PlutusDAO Review: Profit Optimization DeFi Project On Arbitrum

PlutusDAO is likened to Convex Finance of Arbitrum’s ecosystem. This is a profit optimization platform for veToken holders, one of the potentials of the DeFi array being exploited.

So what is PlutusDAO? Let’s find out more about this project with Coincu.

What is PlutusDAO?

PlutusDAO is a project that offers an infrastructure for Arbitrum DAO development. PlutusDAO values are derived from Convex Finance and seek to increase value for holders and liquidity providers. Having more PLS (the platform’s native token) will aid in platform governance.

Plutus accomplishes this via the issuance of derivative asset classes plsAssets and plvAsset.

PlutusDAO has already collaborated with numerous notable projects in the Arbitrum ecosystem, including Dopex, Radiant, GMX, Sperax, and Jones…

How does it work?

Let’s take a peek at previous Curve Wars before learning more about PlutusDAO. Curve Wars is a war between platforms with the goal of collecting as many CRVs as possible from the market, namely from consumers. On the Curve Finance platform, raise the voting margin (Vote-Escrowed CRV or veCRV). From there, you may win a large number of votes and control the majority of the inflation decisions, bring the best interest rate for your LP, Pool, attract users, and create money.

To win this race, competing platforms must recruit investors who are willing to commit to permanently locking in the CRV at a high enough APR. And the winner is Convex Finance.

PlutusDAO’s operating strategy is comparable to derivative products that lock in Boost APR from PLS and platform fees in perpetuity. PlsAssets and plvAssets are the goods, but PlutusDAO’s vision is greater, as they continue to introduce products such as plsDPX, plsJONES, plvGLP, and, most recently, plsSPA.

PlutusDAO’s operational strategy is similar to that of derivative goods that lock in permanently to collect Boost APR (Annual Percentage Rate) from PLS and platform fees. plsAssets and plvAssets are the goods, but PlutusDAO’s vision is greater as it continues to introduce products such as plsDPX, plsJONES, plvGLP, and, most recently, plsSPA.

You will get veToken when you lock your token into the project. Users of veToken may receive yield, protocol fees, and governance, but the number of tokens is locked and cannot be spent. Plutus, on the other hand, will not be locked if DPX is directly locked on its own platform. Moreover, holding plsDPX allows you to earn Plutus tokens.

Users engage in staking assets into PlutusDAO in exchange for yield. The aforementioned yield is reduced by the project’s income.

Particularly, participants in the platform (plsDPX, plsJONES, plsSPA, or plvGLP) must pay a charge, which is remitted to Plutus’ treasury and serves as the platform’s primary income. The following fees must be paid by participants:

- 12% plsDPX (Doppex) (based on veDPX yield).

- 10% for plsJONES (JonesDAO) (calculated on the JONES-ETH LP pair yield).

- 20% plsSPA (Sperax) (calculated on veSPA yield).

- 10% plsGLP (GMX) (calculated on GLP yield).

Features of PlutusDAO

PlutusDAO’s model includes two derivative assets: plsAsset and plvAsset. Owners of pls (DPX, JONES) may exchange, get veToken incentives, and participate in governance. Alternatively you may lock the received PLS to gain extra token incentives (PLS, esPLS.).

The group that holds veToken (veDPX, veJONES) may lock and receive plsAsset through PlutusDAO. plsAssets will not be locked; instead, users will be able to switch to DPX through plsAsset’s liquidity pool. Since we own plsDPX, we have the chance to earn PLS tokens from Plutus.

plsAsset

plsAsset is concerned with the administration and development of user incentives, which is more lucrative and supported by the project for liquidity reasons. When a user deposits Jones, DPX, or SPA into Plutus through Convert, the plsAsset asset is created. Everything will be locked as veAsset (stake reward).

Plutus then delivers a plsAsset (plsDPX, plsJones, or plsSPA) instance for users to utilize for staking (under Stake), creating liquidity for pools (LP Farms), or swapping.

