☘️ Chasing the Green

GM, and welcome to another edition of CoinStats Scoop! 🥂 Here’s an overview of this week’s newsletter:

The usual market overview with a rundown on the incredible rally this week

Updates on this week’s noteworthy news and developments

Breaking down portfolio management, security, & the tools to track crypto (hint: CoinStats)

Reading & thinking about Arbitrum’s long-awaited upcoming token airdrop

Weekly wrap-up: predictions & takeaways.

Market Overview

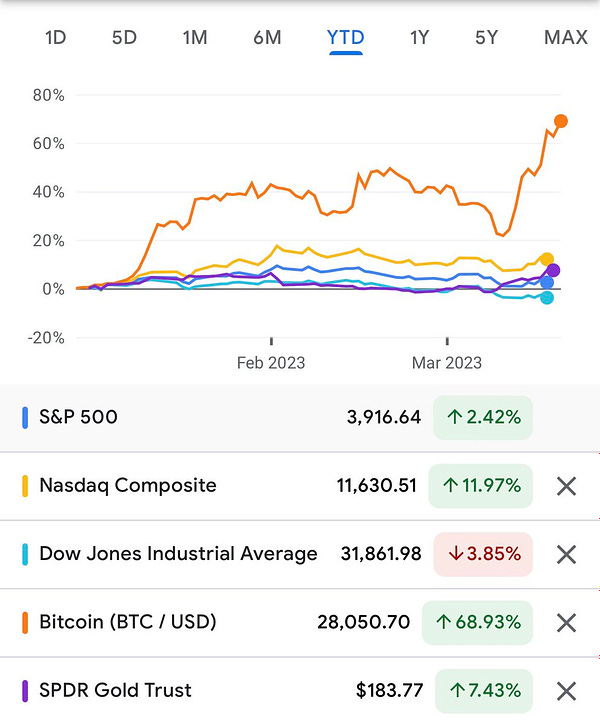

It’s been another wild week in crypto! Fortunately, this tumultuous week has led to significant rallies across the board, with the total crypto market cap exceeding $1.2 trillion. Spurring the strong rally throughout the entire sector was non-other than the OG token, Bitcoin, as the large orange coin gained an incredible 38% this week. ETH followed closely behind, gaining an impressive 23%, with crypto markets once again proving how fast they can rally. 💪

In the previous editions of CoinStats Scoop, we took note of BTC and the broader crypto market’s impressive start-of-the-year rally, acknowledging that a pullback was likely. Well, the pullback of the past few weeks appears to be over, as BTC gained a staggering 6k this week. 🤑 We previously stated and will continue to reiterate this week that pullbacks are likely due to the insane momentum that drives crypto markets forward!

Some of you may be reading this and thinking, “what, a pullback?!” but we promise this is actually a healthy thing! We previously wrote about the likelihood of this happening because of the recent rally that started the year. When crypto experiences rapid gains, like on those two occasions, it normally occurs in a violent manner within a brief couple of days! A 20-30% rally in an asset class in the course of a few days indicates that the asset class is primed for a pullback because, unfortunately, it's simply not sustainable for things to keep going up indefinitely. Now, this doesn't diminish the impressive rally that cryptocurrencies have had this week, but it's worth noting that when asset values increase drastically, they tend to experience a slight retraction.

Slightly is the keyword here, as we’re not saying that crypto is likely to crash because of its strong rally. It’s actually the opposite, as we’re saying that when crypto is experiencing a consistent uptrend like this one, in some days, BTC and ETH gain 15-30%, followed by weeks when they give back 5-10% in total. Importantly, this equation results in higher lows for the asset class at large and nets out to a gain of 5-20%, which is a healthy market expansion. 🚀

To summarize, crypto is a unique market where intense rallies can occur in just a few days or weeks. Often, the asset class gives back some of those gains due to some unfortunate instances, as mentioned in the tweet above, but importantly remains 5-15% higher than before the gains! Rinse and repeat this cycle, and all of a sudden, BTC ends up 70%+ to start the year despite weeks where it felt like the entire market was down. If you extrapolate this common trend for 6 months to a year+, you can imagine the potentially higher prices at which BTC, ETH, and the entire market may start in 2024! Therefore, you should never be discouraged by a down week or two, or even a month, because when crypto rallies, it will make up for those down weeks many times over. 💪

As mentioned, the entire space rallied hard this week, and the entire ecosystem benefitted! Let’s divide the ever-expanding crypto space into sectors to paint a clearer picture:

