.

So, these channels serve as important indicators for crypto investors, enabling them to anticipate market movements and adjust their strategies accordingly amidst the dynamic landscape of the crypto market.

2.2. US Federal Reserve Chairman & Crypto Markets

The US Federal Reserve Chairman plays a pivotal role in shaping crypto markets.

The current chairman, Jerome Powell, in a recent statement, said that he and his colleagues would keep their heads down in a charged presidential election year, with interest rate cuts still likely in coming months but only if warranted by further evidence of falling inflation.

Investors closely monitor the US Fed Chairman’s statements as he holds sway over interest rate decisions. His words provide valuable clues about the Fed’s future actions, influencing investor sentiment and market dynamics. Understanding the chairman’s stance is important for crypto investors, as it helps them anticipate potential market movements and adjust their strategies accordingly.

3. Consumer Price Index & Crypto Markets: An Overview

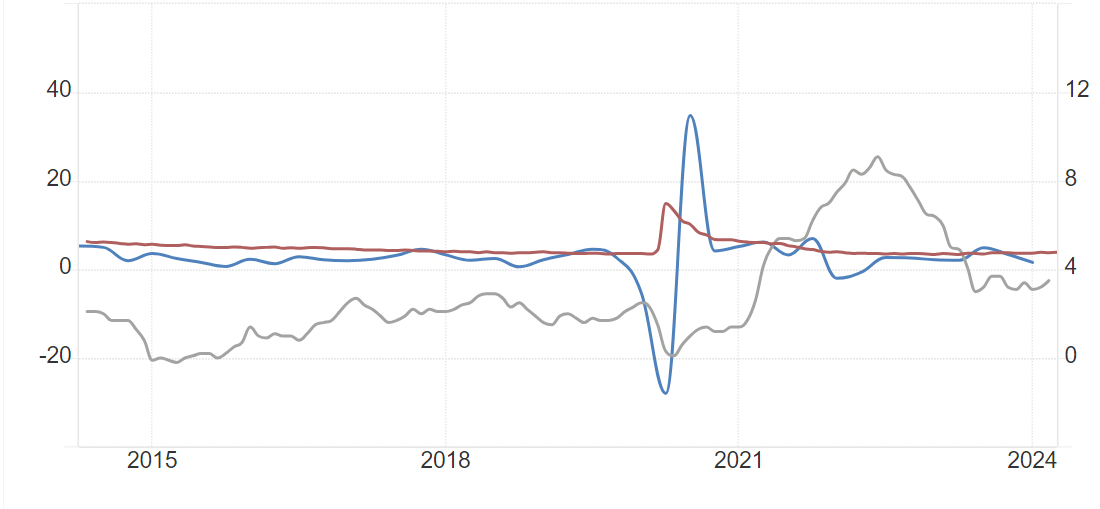

The US inflation rate, measured by the consumer price index (CPI), serves as a key indicator of the economy’s health. CPI reflects the average change in prices paid by consumers for a basket of goods and services over time.

The Federal Reserve closely monitors inflation, aiming to maintain it around 2% annually. When inflation exceeds this target, it can erode purchasing power and destablise the economy. In response, the Fed adjusts interest rates to control inflation.

If CPI matches investor expectations, it suggests stability, potentially triggering slight rallies in asset markets, including cryptocurrencies.

Additionally, monitoring the producer’s price index is crucial, as it anticipates changes in CPI by measuring the costs of goods and services at the production level, which eventually influence consumer prices.

Also Check Out : Crypto Trading Indicators: Decoding the Secrets of Successful Trading

4. Other Prime Economic Factors that Influence Crypto Markets

Other important economic factors that influence crypto markets are:

- Economic Indicators

Metrics like GDP growth, unemployment rates, and consumer spending impact crypto markets by reflecting broader economic conditions and influencing investor sentiment.

- Global Events

Geopolitical tensions, international trade policies, and major world events affect crypto markets by shaping investor risk appetite and market volatility.

- Adoption and Innovation

Factors such as mainstream adoption, technological innovations, and regulatory clarity influence crypto markets by driving investor interest, project viability, and market liquidity.

- Institutional Investment

The entry of large financial institutions, investment funds, and corporate entities into the crypto space affects markets by increasing liquidity, legitimising the asset class, and influencing market trends.

- Security and Regulation

Changes in cybersecurity, regulatory frameworks, and compliance requirements impact markets by affecting investor trust, project legitimacy, and market stability, influencing market participation and behaviour.

Endnote

Understanding the intricate relationship between economic factors and cryptocurrency markets is paramount for informed trading decisions. The interplay of variables like interest rates, inflation, and central bank policies significantly impacts market dynamics. Moreover, factors such as GDP growth, geopolitical tensions, and regulatory frameworks also wield considerable influence. By monitoring these indicators, investors can navigate market volatility and adjust strategies accordingly. This comprehensive analysis underscores the importance of staying abreast of economic developments to effectively engage in the dynamic realm of crypto trading.