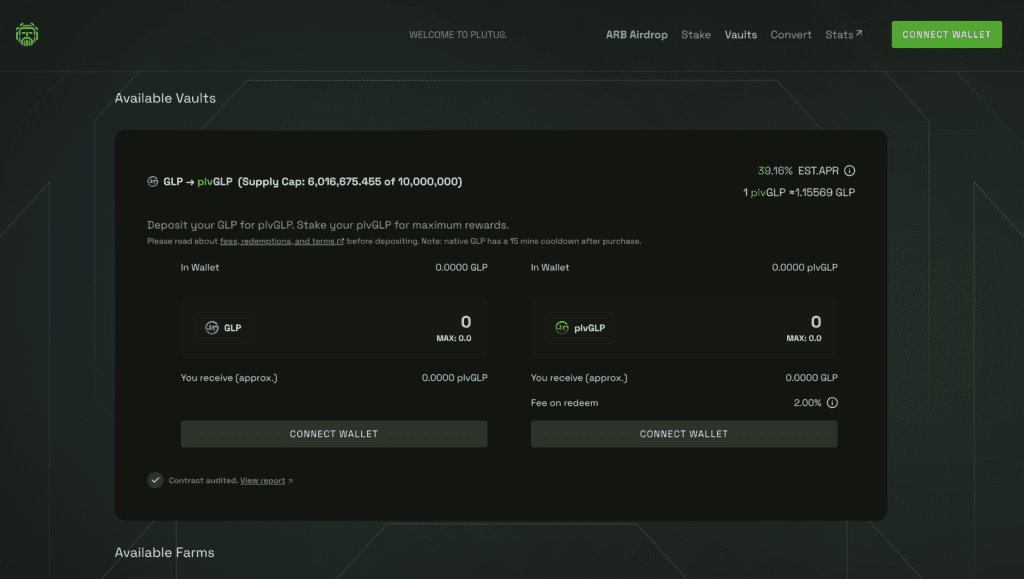

plvAssets

This is a collection of assets used for vaults in the PlutusDAO ecosystem; users may transmit GLP and plvGLP and stake them to get rewards (APR). In terms of plvAsset, only GLP is widely supported; users may utilize them for activities such as:

- Deposit GLP is completely free.

- Convert or redeem plvGLP to GLP (2% cost) and vice versa.

- Vault (ETH reward vault): is a bot-based automated pooling tool.

Products

Vault

plvAssets’ only current product is plvGLP, the GMX liquidity token.

Vault is incredibly easy to use; just lock GLP into the platform to get plvGLP and remove Stake. The platform will automatically aggregate your ETH reward and pay the extra incentive in PLS rather than esGMX.

If you believe PLS has a high growth potential, are dedicated to providing long-term liquidity for GMX, and want to sell esGMX awards without having to wait for linear vesting while still getting interested, plvGLP is the end destination for the amount of GLP you possess.

Staking Pool

plsAssets, like Convex Finance, provides consumers with the following benefits:

- Earn incentives comparable to locking for the longest possible period.

- Flexibility in exchanging without impediment

- Obtain additional benefits from PLS and platform fees.

- Buying and selling voting rights.

- It operates by allowing users to permanently lock tokens supported by the platform with the longest possible lock duration and mint out plsAssets. Users may, however, “drain” their holdings on the secondary market.

It is essentially a derivative asset that is employed in Liquid Staking, such as stETH, cETH, rETH, and so on.