DeFi — UNI+21%, AAVE +20%, SNX +33%, ZRX +24%, COMP +23%, YFI +18%, BAL +18%, SUSHI +15%, CVX +15%,

Scaling — OP +47%, MATIC +13%, DYDX +50%, INJ +42%, SYN +28%, MATIC +13%, STX +96%, IMX +84% MINA +41%, LRC +32%

GameFi — RON +64%, PYR +34%, MAGIC +74%, AXS +26%

Infrastructure Tokens — LINK +16% RNDR +53% GRT +40% FIL +24% AR +20% LPT +28% MC +26%

Alternative L1s — SOL +23%, ATOM +13%, XTZ +27%, BNB +23%, AVAX +23%, NEAR +20%, DOT +20%, ADA +14%, ZCASH +17%, ROSE +30%

Liquid Staking Tokens — RPL +28% SD +40% LDO +19%

Arbitrum Tokens — GMX +34% MAGIC +74% VELA +41% GRAIL +200% PENDLE +53% GNS +51% RDNT +93% JOE +75%

News & Developments

Arbitrum, the leading ETH L2 in terms of its user base, transaction volume, and TVL, finally announces the launch of its long-awaited ARB token on March 23rd

Fidelity, one of the world’s largest asset managers, quietly launches its retail product Fidelity Crypto, enabling millions of users to buy BTC & ETH

Payments giants Mastercard and Visa continue to expand crypto offerings as they partner with crypto startups worldwide to offer crypto debit cards

Gaming giant Epic Games announced it has “close to 20” crypto games in its native store pipeline to add to its platform in the next year

DeFiance Capital has raised $100 million for a new liquid crypto token fund

Polygon’s MATIC announces EUROe, a digital EURO, on the GEN-X Network

Uniswap (UNI) officially launches on Binance’s BNB chain

Blur (BLUR), the leading NFT marketplace on Ethereum, announces mobile support

Coinbase, the largest crypto exchange in the United States, is exploring the launch of an offshore, overseas platform to include perpetual swaps

The National Australia Bank completes its first intra-bank cross-border transaction using its own stablecoin on Ethereum

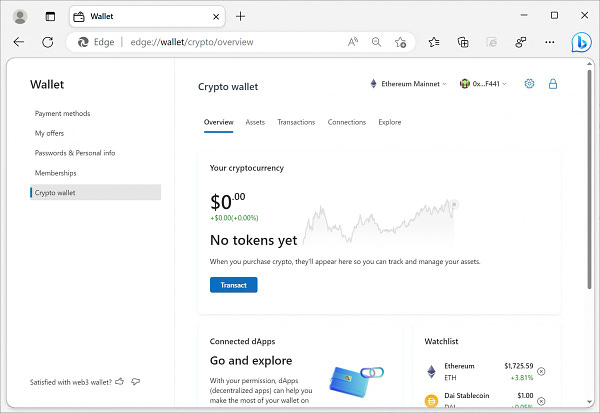

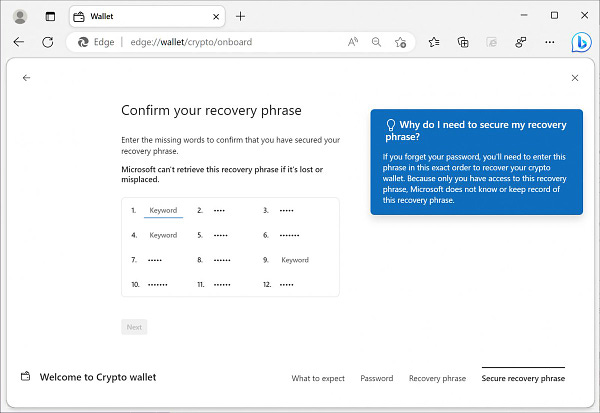

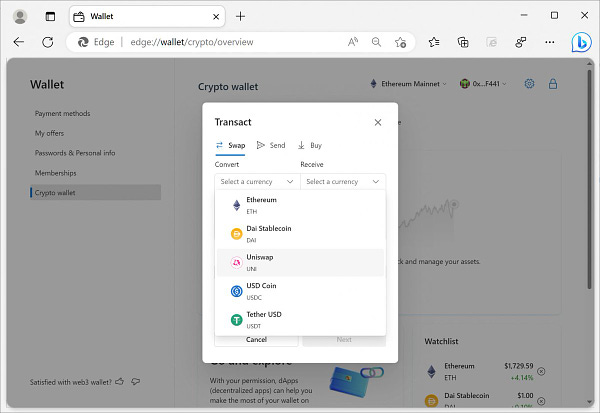

Microsoft, the world’s third largest company, is said to be working on a crypto wallet for its web browser Edge; the company is reportedly working with Ethereum development giant Consensys to build its native crypto features and support 🤯

