Reserve Bank of New Zealand (RBNZ) Kicks Off New Retail-Focused CBDC Project

The Reserve Bank of New Zealand (RBNZ) has launched a public consultation on a proposed central bank digital currency (CBDC), termed “Digital Cash,” according to a consultation paper the central bank published on April 17.

This consultation marks the second phase of the process and is scheduled to run for 101 days, from April 17 to July 26. Following this period, the bank will review feedback and develop a business case based on Stage 2 insights before deciding whether to proceed to Stage 3.

The consultation paper is crucial for understanding the motivations and objectives behind New Zealand’s interest in developing a CBDC.

Reserve Bank of New Zealand’s Main Goal Is To Reduce The Use Of Physical Cash

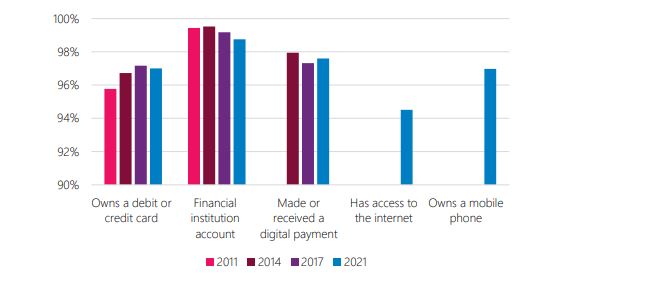

The Consultation Paper indicates that New Zealand’s proposed Digital Cash will be a Central Bank Digital Currency (CBDC) focusing on retail use, aimed at both individual consumers and businesses. The Reserve Bank of New Zealand attributes its push for a CBDC to the diminishing use of physical cash, which could negatively impact those dependent on cash transactions for financial inclusivity.

Survey results included in the consultation paper show a decline in physical cash usage among consumers, from 63% in 2021 to 58% in 2023, highlighting a steady decrease in traditional currency engagement. The Reserve Bank of New Zealand also aims to introduce digital cash as a response to falling cash transactions, intending it to cater to emerging needs and foster financial innovation.

Source: Reserve Bank/Consultation Paper

The paper underscores the swift advancements in cryptocurrency, distributed ledger technologies, and digital currencies by major tech companies. There’s a concern that if innovations continue to progress predominantly outside of the New Zealand dollar sphere, New Zealanders might switch to alternate digital currencies for their transactions, risking the nation’s monetary autonomy.

In response, the Reserve Bank of New Zealand views digital cash as a strategic initiative to promote innovative payment options within the country and safeguard its monetary sovereignty.

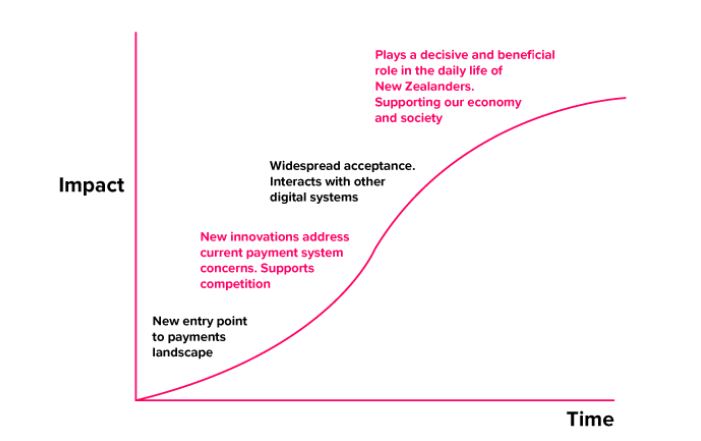

The bank emphasized that New Zealand’s payment services lag in innovation compared to other nations. By introducing digital cash, the bank aims to lower the barriers to entering the payments market and establish a new digital infrastructure that would support the country’s digital transformation.

Finally, the Reserve Bank of New Zealand has proposed a detailed four-phase plan to develop and roll out the New Zealand CBDC.

How The Reserve Bank of New Zealand Will Execute Its Plan

The Reserve Bank of New Zealand has implemented a phased approach to introduce digital cash. The initiative commenced in 2021 with the first stage, which included the release of an issues paper to evaluate the demand for digital cash in New Zealand (Aotearoa), garnering over 6,000 submissions and demonstrating significant public interest.

Currently, the RBNZ is in the midst of the second phase of its Central Bank Digital Currency (CBDC) project, focusing on exploring design alternatives for digital cash, engaging in consultations, and setting up fiscal frameworks.

Following the completion of the consultation period, the RBNZ plans to further develop the structural and policy requirements, aiming to finalize this stage by June 2025. Subsequently, a cost-benefit analysis will be performed.

Source: Reserve Bank/Consultation Paper

The conclusion of Stage 2 is projected for 2026, at which time the RBNZ will decide whether to advance to Stage 3, which includes the development and testing of prototypes to verify the operational effectiveness of the digital cash system. The final phase, Stage 4, is expected to culminate in the official release of the New Zealand CBDC by 2030.

Globally, other countries are actively pursuing CBDC projects. South Korea is accelerating its efforts, with plans to assess the practicality of the digital Korean Won (KRW) by the end of 2024.

In addition, Hong Kong has progressed to the second stage of its e-HKD initiative, continuing to explore the potential applications of a digital currency.

New Zealand’s Minister Says The Country’s Been Too Slow And Missing Opportunities In The Crypto Space

Andrew Bayly, New Zealand’s Minister of Commerce and Consumer Affairs, recently expressed concerns over the country’s cautious stance on exploring and embracing innovations in digital assets and blockchain technology.

In response to questions from the parliamentary Finance and Expenditure Committee regarding cryptocurrencies, Bayly’s office commented that the prevailing “wait and see” approach might lead New Zealand to miss out on the potential advantages of advancements in the digital asset sector.

The minister’s advisers have put forward eight critical recommendations aimed at helping New Zealand catch up with the global trend in cryptocurrency. These suggestions include the implementation of policies and regulations that promote the growth of digital assets and blockchain technology, as well as enhancing cooperation between the government and industry stakeholders.

The post Reserve Bank of New Zealand (RBNZ) Kicks Off New Retail-Focused CBDC Project appeared first on Coinfomania.