PlutusDAO Token

Key Metric

- Token Name: PlutusDAO

- Ticker: PLS

- Blockchain: Arbitrum

- Token Contract: 0x51318b7d00db7acc4026c88c3952b66278b6a67f

- Token Type: Utility, Governance

- Total Supply: 100,000,000 PLS

- Circulating Supply: 10,830,000 PLS

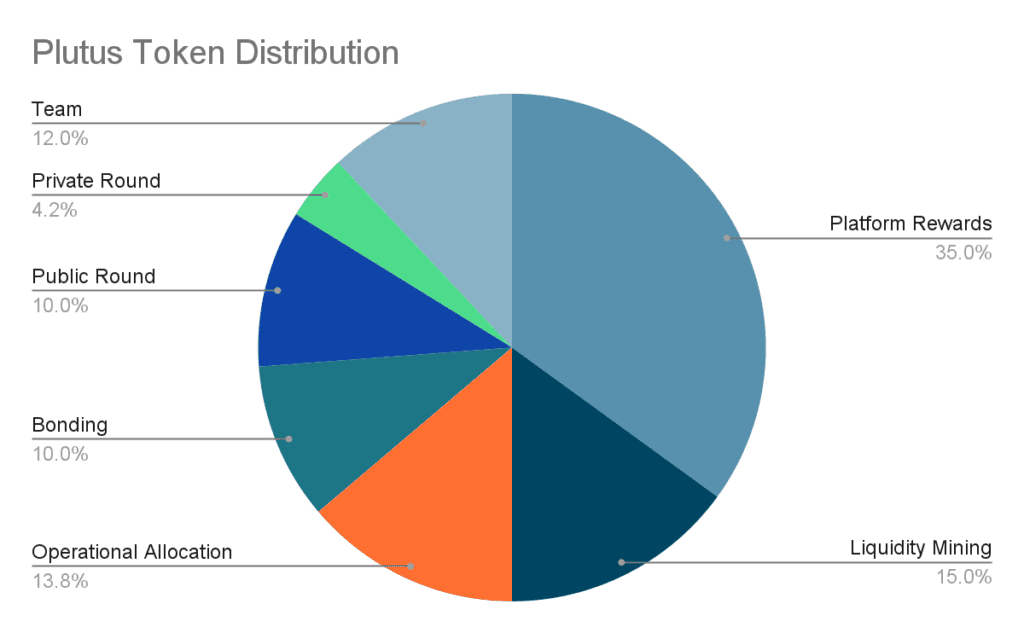

Token Allocation

- Platform Rewards: 35% – 35,000,000 PLS

- Liquidity Mining: 15% – 15,000,000 PLS

- Operational Allocation: 13.8% – 13,800,000 PLS

- Team: 12% – 12,000,000 PLS

- Bonding: 10% – 10,000,000 PLS

- Public Round: 10% – 10,000,000 PLS

- Private Round: 4.2% – 4,200,000

Release Schedule

- There will be no Platform Rewards or Operational Allocation during the Plutus token allocation period.

- Liquidity Mining: Users are rewarded with liquidity mining (the group that owns plsAsset).

- Private sale: Tokens will be locked for three months and then unlocked for three months.

- Public sale: Tokens will be available for purchase as soon as the TGE is completed.

- Team: the token will be frozen for three months before vesting progressively over the next 18 months.

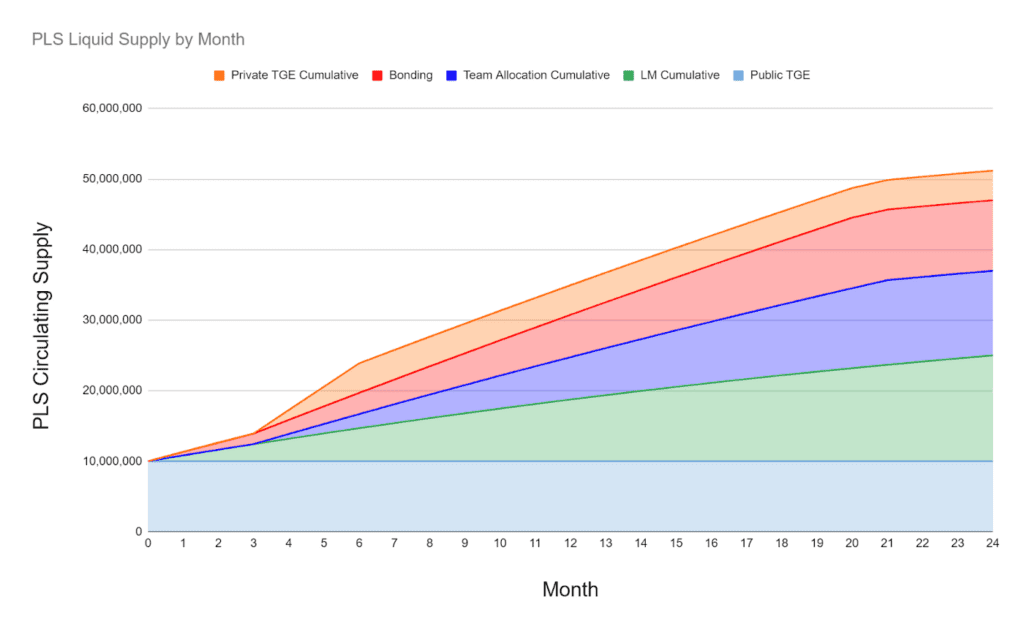

Starting in 2021, the project will release all 100 million tokens within 5 years. The graphic below shows the details of the Release token time.