We Always Have Your Back

This week, we’re selfishly highlighting a fireside chat with Pontem Network. We may be biased, but we believe it’s packed with lessons that every crypto enthusiast should learn. 💪

The insights shared in this discussion can help us navigate the exciting yet unpredictable crypto landscape we so cherish.

Some of our favorite highlights include:

CoinStats is committed to the security and uses industry-standard practices, including running quarterly audits by multiple auditing firms

The builders throughout the space focus on improving the accessibility and ease of use for participants to track and use DeFi protocols

CoinStats provides an all-in-one solution for crypto portfolio management

DeFi and crypto, at large, focus on removing middlemen from everyday financial services to save users' fees on their hard-earned money

The recent increase in developers and teams focused on easy-to-use wallets to onboard the next 100 million users to crypto

CoinStats provides a non-custodial wallet that enables EVM chain transactions and plans to expand its support to other blockchains

Transparency — it’s often overlooked, but as we’ve seen with the recent banking crisis, crypto provides transparency (the open blockchain) as no other financial sector

CoinStats is launching new products, such as increased blockchain analytics, redesigned portfolios, new reward systems, integrations with more blockchains/platforms, advanced trading and liquidity provider support, and our favorite loot boxes! 🤫

A moment of appreciation: While we’re enjoying the current upward bull trend, dedicated teams across the space, including CoinStats, are working to provide improved services for the next billion users of crypto. 💪

Read of the Week

“Arbitrum Airdrop and How to Play It” — Onchain Wizard

This week's read is timely, topical, and ahead of Arbitrum’s long-awaited token launch on Thursday, March 23rd. Our read comes from Onchain Wizard, a crypto research and on-chain analyst that has been actively participating and investing in the space for years. OW is also the founder of ChainEDGE, a “cross-chain smart money movements and on-chain analytics tool.”

It goes without saying that OW's words and thoughts hold significant value in our ecosystem. And this week, OW was kind enough to provide a framework (not financial advice) on approaching the upcoming Arbitrum token and its ripple effects throughout the Arbitrum ecosystem. 🤑

“The token will launch and be claimable on Thursday, March 23. So if you see scam ARB tokens already trading, you should obviously avoid them…Ok, so we have a rough range of where it could trade (anywhere from $1-2 makes “sense”), but how will the price action of the token be once it's claimable?..I am going to watch for similar price action to Blur’s airdrop to time when to sell my tokens or even accumulate more…**Because of the airdrop; the Arbitrum ecosystem will effectively be getting a $1bn stimulus check…**The TLDR is ARB should “probably” trade above $1 and its not hard to make an argument for ~$2.”

In addition to the extremely valuable information regarding Arbitrum and its upcoming token, Onchain Wizard also provides us with some Arbitrum ecosystem tokens to monitor (several of which are in the Market Overview) as the ecosystem enjoys an influx of liquidity:

Gridex — onchain DEX trading order book

RDNT — omnichain money market project

VELA — perpetual swap decentralized exchange on Arbitrum

ARC — casino themed token

GRAIL — has been one of the strongest Arbitrum tokens in recent days

GMX — the dominate decentralized exchange on Arbitrum

MAGIC — represents the Treasure gaming ecosystem on Arbitrum

Tweets & Memes

Arbitrum’s token announcement video as the leading L2 finally confirms the token 🤩

Microsoft joins Amazon. We’re ready for its crypto strategies!

Bitcoin is uniquely positioned to benefit from the banking chaos & ongoing inflation

Wrapping Up

Highlighting Bitcoin's unique, immensely positive position, we conclude this week’s CoinStats Scoop. 💫

We provided the regular market update, including an overview of a massively green week and top-performing sectors/tokens, read and analyzed the upcoming Arbitrum airdrop and the best methods to play the token, provided the weekly impactful news and token developments, and detailed some exciting developments from the CoinStats Team that will lead to the next billion users of crypto. 💪

CoinStats will continue to guide you through the crypto and DeFi world. We'll see you next week for another edition of CoinStats Scoop! 😎