How Will Bitcoin Halving Impact Top Cryptos

The post How Will Bitcoin Halving Impact Top Cryptos appeared first on Coinpedia Fintech News

The 2024 Bitcoin halving is just around the corner, causing a stir in crypto circles. People are buzzing about its impact, such as its impact on Bitcoin miners – the event will cut in half the rewards miners get for verifying transactions. But its effects might not stop there – it could also shake up Altcoins. You might be wondering how a Bitcoin event could rattle other cryptocurrencies. Let’s dive in and see if Altcoin holders have reason to fret.

1. Bitcoin Halving Explained

Bitcoin halving is a big event in the Bitcoin world and it happens about every four years. It is part of how Bitcoin works, and it is all about cutting the reward miners get for creating new blocks in half. When this happens, fewer new Bitcoins are made, which makes them more scarce. So far, there have been three Bitcoin halvings, and the next one is set to take place in April, 2024 – in a couple of days.

2. Prime Areas Impacted by Bitcoin Halving

Apart from Bitcoin miners, who see their rewards cut in half, other prime areas impacted include:

- Bitcoin Price

The anticipation and aftermath of Bitcoin halving events often result in significant price movements, with many investors expecting increases in Bitcoin’s value due to its reduced supply.

- Mining Industry

Bitcoin halving directly affects the profitability of Bitcoin mining operations, prompting miners to adjust their strategies and investments in response to the reduced mining rewards.

- Network Security

Changes in mining rewards can influence the security of the Bitcoin network, as fluctuations in mining activity may impact the network’s hash rate and resilience against potential attacks.

- Investor Sentiment

Bitcoin halving events garner widespread media attention and speculation, shaping investor sentiment and contributing to market volatility in the lead-up to and aftermath of the event.

- Altcoins

Alterations in Bitcoin’s value and mining difficulty can have ripple effects on the broader cryptocurrency market, potentially impacting the prices and market dynamics of alternative cryptocurrencies.

3. How Does Bitcoin Halving Affect Altcoins

Bitcoin halving has serious effects on Altcoins – especially Altcoin prices. It happens through several effects. The prominent ones are:

- Bitcoin’s Price Goes Up

If Bitcoin’s price goes up fast after halving, some people might sell their Altcoins to get more Bitcoin. This could make Altcoin prices drop.

- More People Get Interested

When Bitcoin halving happens, a lot of people start paying attention to cryptocurrencies. This can make them interested in Altcoins too, causing more trading and price changes.

- Altcoins Get Better

Bitcoin halving might make Altcoin developers work harder to improve their cryptocurrencies. This could make Altcoins more attractive to investors and miners, which could make their prices go up.

- Miners Start Mining Altcoins

When Bitcoin mining becomes less profitable after halving. Some miners might switch to mining other cryptocurrencies. This could lead to more mining of Altcoins, making their prices potentially higher.

Also Check Out : Santiment Reveals Top Altcoins Likely to Rebound First Amid Market-Wide Correction

4. Analysing Altcoin Ecosystem

4.1. Top Altcoins of the Month

Core, Ondo, Toncoin, Bitget Token, Mantle, Neo, Bitcoin Cash, Nervos Network, WhiteBIT Coin and Dogecoin are the top Altcoins of the month in terms of 30-day price change.

| Altcoins | 30-Day Price Change | Price |

| Core | +268.8% | $2.25 |

| Ondo | +69.5% | $0.8082 |

| Toncoin | +58.5% | $6.10 |

| Bitget Token | +42.7% | $1.23 |

| Mantle | +35.1% | $1.13 |

| Neo | +18.9% | $17.89 |

| Bitcoin Cash | +14.8% | $461.94 |

| Nervos Network | +14.5% | $0.02108 |

| WhiteBIT Coin | +13.1% | $9.26 |

| Dogecoin | +3.7% | $0.1527 |

Core marks the highest 30-day price change of +268.8%. Ondo and Toncoin follow closely with +69.5% and +58.5% respectively. Bitget Token and Mantle also stand among the top five list in terms of 30-day price change. Notably, none of the top players in terms of market capital find a place in the top ten list. Notable, Dogecoin, with +3.7% increase, enjoys a position in the list.

4.2. Top Five Altcoins with Highest Market Cap: Price Change Analysis

| Altcoins | 30-Day Price Change | 7-Day Price Change | Price |

| Ethereum | -15.6% | -13.6% | $3,026.11 |

| Tether | +0.2% | +0.1% | $1.00 |

| BNB | -5.8% | -8.6% | $534.86 |

| Solana | -35.9% | -21.6% | $132.09 |

| USDC | -0.0% | -0.2% | $0.9985 |

The 30-Day price change of Bitcoin stands at -8.1%, and its 7-day price change at -9.3%. The top Altcoins with highest market capital, it seems, also follow the same trend.

Ethereum marks an unimpressive 30-day price change of -15.6%, though the worst in terms of this index is Solana, with -35.9% change. The second largest cryptocurrency in terms of market capital after Bitcoin, Ethereum, also suffers a negative 7-day change of -16.6%. Here too, the worst is Solana, with -21.6%. Stablescoins, for its nature, remains stable. None of the others shows any impressive performance.

