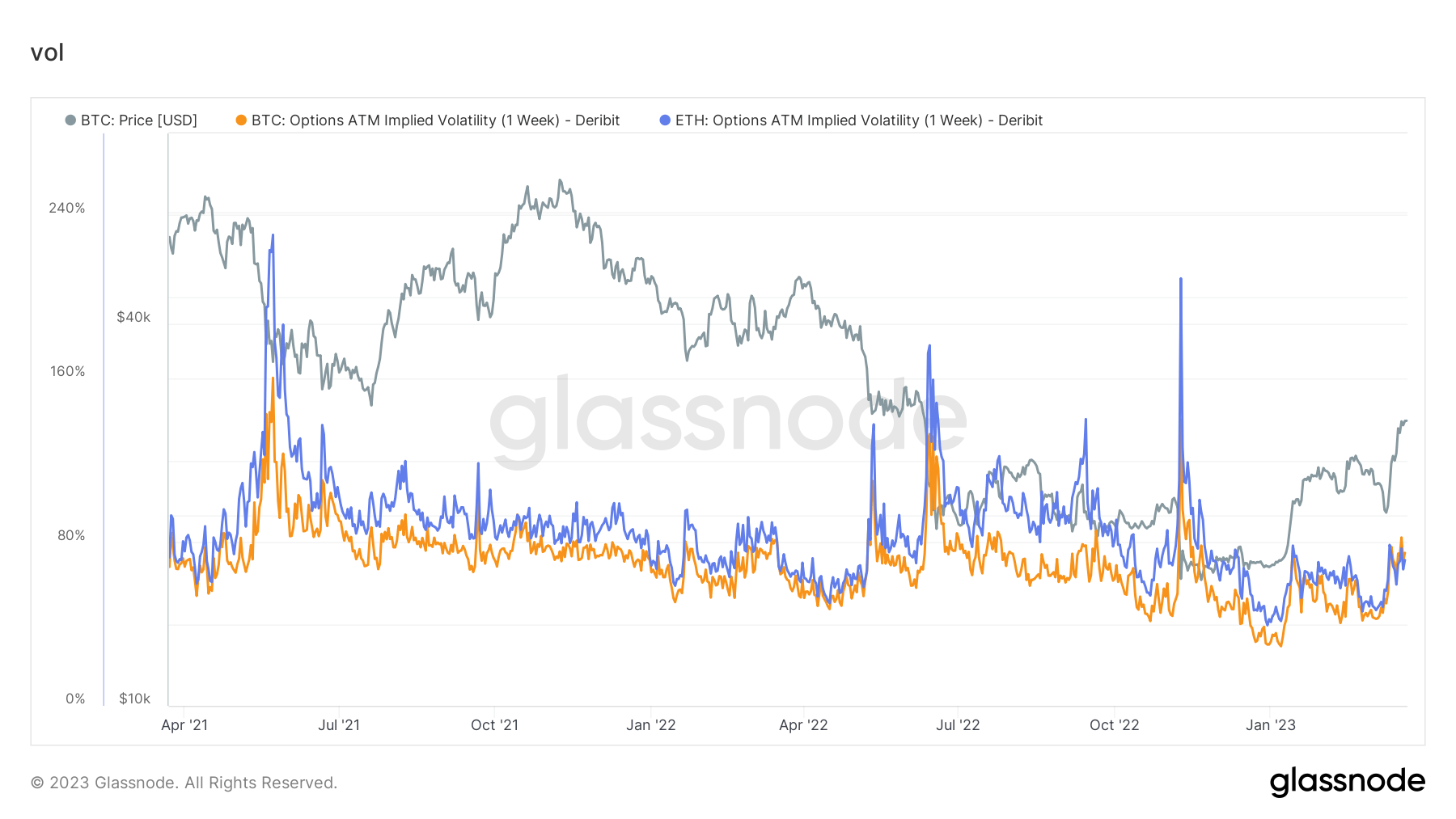

Bitcoin options ATM implied volatility exceeds ETH for the first time

full version at cryptoslate

Definition

Implied Volatility is the market’s expectation of volatility. This metric shows the ATM implied volatility for options contracts that expire 1 week from today.

Quick Take

- For the first time since data has been recorded on Glassnode, Bitcoin implied volatility had exceeded Ethereum implied volatility ( 1 week).

- Due to the implications of the past few weeks of bank failures, Bitcoin is outpacing Ethereum in terms of price action.

- Options volume hitting two-year highs in Bitcoin recently are all contributing factors to this surge in implied volatility.

BTC implied volatility (1 week): 74.8%.

ETH implied volatility (1 week): 71.3%.

The post Bitcoin options ATM implied volatility exceeds ETH for the first time appeared first on CryptoSlate.