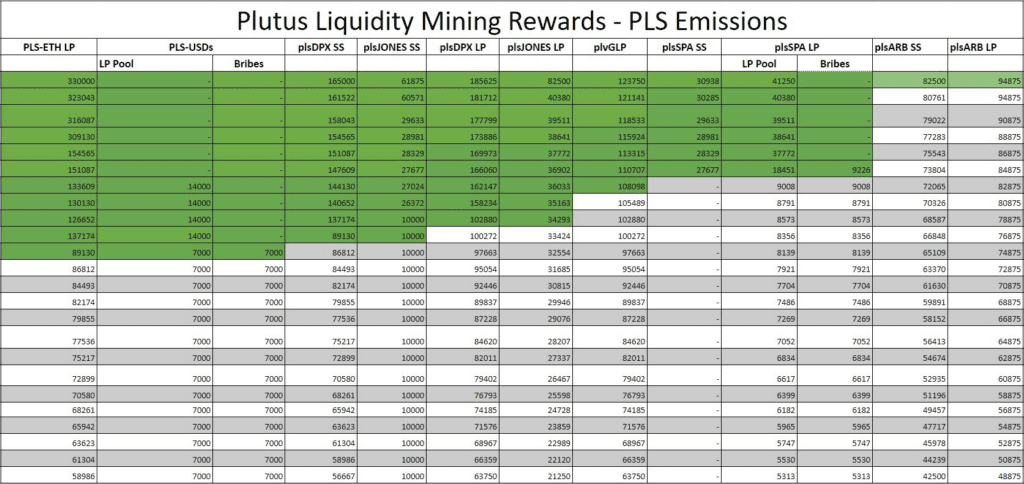

Liquidity Mining Emissions

During the first month, there will be 825,000 PLS tokens distributed through the release of Liquidity Mining. Each subsequent month, the total amount of PLS distributed through the Liquidity Mining issuance will decrease by approximately 17,391 PLS tokens.

Liquidity mining rewards will be divided among the following pools:

- PLS-ETH LP – 20%

- plsDPX SS – 20%

- plsJONES SS – 3.75%

- plsDPX LP – 22.5%

- plsJONES LP – 5%

- plvGLP SS – 15%

- plsSPA SS – 3.75%

- plsSPA LP – 5%

Points to note

- PLS token has strong inflation from the third month (8/2022) to the sixth month (11/2022), then the inflation rate will steadily grow until the twenty-first month (2/2024) and will not be as high as before.

- TGE received full payment for the Public Round.

- Currently, there are around 20.3 million PLS in circulation (almost 20% of the entire supply).

- The number of Non-Rebase Bonding tokens (10%) will not be issued to the market until it is required to develop the project after the supply is depleted (90 million PLS).

Lock in PLS in order to be awarded plsDPX and plsJONES at APR milestones:

- 1 month: 5.571%

- 16.3% after three months

- Six months: 78.129%

Nevertheless, the one-month epoch has been closed, and the six-month epoch will be opened in early November. When the project implements Tokenomic V2, these Stake Pools will be replaced with another form.

Potential of the project

Promotion

Presently, swapping DPX to plsDPX at Sushi Swap yields a 5.2% discount, while plsJONES yields a 20% discount when compared to simply locking into the Plutus Conversion Pool. This will increase user interest in utilizing Staking Pools on this platform in the future to attract the site’s TVL.

Tokenomic 2.0

This is the key to PlutusDAO’s forthcoming growth potential, which was unveiled at the end of October.

Tokenomic 2.0 is split into two halves. Part 1 is the lowering of PLS inflation in Pools, and Part 2 was just revealed with the unveiling of the integrated model of Convex Finance’s Bribe and GMX’s Multiplier Point/esAssets.

- Customers may lock PLS or PLS-ETH LP within 16 weeks to earn lPLS, with PLS-ETH LP receiving a 10% greater APR than locking each PLS individually.

Bribes, Plutus Multiplier Points (PMP), and esPLS will be given to lPLS.

Users with lPLS will earn PMP at a rate equal to 50% of APR; however, when the PLS is removed from the Pool, the PMP will vanish. This will encourage users to lock their Accounts for an extended period of time, commit to using the platform, and be rewarded in return.

PlutusDAO’s esPLS incentive payout will be harvested linearly over a year; if users wish to begin harvesting, they must re-lock their lPLS.

Also, having a large number of lPLS will help to increase the APR of Pools on the platform. The APR rises proportionately to the quantity of lPLS owned, up to a maximum of 2.5 times; this does not result in PLS inflation but rather the contrary.

As can be observed, the more future rewards you want, the more users are necessary to lock in more PLS, thus reducing the circulating supply. And the lPLS inflation bonus employs the esAssets mechanism, allowing the selling pressure to dissipate over time.

Tokenomic 2.0 is planned to be published soon once the PLS Staking Pools have been finished.

Core team

Currently, the PlutusDAO project has not announced the project team

Investors, partners

Prominent projects that are partners with PlutusDAO include: GMX, JonesDAO, Dopex, Sperax, Lodestar Finance, …

Conclusion

PlutusDAO is based on the same concept as the Convex Finance project, which was fairly successful by the end of 2021, increasing more than x10 times from the time of debut.

The price of PLS rises in direct proportion to the progress of the Dopex and Jones projects, particularly Dopex, which controls more than half of the voting rights.

The project has been rather active since its inception, but with the exception of the GMX token, which serves actual requirements, it has gotten little market attention.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News