4.3. Top Five Altcoins with Highest Market Cap: Historic Data Analysis

The 1st Bitcoin Halving was on 28th November, 2012. The second happened on 9th, 2016. And the previous one was on 11th May, 2020. Let’s see how the prices of the top Altcoins reacted a day after the previous event and one month after the previous event.

| Altcoins | Price on the Day of the Event | A Day After the Event | One Month After the Event |

| Ethereum | $185.67 | $189.31 | $232.00 |

| Tether | $0.999563 | $1.002 | $0.999710 |

| BNB | $15.08 | $15.74 | $16.31 |

| Solana | $0.513923 | $0.53343 | $0.571998 |

| USDC | $0.996559 | $0.998483 | $1.002 |

The above data clearly shows that all the top five cryptocurrencies have experienced a positive moment just a day after the event, and it trend continued even a month after the event.

Read Also : With Bitcoin Halving Few Hours Away: Bitwise CEO Predicts Bitcoin Price To Hit $100k Soon

4.4. Top Five Altcoins with Highest Market Cap: Technical Analysis

Ethereum, Tether, Binance Coin, Solana and USD Coin all demonstrate varying levels of stability and potential for growth.

Ethereum, despite recent fluctuations, shows resilience with its broad market participation. Tether maintains stability as a stablecoin. Binance Coin and Solana exhibit potential for upward momentum, although both face challenges with recent bearish trends. USD Coin, while stable, faces minor downward pressure.

In the event of a Bitcoin halving, the top cryptos may experience increased attention and investment as investors seek alternatives to Bitcoin. Ethereum’s robust ecosystem and utility could lead to surge in demand, while stablecoins like Tether and USD Coin may benefit from a flight to stability. Binance Coin and Solana could see heightened interest due to their strong technological foundations and potential for growth.

5. Post-Halving Predictive Analysis: What Altcoins Can Expect

To understand clearly, what Altcoins can expect after the upcoming Bitcoin halving, we should analyse how it reached in the first three halvings. For a justifiable analysis, we can ignore the first halving, because at that time Altcoins were the tiniest section of the crypto market, where Bitcoin enjoyed an extreme majority.

Following the 2016 halving, Bitcoin soared by 3,000%, while struggling for six months due to lower popularity. But, in 2017, Altcoins surged as Bitcoin’s dominance waned. Meanwhile, after the 2020 halving, Altcoins didn’t witness immediate surge, but within 18 months, their market value surged from $68 billion to over $1.7 trillion, marking a 25x increase. The sustained growth in Altcoins post the last Altcoin was majorly fueled by increased crypto adoption and the entry of new investors into the market.

As of April 15, 2014, the total market cap of the top 125 cryptocurrencies, excluding Bitcoin, is $254.27 billion, with a volume of $26.314 billion. We are in the pre-halving phase, similar to 2016 and 2020, hinting at potential growth in Altcoins post halving.

However, an expert warns that past popular Altcoins have failed to surpass previous highs, unlike Bitcoin.

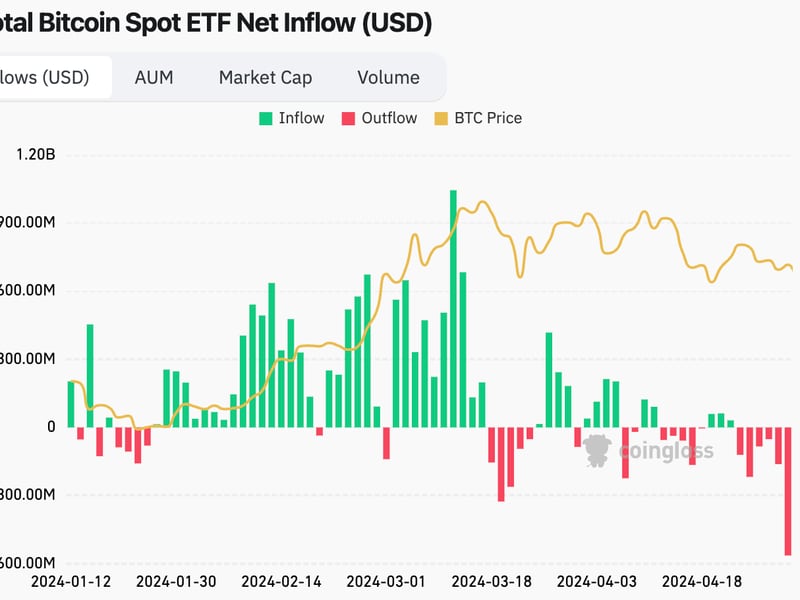

They caution against assuming Altcoins will outperform Bitcoin due to factors like Bitcoin’s ETF advantage.

This Might Interests You : Why Past Bitcoin Halvings May Not Predict Future Prices: Goldman’s Warns

Endnote

The cryptocurrency market’s unpredictability necessitates vigilance. Amid Bitcoin halving, observe for potential buying chances and capitalise on sell-offs. Bitcoin halving may impact Altcoins differently; while historical trends suggest a post-halving surge in Altcoin market value, some expert opinions caution against assuming past performance will repeat. Stay attentive to market dynamics, adapting strategies accordingly to navigate potential shifts in Altcoin performance amidst Bictoin’s halving.